Accounting and finance firms operate in a high-risk environment where trust, accuracy, and confidentiality are non-negotiable. Client financial records, tax files, payroll data, and sensitive business documents make these firms prime targets for cyberattacks—and regulatory expectations continue to rise each year. At the same time, modern firms must support hybrid work, maintain uptime during audit and tax season, and scale systems without increasing overhead.

This is where Managed IT Service Providers (MSPs) have become essential. A well-qualified MSP delivers proactive monitoring, cybersecurity, compliance support, cloud management, and business continuity planning—helping firms reduce downtime, control costs, and stay audit-ready. More importantly, MSPs provide the technical foundation that enables accountants and finance teams to focus on client delivery instead of troubleshooting IT.

In this guide, you will learn what MSPs do, how they compare to traditional IT support, and why accounting and finance firms increasingly rely on MSP partnerships to strengthen security, support compliance frameworks, and improve operational efficiency.

What is a Managed IT Service Provider (MSP)?

A Managed IT Service Provider, also known as an MSP, is a company that handles your business’s information technology operations, often remotely. While many firms once believed only large corporations could truly benefit from specialist support, the reality is quite different today. Particularly in accounting and finance, outsourcing IT has become essential since regulations, cybersecurity threats, and cloud adoption have evolved rapidly.

MSPs proactively monitor your system 24/7. Consequently, they address issues before they impact your workflow. Instead of only providing help after a problem arises, an MSP keeps your technology running efficiently from the start. They also manage networks, protect against cyber threats, back up critical data, and maintain compliance. While you focus on your clients, your MSP ensures your IT works in the background. As you continue reading, you’ll learn not just the definitions but also see how these services work in practice.

Key Terminology:

| Term | Definition |

|---|---|

| MSP (Managed Service Provider) | A company managing ongoing IT support, maintenance, and security for other businesses. |

| SLA (Service Level Agreement) | A contract setting performance standards and support commitments. |

| MSSP (Managed Security Service Provider) | MSP specializing in security, threat monitoring, and compliance. |

| Cloud Hosting | Providing computing resources (like storage and software) online, usually managed by an MSP. |

How Does a Managed IT Service Provider Work?

Imagine your IT like electricity: you simply expect it to work every time. Although issues sometimes arise, MSPs resolve them seamlessly, typically before you even notice! For example, instead of waiting for your server to fail, a managed IT provider monitors and updates systems so staff experience fewer disruptions.

Modern MSPs go far beyond break/fix repair. Not only do they install and maintain cloud solutions, but also provide structured cybersecurity, regulatory guidance, employee tech support, and disaster recovery planning—all for a fixed monthly fee. As a result, budgeting becomes easier and costs are more predictable.

In practical terms, here’s what MSPs do:

- Proactively monitor IT systems, networks, and software.

- Manage and resolve security incidents or threats around the clock.

- Enable remote and secure access for staff, which is crucial for hybrid or remote accounting teams.

- Perform regular compliance checks and maintain documentation for audits.

- Automatically back up data and test disaster recovery procedures to minimize potential downtime.

MSP vs. Traditional IT Support

Transitioning from traditional “break/fix” IT support to an MSP model brings several distinct differences. Although break/fix support addresses problems only after they occur, an MSP anticipates and prevents them.

| Feature | Managed IT Service Provider (MSP) | Traditional IT Support (Break/Fix) |

|---|---|---|

| Proactivity | Monitors, maintains, and prevents issues | Addresses issues only after they appear |

| Cost Model | Fixed monthly fee | Pay-per-incident |

| Security | Ongoing updates & cybersecurity | Basic, often inconsistent |

| Compliance | Built-in support for industry rules | Usually limited or extra cost |

| Scalability | Easily adds new users or services | Challenging and expensive to expand |

| Example | Proactive software updates | Reacts to malware or hardware failure |

Furthermore, MSPs use automation and AI tools to identify risks, while legacy IT support often lacks such technology.

Why Choose an MSP for Accounting & Finance?

Since financial data is highly confidential and heavily regulated, accounting and finance businesses face unique IT challenges. Nevertheless, MSPs offer several compelling advantages:

- Enhanced Security & Compliance: Over 81% of financial institutions rank cybersecurity as their leading IT challenge. As regulations like GDPR, SOX, and PCI become stricter, MSPs keep firms audit-ready through automated tracking and regular reporting.

- Predictable, Lower Costs: Rather than unpredictable repair bills, businesses pay a steady monthly fee. U.S. managed services are expected to reach $69.55B in 2025, with small businesses saving up to 40% compared to in-house or ad-hoc support.

- Minimal Downtime: Since MSPs work proactively, downtime and data loss drop dramatically. Even in the event of a crisis, plans for cloud-based disaster recovery ensure your work continues.

- Access to Top Technology: MSPs keep up with emerging solutions. That means even smaller firms enjoy resources such as the newest cybersecurity, AI-based data protection, and cloud hosting, which would be otherwise unaffordable.

- Scalability: If your firm grows or your needs shift, an MSP quickly adjusts your service plan. Therefore, you pay only for what you truly need.

Examples: How MSPs Help in Finance and Accounting

- Cloud Hosting for Tax Season: When deadlines approach, a CPA firm migrates tax software to a managed cloud. As a result, staff access files securely from anywhere and backups are automatic.

- Regulatory Ready: An MSP sets up audit trails and compliance documentation for an accounting business, so future reviews are much easier.

- Disaster Preparedness: In the event of ransomware, the MSP restores all data from secure backups—client operations resume in hours, not days.

US MSP Market Overview

| Statistic | Value |

|---|---|

| US Managed Services Market Size (2025) | $69.55B, projected to hit $116.25B by 2030 |

| Market Growth Rate | 10.8% CAGR (2025–2030) |

| Top Priorities for Firms | Cybersecurity, cloud migration, compliance, automation |

| SMB Efficiency Gains with MSP | 35% improvement (72% of firms report this benefit) |

In addition, MSPs are now integral to many organizations’ long-term IT strategy.

Top Trends in the Managed Service Provider Industry

Because the landscape keeps changing, successful MSPs constantly evolve:

- Security-First Approach: Cybersecurity is now a built-in, default part of every MSP package. Rather than an optional add-on, it is a necessity.

- AI and Automation: From round-the-clock monitoring to instant user support, AI tools have streamlined MSP operations, making them more reliable than ever before.

- Expert Compliance Partners: Rather than acting as only tech providers, MSPs advise on audits and compliance for finance and accounting as regulations become more complex each year.

- Cloud-First Solutions: The majority of applications and data now run in the cloud, so MSPs must excel at seamless cloud integration.

- Workforce Flexibility: When accounting firms need to scale, MSPs respond within days instead of months.

Did you know? By 2025, over 341,000 managed service partners will exist worldwide, highlighting the widespread reliance on MSPs for business technology needs.

Use Case: Ntiva (Chicago, IL)

To illustrate, consider Ntiva, a leading U.S. MSP. By managing over 60,000 devices and providing 24/7 support, Ntiva slashed one nonprofit client’s IT expenses by more than 50%. Its client base includes healthcare providers, insurance companies, and educational institutions, demonstrating the value these partnerships offer across sectors.

| US Top MSPs | Notable Clients |

|---|---|

| Ntiva | Blue Cross Blue Shield, Fairlife |

| Kanda Software | OneSky, Lionbridge |

| Miles IT | Henning’s Market, PSS Distribution |

MSP vs. In-House IT Teams

Although hiring internal staff once seemed like the only option, many businesses now compare carefully.

| Feature | MSP (Managed Service Provider) | In-House IT Team |

|---|---|---|

| Staff Expertise | Broader, deep specialization | May lack advanced knowledge |

| Cost | Predictable, lower overhead | Salaries, benefits, training |

| Scalability | Quickly adjustable service levels | Expensive and slow to expand |

| Response Time | 24/7, SLA-backed | Office hours only |

| Security | Layered, continuous protection | Dependent on team’s skills |

| Cloud Integration | Seamless, included | Often requires extra investment |

How an MSP Partnership Works: Step-by-step

Although every firm is different, the core process is similar:

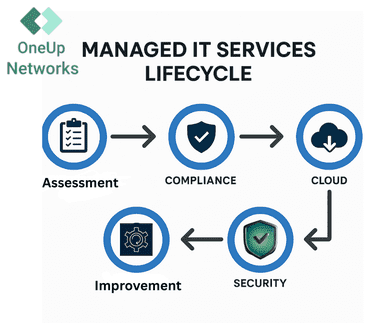

- Discovery & Assessment: The MSP reviews your technology and goals, identifying where upgrades or compliance steps are needed.

- SLA Agreement: All expectations, support levels, and costs are written out, so there are no surprises later.

- Onboarding: MSP migrates IT systems, sets up monitoring, and implements secure networks.

- Ongoing Management: Proactive maintenance, round-the-clock support, and regular check-ins ensure optimal performance.

- Reporting: You regularly receive reports on security, uptime, and budgets.

- Continuous Improvement: As your needs grow, your MSP adapts—keeping you competitive and protected.

Lifecycle of Managed IT Services — from assessment ➝ onboarding ➝ compliance ➝ cloud ➝ security ➝ improvement

MSP Facts & Figures

- 97% of firms working with MSPs report noticeable security improvements.

- Up to 50% annual IT cost savings versus in-house or ad-hoc IT.

- 83% of SMBs believe using MSPs boosted their operational efficiency.

- The managed IT market outpaces global growth, increasing 12% CAGR in the U.S. alone.

- By 2025, 80% of finance firms are boosting their managed IT investments.

Frequently Asked Questions (FAQ)

MSP stands for Managed Service Provider—a firm handling IT for other businesses.

MSPs work proactively, provide predictable costs, and are available 24/7. Traditional IT fixes problems after they happen, which can cause higher costs and more downtime.

Absolutely! Top MSPs understand industry rules (SOX, FINRA, PCI) and assist during audits.

Yes, reputable MSPs use strong encryption, real-time monitoring, and industry certifications (SOC 2, ISO 27001).

Steps include assessment, planning, migrating data, system setup, testing, go-live, and ongoing support—while minimizing disruptions.

Conclusion

In accounting and finance, technology is no longer just a support function—it is a core part of service quality, compliance readiness, and client trust. When systems slow down, data is exposed, or outages occur during peak season, the business impact can be immediate and costly. Managed IT Service Providers help firms prevent these risks by combining proactive monitoring, security controls, compliance documentation support, cloud optimization, and disaster recovery planning into one structured service model.

For firms that manage sensitive financial data, operate under regulatory expectations, and require consistent uptime, an MSP offers a strategic advantage. It replaces reactive support with preventive protection, reduces IT complexity, strengthens resilience against cyber threats, and creates predictable costs that are easier to manage.

Secure Your Accounting Firm’s IT, Compliance, and Uptime with a Trusted MSP

If your firm faces ransomware risk, frequent IT downtime, slow remote access, software update issues, helpdesk delays, or compliance pressure during audit and tax season, an MSP-led IT management model can deliver stronger security, faster support, and reliable performance. OneUp Networks helps accounting and finance firms run secure, compliant, and scalable IT environments with 24/7 monitoring, proactive maintenance, and disaster recovery planning built for peak workloads and client confidentiality.

- Book a Demo – Review your current IT risks, compliance needs, and performance gaps with an expert.

- Start a Service Trial – Experience proactive monitoring, ticket support, and security management in real conditions.

- Request a Quote – Receive a tailored MSP plan based on users, systems, and compliance requirements.

You May Also Like These Articles: