Managing finances—whether personal or business—can be complicated. From tracking income and expenses to filing taxes accurately, mistakes can, indeed, cost time, money, and peace of mind. Fortunately, software solutions like TurboTax and QuickBooks, both developed by Intuit, make financial management far more manageable.

While many people use these tools, they often don’t fully understand their purposes or, moreover, how they differ. In this comprehensive guide, we’ll dive deep into TurboTax, explore QuickBooks, and then compare both platforms so you can choose the right solution for your needs.

Table of contents

What is TurboTax?

TurboTax was introduced in 1984 and quickly became a household name for digital tax filing. Initially created as a desktop software, it enabled individuals to calculate their taxes without manually filling out forms. Over the decades, TurboTax has, in fact, expanded its offerings to include online versions, mobile applications, and live expert support. Today, millions of Americans rely on TurboTax annually to ensure accurate filings, maximize refunds, and, as a result, stay compliant with federal and state tax laws.

What is TurboTax Login?

TurboTax Login is the secure portal where users access their TurboTax account. It allows you to start, continue, or review your tax returns, access previous filings, and manage your account information. The login ensures that your sensitive tax data remains safe and protected.

How to Log In to TurboTax

- Visit the official website: turbotax.intuit.com

- Click “Sign In”: Usually located in the top-right corner.

- Enter your Intuit ID: This is your email address associated with TurboTax.

- Enter your password: Use the password you created during account registration.

- Two-Factor Authentication (if enabled): You may receive a verification code via email or SMS.

- Access your account: Once logged in, you can view current or past tax returns, track refunds, or update your account.

Key Features of TurboTax

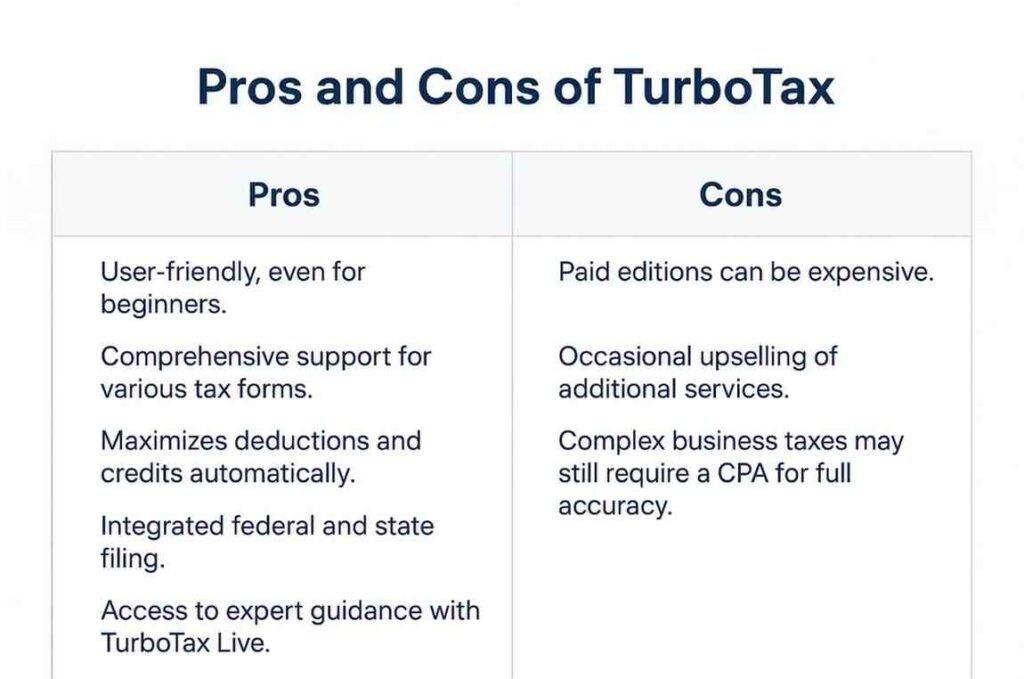

TurboTax stands out in the market due to its comprehensive set of features designed to simplify tax filing:

User-Friendly Interface

TurboTax uses a question-and-answer format, guiding users through the tax process step by step. Even individuals with no prior tax experience can navigate the software confidently.

Support for Multiple Tax Forms

TurboTax supports all major tax forms, including 1040, 1040X, W-2, 1099-NEC, 1099-MISC, Schedule C, Schedule E, and more. Whether you’re an employee, investor, or small business owner, TurboTax has, therefore, a solution for your needs.

Maximizing Deductions and Credits

TurboTax automatically identifies eligible deductions and credits, such as education credits, mortgage interest, and charitable donations. This ensures users maximize their refunds or, in addition, reduce tax liability.

Integrated State Tax Filing

The software allows users to file both federal and state taxes seamlessly, with automatic state-specific calculations.

TurboTax Live

For those who want added confidence, TurboTax Live connects users to certified tax professionals and CPAs. They can answer questions, review returns, and, moreover, provide audit guidance.

Audit Support

TurboTax offers audit assistance, including guidance, document checklists, and access to tax experts if the IRS questions your return.

Refund Estimators and Cash Advances

Users can estimate their refund before filing and, in certain cases, receive an advance on their refund via TurboTax’s refund advance program.

Import Capabilities

TurboTax can import financial information directly from W-2s, 1099s, banks, and investment accounts, reducing manual entry and, as a result, minimizing errors.

TurboTax Products and Editions

It offers multiple editions to meet the needs of different users:

- Free Edition: Ideal for simple tax returns, particularly for individuals with W-2 income, standard deductions, and no itemized deductions.

- Deluxe: Tailored for homeowners and those with deductible expenses, this edition helps maximize tax deductions and credits.

- Self-Employed / Home & Business: For freelancers, independent contractors, and small business owners, this edition tracks business expenses, deductions, and self-employment taxes.

- TurboTax Live: Adds professional guidance from CPAs and enrolled agents to any edition, ensuring accuracy and personalized support.

How TurboTax Works

TurboTax simplifies tax filing through a structured workflow:

Input Income and Expenses

Users provide income information from W-2s, 1099s, business records, and other sources.

Answer Simple Questions

The software asks targeted questions to identify deductions, credits, and tax situations, such as education, homeownership, or dependents.

Maximize Refund

TurboTax calculates eligible deductions and credits automatically to maximize your refund or, therefore, reduce taxes owed.

E-file Federal and State Returns

Once your return is complete, you can electronically file with both the IRS and state tax agencies.

Track Your Refund

TurboTax provides real-time status updates for federal and state refunds and estimated deposit dates.

How TurboTax for Businesses and Self-Employed Individuals

TurboTax isn’t just for employees. Small business owners and self-employed individuals can, moreover, benefit greatly:

- Business Tax Filing: Handles LLCs, S corporations, partnerships, and corporations with tailored guidance.

- Schedule C Support: Automatically calculates business income, expenses, and deductions.

- Quarterly Taxes: Assists in calculating and filing estimated taxes to avoid penalties.

- Expense Tracking: Tracks business-related expenses, depreciation, and other deductions to minimize tax liability.

By integrating these features, TurboTax ensures that, in fact, even complex tax situations are handled efficiently and accurately.

Security and Privacy

TurboTax takes data security seriously. The platform uses encryption, multi-factor authentication, and secure servers to protect user information. Additionally, Intuit complies with IRS security standards, ensuring that sensitive tax data remains confidential and secure.

TurboTax has, indeed, revolutionized tax filing by making it accessible, accurate, and user-friendly. From simple W-2 filings to complex business taxes, TurboTax offers solutions for individuals, self-employed professionals, and small businesses. With integrated state filing, audit support, expert guidance, and secure systems, TurboTax reduces stress and helps maximize refunds. For anyone looking to simplify their taxes and, therefore, stay compliant with the IRS, TurboTax is an essential tool.

What is QuickBooks?

QuickBooks was launched in 1983, making it one of the oldest accounting software platforms still widely used today. Initially designed for small businesses to handle basic bookkeeping, QuickBooks has, in fact, evolved into a sophisticated platform that supports invoicing, payroll, inventory management, tax preparation, and real-time reporting. Today, millions of businesses across various industries rely on QuickBooks for accurate, organized, and efficient financial management.

What is QuickBooks Login?

QuickBooks Login is the secure portal where users access their QuickBooks account to manage accounting, bookkeeping, payroll, and financial data. The login ensures only authorized users can access sensitive business information.

How to Log In to QuickBooks

- Visit the official website: quickbooks.intuit.com

- Click “Sign In”: Usually located at the top-right corner.

- Select Account Type: QuickBooks Online, QuickBooks Self-Employed, or QuickBooks Desktop users may choose different login portals.

- Enter Intuit ID or Email: This is the email linked to your QuickBooks account.

- Enter Password: Use the password created during registration.

- Two-Factor Authentication (if enabled): Enter verification code sent via email or SMS.

- Access Your Dashboard: Manage invoices, expenses, payroll, reports, and more.

Key Features of QuickBooks

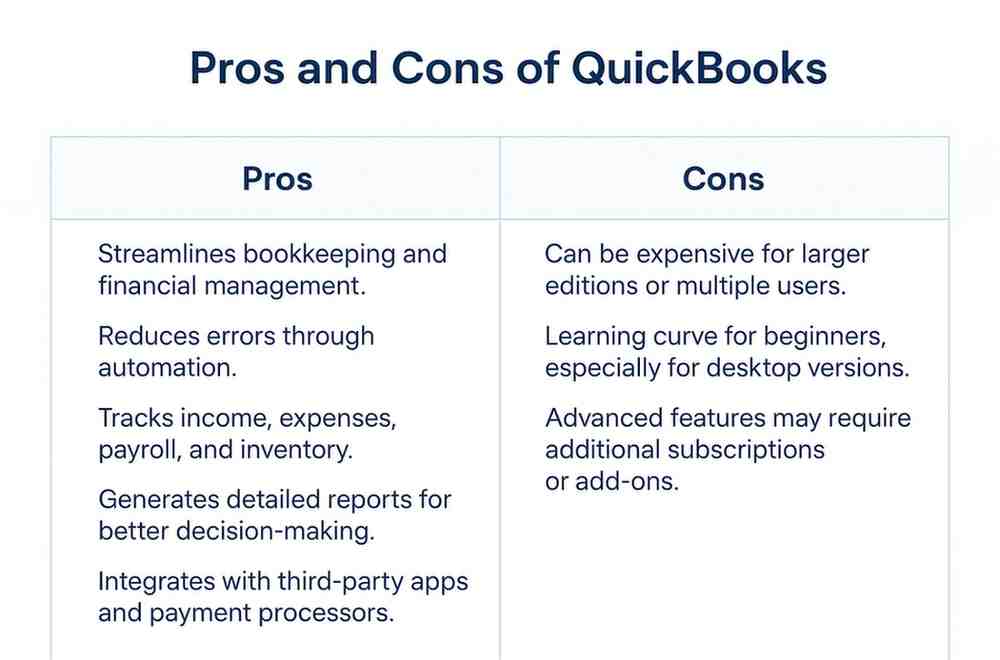

QuickBooks is known for its robust feature set that caters to a wide range of business needs:

Bookkeeping and Accounting

QuickBooks automates essential bookkeeping tasks, such as recording transactions, tracking expenses, and categorizing income. This ensures accurate financial records and, as a result, reduces the likelihood of errors.

Invoicing and Payments

Users can create professional invoices, send them to clients, and even accept online payments. Automated reminders help, therefore, ensure timely payments.

Expense Tracking

QuickBooks connects to bank accounts and credit cards, automatically importing transactions and categorizing them for easy tracking of business expenses.

Payroll Management

QuickBooks provides payroll services, including calculating wages, withholding taxes, and generating paychecks. This streamlines payroll processing for small businesses.

Inventory Management

Businesses that sell products can track inventory levels, costs, and sales, preventing stockouts and overstock situations.

Tax Preparation

QuickBooks tracks income and expenses, organizes receipts, and generates financial reports that simplify tax filing. It integrates with TurboTax, making tax preparation seamless for business owners.

Reporting and Analytics

QuickBooks generates detailed financial reports, including profit and loss statements, balance sheets, cash flow reports, and custom reports. These insights help, moreover, business owners make informed decisions.

Cloud-Based Access

QuickBooks Online allows users to access financial data from anywhere with internet access. This is ideal for business owners on the go or teams working remotely.

Third-Party Integrations

QuickBooks integrates with hundreds of apps, including payment processors, CRM platforms, inventory management tools, and e-commerce platforms, creating a fully connected financial ecosystem.

QuickBooks Products and Editions

QB offers multiple versions tailored to different business needs:

- QuickBooks Online: Cloud-based solution accessible from any device, ideal for small businesses and remote teams.

- QuickBooks Desktop: Installed on a computer, offering advanced features and higher performance for larger businesses.

- QuickBooks Self-Employed: Designed for freelancers and independent contractors, tracking income, expenses, and mileage.

- QuickBooks Payroll: Adds payroll processing to QuickBooks Online or Desktop for a seamless experience.

- QuickBooks Enterprise: For larger businesses needing advanced inventory management, reporting, and multi-user access that can also be hosted on the cloud.

Each edition caters to specific business needs, allowing owners to select the right solution for their financial workflow.

How QuickBooks Works?

QuickBooks simplifies financial management by following a structured workflow:

- Set Up Business Profile: Users enter their business information, bank accounts, and financial preferences.

- Connect Accounts: Link bank accounts, credit cards, and payment platforms for automatic transaction imports.

- Record Transactions: QuickBooks categorizes income and expenses automatically, allowing for easy tracking of financial health.

- Generate Invoices and Accept Payments: Users can create invoices, send them to clients, and accept online payments through integrated payment options.

- Track Expenses and Payroll: QuickBooks monitors spending, reconciles accounts, and calculates payroll with tax withholding for employees.

- Generate Reports: Access detailed financial reports, helping make informed decisions and, in addition, prepare for tax filing.

- Integrate Tax Filing: QuickBooks works with TurboTax to simplify tax filing, ensuring accurate reporting of business income and expenses.

How QuickBooks for Small Business and Freelancers

QuickBooks is particularly beneficial for small business owners, freelancers, and independent contractors:

- Small Businesses: QuickBooks helps manage multiple clients, track revenue and expenses, and streamline payroll and taxes.

- Freelancers / Independent Contractors: QuickBooks Self-Employed tracks income, expenses, and mileage, generating profit and loss reports for tax purposes.

- Consultants / Service Providers: Invoice management, automated reminders, and online payments reduce administrative overhead, freeing up time to focus on clients.

By centralizing financial data and automating routine tasks, QuickBooks improves efficiency and ensures accurate records for decision-making.

Security and Privacy

QuickBooks places a strong emphasis on data security. The platform uses encryption, multi-factor authentication, and secure servers to protect sensitive financial information. Cloud-based QuickBooks Online stores data safely, with regular backups to prevent loss. For desktop users, QuickBooks provides local encryption and options for secure storage of financial files.

Key Differences Between TurboTax and QuickBooks

While both TurboTax and QuickBooks are designed to simplify financial tasks, their purposes, features, and use cases differ significantly.

| Feature / Aspect | TurboTax | QuickBooks |

|---|---|---|

| Primary Purpose | Tax preparation and filing | Business accounting and financial management |

| Users | Individuals, freelancers, small business owners | Businesses of all sizes, freelancers, small business owners |

| Focus | Filing accurate taxes and maximizing refunds | Managing day-to-day finances, bookkeeping, payroll, invoices |

| Integration | Can import financial data for tax purposes | Integrates with banks, payment processors, payroll services, e-commerce platforms |

| Reports | Tax forms and summaries, refund estimates | Profit & loss, balance sheets, cash flow, expense reports |

| Automation | Deduction and credit calculations, error checks | Expense categorization, bank reconciliation, invoicing, payroll calculations |

| Tax Filing | Directly files federal and state taxes | Does not file taxes directly; data can be exported to TurboTax for filing |

| Learning Curve | Low to moderate; guided questions | Moderate to high; understanding accounting principles helps |

| Cost | Based on edition (Free, Deluxe, Premier, Self-Employed) | Based on edition and number of users (Online, Desktop, Enterprise, Payroll add-ons) |

How They Work Together

One of the advantages of using TurboTax and QuickBooks is that they can, indeed, complement each other. For businesses using QuickBooks for accounting, the software can export financial data directly to TurboTax. This allows for:

- Accurate Tax Filing: Business income, expenses, and deductions are already tracked, minimizing manual entry errors.

- Time-Saving: Reduces the time spent gathering financial records at the end of the tax year.

- Maximized Deductions: QuickBooks ensures that all eligible business expenses are recorded, which TurboTax can then apply to reduce taxable income.

This integration is particularly useful for self-employed individuals, freelancers, and small businesses who need both accounting management and tax filing support.

Which One Should You Use?

- Individuals and Freelancers: TurboTax is the better choice for filing personal taxes, handling deductions, and managing self-employment income. QuickBooks Self-Employed can, moreover, complement TurboTax by tracking income and expenses throughout the year.

- Small Businesses: QuickBooks is essential for managing accounting, payroll, invoicing, and cash flow. TurboTax can then, therefore, be used at the end of the year for filing taxes accurately using QuickBooks data.

- Medium and Large Businesses: QuickBooks Enterprise or Online Plus handles complex financial workflows, multi-user access, and inventory management. TurboTax ensures that corporate taxes are filed efficiently.

Frequently Asked Questions (FAQ)

TurboTax is primarily designed for tax preparation and filing, while QuickBooks focuses on accounting and bookkeeping. TurboTax calculates taxes and guides users through filing, whereas QuickBooks tracks income, expenses, and financial reports.

Yes. QuickBooks can export your financial data directly to TurboTax, making tax filing easier and more accurate, especially for small business owners and self-employed individuals.

TurboTax is ideal for individuals, freelancers, self-employed professionals, and small business owners who need to file federal and state taxes accurately and want to maximize deductions and credits.

QuickBooks Hosting is best for small business owners, accountants, and entrepreneurs who need to manage daily financial operations, track expenses, generate invoices, and prepare financial reports.

Both tools offer multiple plans. TurboTax has options based on tax complexity (e.g., Deluxe, Premier, Self-Employed), while QuickBooks offers Online, Desktop, and Enterprise versions. Costs vary depending on features and business needs.

No. TurboTax is focused on tax filing, not day-to-day accounting. For full financial management, QuickBooks is necessary to track income, expenses, payroll, and reports. TurboTax can complement QuickBooks during tax season.

Conclusion

TurboTax and QuickBooks serve distinct yet complementary purposes. TurboTax focuses on accurate tax filing, ensuring individuals and businesses maximize deductions and credits. QuickBooks is an accounting powerhouse, managing the daily financial operations of a business, from bookkeeping to payroll to reporting. By clearly separating day-to-day financial management from tax filing, these two Intuit solutions make running a business or managing personal finances more manageable, efficient, and, in fact, accurate.

For most small business owners, freelancers, or self-employed individuals, using both platforms together provides the best results. QuickBooks tracks and organizes all financial data throughout the year, while TurboTax uses that data to ensure a seamless and accurate tax filing process. Understanding the differences between these two tools empowers you to choose the right platform for your needs and, therefore, optimize your financial management strategy.

Unlock Seamless Financial Management with OneUp Networks

At OneUp Networks, we specialize in empowering businesses with secure, scalable, and efficient cloud solutions. Whether you’re looking to host QuickBooks, enhance your cybersecurity, or streamline your IT infrastructure, we’ve got you covered.

Here’s how we can assist you:

- Chat with an Expert: Engage with our knowledgeable team to discuss your specific needs and find the best solutions tailored for you.

- Contact Us: Reach out directly to explore how our services can benefit your business operations.

- Book a Demo: Experience firsthand how our cloud hosting, backup solutions, and IT services can transform your workflow.

- Start Your Free Trial: Take advantage of our 15-day free trial to test our services and see the difference for yourself.

Discover more about our offerings at OneUp Networks and elevate your business to new heights.

Also Check Out These Related Articles:

- Essential 1099 Tax Tips Every Employee Should Know

- What is the Average Tax Refund Amount in Your US State?

- What Are The Benefits Of Using Drake Tax Software For Small Businesses?

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- New IRS Tax Laws 2026: What Small Businesses Must Know to Save Thousands