Tax season always gets millions of people asking the same question: What is the average tax refund amount in your state and how does yours compare? By knowing the typical tax refund with average tax rebate and the average amount IRS tax refund is essential for every taxpayers to do their better budgeting, tax planning and also avoiding some surprising moments when your tax refunds get credited.

This guide covers everything—from average tax return by income and state, factors affecting refunds, and also tips for maximizing your refund, to future IRS trends. By the end, you’ll know how much should my tax return be, and how to make it as high as legally possible.

What is an Average Tax Refund?

An average tax refund is the typical amount of money a taxpayer receives back from the IRS after filing their federal income tax return. It represents the difference between the taxes you’ve paid throughout the year (through paycheck withholding or estimated payments) and also the actual tax you owe based on your income, deductions, and credits.

- If you overpaid, you will get a tax refund, tax rebate, or average tax return amount.

- If you underpaid, you might owe additional taxes, affecting your typical tax refund.

Example:

- Nationally, the IRS average tax refund payment is around $3,116, though it varies by average tax refund by income, filing status, and state.

- Higher-income filers may see average tax refunds for $100k salary or more, depending on withholding, credits, and deductions.

A key point: getting a big refund isn’t necessarily “better,” because it usually means you’ve effectively given the government an interest-free loan throughout the year. Knowing how much should my tax return be can help optimize your refund and reduce over-withholding.

| Term | Definition |

|---|---|

| Tax Refund | Money returned to taxpayers when overpaid |

| Tax Rebate | Another term for refund, sometimes for government incentives |

| Average Tax Refund | Mean refund across all filers in a category, state, or federal level |

| Typical Tax Return Amount | What most filers should expect based on IRS averages, income, and deductions |

| IRS Tax Refunds Average Amount | Official average reported by IRS |

| Individual Tax Return | Tax return filed by a single taxpayer |

e.g.: In 2025, the IRS average tax refund payment was $3,116, while state averages range from $2,656–$3,852.

Large Refunds: Refunds above $5,000 are generally considered large, though rare cases can exceed $1 million due to business credits or overpayments.

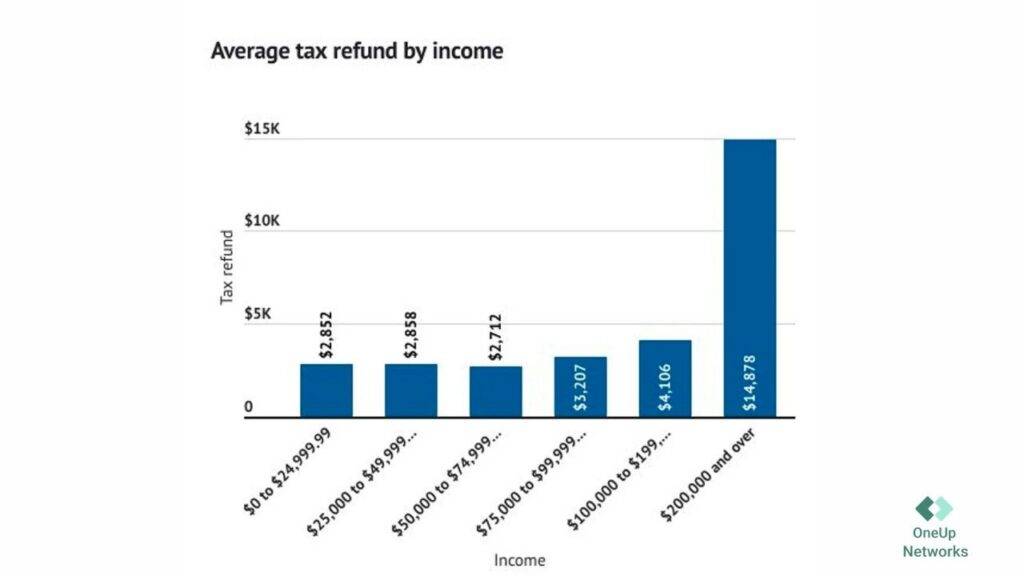

Tax Refund Amount by Income

| Income Bracket | % Receiving Refund | Average Refund |

|---|---|---|

| Under $50,000 | 77% | $2,403 |

| $50,000–$99,999 | 68.3% | $2,789 |

| $100,000–$199,999 | 55.4% | $4,188 |

| $200,000+ | 35% | $15,350 |

- For those with a $30k salary, the average income tax refund is typically $2,200–$2,400, while the average tax refund for $70,000 salary is about $2,800. If you made $100,000, the average tax refund is $4,100–$4,800, and for a $150k tax return, the average is even higher.

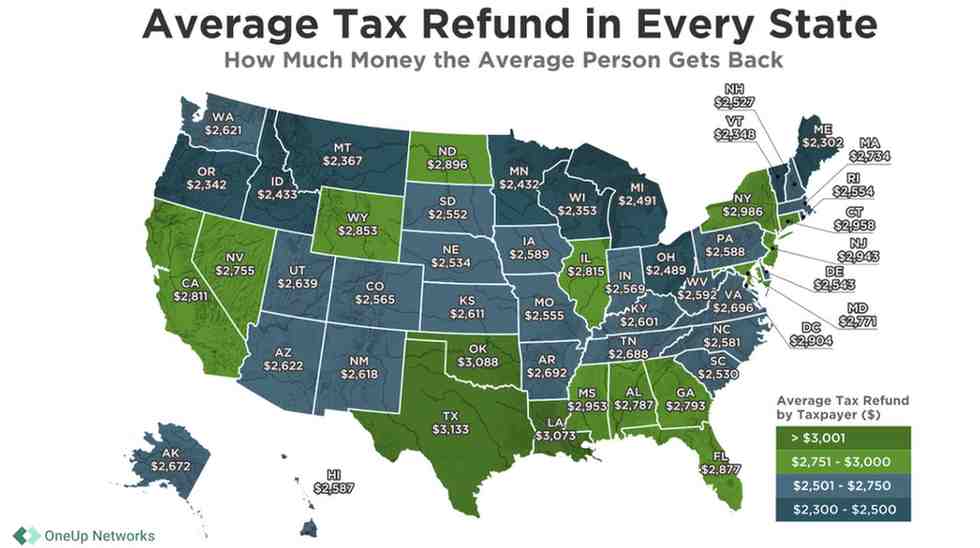

Average Tax Refund by State

Here is the full, up-to-date state-by-state table of average tax refund amounts and related stats for each U.S. state, current through the 2025 season:

| Rank | State | Average Refund (Overall) | Avg Refund (<$50k) | Avg Refund ($50–$100k) | Avg Refund ($100k–$200k) | Avg Refund ($200k+) | % Returns With Refund | % Refunds via Direct Deposit |

|---|---|---|---|---|---|---|---|---|

| 1 | Florida | $3,852 | $2,654 | $3,075 | $4,822 | $25,430 | 67.1% | 91.6% |

| 2 | Texas | $3,774 | $2,858 | $3,153 | $4,660 | $17,806 | 71.3% | 92.4% |

| 3 | Wyoming | $3,720 | $2,092 | $2,893 | $4,373 | $38,247 | 67.8% | 89.5% |

| 4 | Nevada | $3,643 | $2,520 | $2,896 | $4,539 | $25,381 | 69.6% | 91.0% |

| 5 | Louisiana | $3,577 | $3,141 | $3,027 | $4,483 | $15,319 | 73.0% | 91.4% |

| 6 | Georgia | $3,574 | $3,063 | $2,984 | $4,112 | $14,258 | 68.6% | 92.0% |

| 7 | Mississippi | $3,491 | $3,149 | $2,975 | $4,131 | $20,039 | 74.0% | 91.4% |

| 8 | Illinois | $3,394 | $2,498 | $2,840 | $4,118 | $14,709 | 69.6% | 91.6% |

| 9 | Connecticut | $3,362 | $2,092 | $2,717 | $4,169 | $15,254 | 67.0% | 89.6% |

| 10 | Alabama | $3,357 | $2,976 | $2,893 | $3,959 | $14,557 | 70.9% | 91.3% |

| 11 | California | $3,344 | $2,259 | $2,726 | $4,330 | $14,017 | 62.7% | 88.7% |

| 12 | New York | $3,339 | $2,334 | $2,710 | $4,058 | $17,153 | 66.5% | 89.8% |

| 13 | Massachusetts | $3,327 | $1,968 | $2,585 | $4,064 | $14,691 | 65.6% | 86.2% |

| 14 | New Jersey | $3,317 | $2,251 | $2,797 | $4,136 | $11,774 | 65.7% | 87.6% |

| 15 | Washington | $3,310 | $2,073 | $2,679 | $4,076 | $13,072 | 66.4% | 90.8% |

| 16 | Maryland | $3,242 | $2,294 | $2,783 | $4,060 | $11,407 | 65.7% | 90.0% |

| 17 | Arkansas | $3,224 | $2,715 | $2,913 | $4,203 | $15,199 | 71.3% | 90.7% |

| 18 | Virginia | $3,217 | $2,242 | $2,707 | $3,989 | $12,515 | 66.9% | 92.2% |

| 19 | Oklahoma | $3,213 | $2,554 | $2,976 | $4,256 | $16,850 | 69.7% | 94.2% |

| 20 | Utah | $3,210 | $1,892 | $2,766 | $4,268 | $18,817 | 67.1% | 92.0% |

| 21 | Alaska | $3,206 | $2,220 | $2,934 | $4,153 | $12,508 | 62.5% | 91.3% |

| 22 | Tennessee | $3,192 | $2,508 | $2,779 | $4,057 | $16,490 | 70.9% | 92.7% |

| 23 | Arizona | $3,179 | $2,380 | $2,679 | $4,308 | $15,322 | 66.4% | 91.8% |

| 24 | Colorado | $3,142 | $1,903 | $2,461 | $4,078 | $15,130 | 63.7% | 90.9% |

| 25 | New Hampshire | $3,091 | $1,765 | $2,616 | $4,076 | $14,145 | 68.4% | 87.7% |

| 26 | North Carolina | $3,077 | $2,428 | $2,710 | $3,935 | $13,257 | 67.9% | 89.3% |

| 27 | North Dakota | $3,063 | $2,048 | $2,713 | $3,994 | $17,501 | 66.4% | 89.5% |

| 28 | Delaware | $3,048 | $2,330 | $2,759 | $4,060 | $10,817 | 68.9% | 89.4% |

| 29 | Michigan | $3,047 | $2,289 | $2,713 | $4,191 | $14,095 | 69.9% | 89.3% |

| 30 | Idaho | $3,040 | $2,042 | $2,752 | $4,131 | $18,880 | 65.8% | 88.5% |

| 31 | Indiana | $3,028 | $2,290 | $2,863 | $4,078 | $14,738 | 72.8% | 90.7% |

| 32 | South Carolina | $3,020 | $2,435 | $2,643 | $3,929 | $14,945 | 66.7% | 91.4% |

| 33 | Hawaii | $3,011 | $2,138 | $2,743 | $4,305 | $14,016 | 64.6% | 86.0% |

| 34 | Pennsylvania | $3,011 | $2,203 | $2,737 | $4,062 | $12,560 | 71.0% | 87.4% |

| 35 | South Dakota | $3,004 | $2,097 | $2,794 | $4,075 | $18,105 | 67.1% | 90.1% |

| 36 | Kansas | $3,000 | $2,162 | $2,779 | $4,054 | $14,584 | 68.0% | 89.7% |

| 37 | Missouri | $2,991 | $2,326 | $2,758 | $4,014 | $13,370 | 69.6% | 89.3% |

| 38 | Nebraska | $2,935 | $2,081 | $2,698 | $3,828 | $16,792 | 67.4% | 92.0% |

| 39 | Iowa | $2,924 | $2,154 | $2,739 | $3,918 | $13,570 | 68.8% | 90.3% |

| 40 | Kentucky | $2,922 | $2,381 | $2,822 | $3,992 | $13,237 | 73.0% | 89.9% |

| 41 | New Mexico | $2,912 | $2,380 | $2,792 | $4,260 | $12,822 | 68.5% | 92.2% |

| 42 | Ohio | $2,874 | $2,250 | $2,600 | $3,914 | $13,714 | 71.6% | 90.5% |

| 43 | Rhode Island | $2,871 | $2,058 | $2,628 | $4,011 | $12,995 | 69.5% | 88.4% |

| 44 | Montana | $2,870 | $1,919 | $2,617 | $4,089 | $19,677 | 63.9% | 87.1% |

| 45 | Minnesota | $2,838 | $1,937 | $2,459 | $3,695 | $12,397 | 65.8% | 89.7% |

| 46 | West Virginia | $2,834 | $2,256 | $2,914 | $4,138 | $12,339 | 75.4% | 89.8% |

| 47 | Vermont | $2,816 | $1,820 | $2,616 | $4,179 | $15,012 | 67.1% | 85.4% |

| 48 | Oregon | $2,772 | $1,879 | $2,461 | $3,917 | $12,791 | 64.5% | 88.7% |

| 49 | Wisconsin | $2,737 | $1,967 | $2,491 | $3,726 | $13,150 | 68.1% | 88.2% |

| 50 | Maine | $2,656 | $1,836 | $2,481 | $3,942 | $14,286 | 67.5% | 87.1% |

*All values are rounded from latest IRS tax refunds average amount and industry data as of September 2025.

Factors Affecting Your Tax Refund

Several things impact your normal tax return amount:

- Filing status: Married filing jointly often leads to bigger refunds than single filers at the same income.

- Withholding levels: Too much withholding means a big tax refund, while too little could mean owing taxes back or a typical tax refund that’s quite low.

- Eligible credits and deductions: EITC, Child Tax Credit, education credits, mortgage interest, and IRA/HSA contributions all affect the average tax return.

- State income tax: States with no income tax (like Texas, Florida) often see higher federal refunds.

- Life changes: Marriage, divorce, having a child, job loss, or big moves can spike or shrink your tax refund average.

How Much Should Your Refund Be?

- $30,000 salary: Typical refund is $2,200–$2,400, while the average tax return amount for a single mother in this bracket is roughly the same, sometimes more with tax credits.

- $70,000 salary: Average tax refund for $70k salary is $2,789, but this varies with deductions.

- $100,000 salary: Expect an average tax refund for $100k salary of about $4,188, but less than 56% actually get refunds.

- $150,000 salary: The average income tax refund at this level exceeds $5,000, though higher earners may get less often, or may owe instead due to lower withholding or alternative minimum tax.

What is a Good Tax Refund?

Most people would consider refunds above $3,000 “large.” The biggest tax refund ever recorded for an individual reportedly exceeded $1 million due to large losses, business credits, or overpayments. The average price for tax return filing ranges from $100 to $350 (average tax return cost varies by provider).

Do most people get tax refunds? Yes—about 68% of all Americans typically receive some IRS tax refund.

Common Issues & Questions

- Why was my tax return so low this year? Tax law changes, less withholding, fewer credits, or more taxable income reduce average refunds.

- IRS tax refund delay: Processing delays and the PATH Act can impact when you receive your refund—especially for credits like EITC or ACTC.

- Where’s my state WV refund? Use your state’s revenue portal for status updates—similar for all states and for “why is my state refund so low/high?” questions.

- Tax refund delays: Contact IRS for federal issues, your state’s department for state delays; keep checking refund status with IRS’s “Where’s My Refund?” tool.

- Why are tax refunds so low this year? Reduction in available credits, fewer withholdings, and IRS error checks are big reasons.

Tips for Maximizing Your Refund

- Double-check all deductions and credits. Don’t leave money on the table—use a professional tax refund calculator or tax software for precise estimates.

- Adjust your W-4. Increase withholding if you tend to owe or decrease if your refunds are too big.

- Leverage retirement and HSA contributions. They lower taxable income and boost your typical tax refund.

- File early. Early filers often get average tax refunds faster, with fewer delays.

- Use reputable software: TurboTax, TaxSlayer, and others maximize deductions and offer audit support guarantees.

Future Trends & IRS Insights

- Average refund trends: The average IRS refund rose 3.5% from 2024 to 2025, hitting $3,116—even as delays and error-checking increased.

- IRS processing evolution: More returns now get processed within 21 days (sometimes faster for e-filed returns), but paper returns are slower.

- Will refunds go down in the future? Rebate and tax-refund trends depend on future legislation, phase-outs of pandemic credits, and payroll tax changes.

- Watch for IRS news: IRS, Deloitte, and National Taxpayer Advocate reports offer authoritative updates.

- Rough income tax return calculators and MN state tax refund calculator tools are essential for planning each year.

Key Takeaways

Knowing the irs tax refunds average amount in your state and income bracket empowers smarter planning and prevents disappointment during tax season. While the typical tax return amount ranges from $2,400–$4,200 (and much higher for top-income earners), the single most important strategy is to optimize withholding and take every legal credit. Monitor trends, use professional calculators, and lean on reputable information to keep your tax refund average healthy and your stress levels low.

FAQs: Average Tax Refunds

Usually $4,100–$4,800, but only about 55% of filers at this income level receive refunds.

You can expect an average refund of around $2,789, if you’re eligible for typical deductions and credits.

The national average refund is about $3,116, though it varies by state, income, and deductions.

Low refunds are often due to less withholding, fewer tax credits, or policy changes affecting eligibility.

Possible reasons include the expiration of certain tax credits and stricter IRS rules or changes in tax law.

Most people consider a refund of $3,000 or more as strong, especially if it’s above IRS or state averages.

Refunds for single filers usually average between $2,000–$3,200, depending on state, income, and eligible credits.

Most taxpayers receive IRS refunds within 21 days of e-filing, assuming there are no errors or additional reviews.

Yes—many CPA firms and IRS-approved online tools help estimate refunds accurately before filing.

The average cost ranges from $100–$350, depending on the complexity of your return and the provider used.

Conclusion

The average tax refund amount in your state provides a powerful benchmark for your own financial planning. Whether your are aiming for a typical tax refund also seeking to maximizing the IRS taxes you have to understande the factors that influence your average like income, filing status, withholding, and deductions which you have to make better decisions each year. Understanding From the IRS average tax refund amounts to differences between states average information helps you avoid surprises and also gives you more control over your money. So No matter what is your income, smart planning and filing on time can help you get the you deserve.

Are You Ready to take charge of your tax season? Take Your Practice to the Cloud with Confidence

Don’t let outdated systems slow down your accounting or tax practice. With OneUp Networks’ secure and scalable cloud hosting solutions also including specialized hosting for Thomson Reuters applications like UltraTax and CS Professional Suite so you can access your tools anytime, keep client data safe, and improve team collaboration. Whether you’re a CPA, tax professional or also financial advisor our hosting services are designed to give you speed, compliance, and peace of mind.

Start your cloud journey today with OneUp Networks Contacts Now— where security meets productivity.

Sources

CPA Practice Advisor – What is the Average Tax Refund Amount in Your State?

Bankrate – The Average Tax Refund Each Year, and How Tax Refunds Work

IRS.gov – Filing Season Statistics for Week Ending April 25, 2025

Axios – Where Average Tax Refunds Are the Highest and Lowest

SmartAsset – States With the Highest Average Tax Refund

LiveNow FOX – Here’s the Average Tax Refund for 2025 Filers

TurboTax – 7 Most Common Tax Questions Answered by a CPA

Financial Express – Income Tax Refund Delays & Updates

Also Read These Helpful Blogs:

- New IRS Tax Laws 2026: What Small Businesses Must Know to Save Thousands

- Trends in Accounting in 2024

- Why Is UltraTax Downtime a Critical Issue for Tax Firms?

- All About Tax Season: What to Expect in 2025 and How to Prepare?

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?