Did you know that 60% of small businesses cite financial visibility as their top challenge? The profit and loss (P&L) statement—also called the “p&l statement,” “profit and loss report,” or “p and l statement”—solves this problem by summarizing income, expenses, and net profit for any business size or sector. Accurate P&L management anchors decision making, supports growth, and is vital for financial compliance.

Whether tracking monthly P&L or preparing investor-ready reports, understanding the ins and outs of P&L accounting is foundational for business prosperity. This comprehensive guide demystifies every aspect to ensure OneUp Networks readers master the P&L from basics to advanced analysis.

What is Profit & Loss Statement ?

A Profit and Loss (P&L) statement—also called a P&L report, profit and loss account, or income statement—is one of the most important financial documents for any business. It summarizes a company’s revenues, costs, and expenses over a specific period (monthly, quarterly, or annually) to reveal the net profit or loss.

Businesses use the P&L statement to:

- Assess operational efficiency by tracking how revenue translates into profit.

- Make strategic decisions regarding pricing, cost management, and investments.

- Ensure accounting and tax compliance by providing accurate records of income and expenses.

In essence, the P&L statement gives a complete snapshot of financial performance, helping owners, managers, and investors understand how well the business is performing and where improvements are needed.

Key takeaway: A well-prepared P&L isn’t just a report—it’s a decision-making tool that supports growth, profitability, and long-term business success.

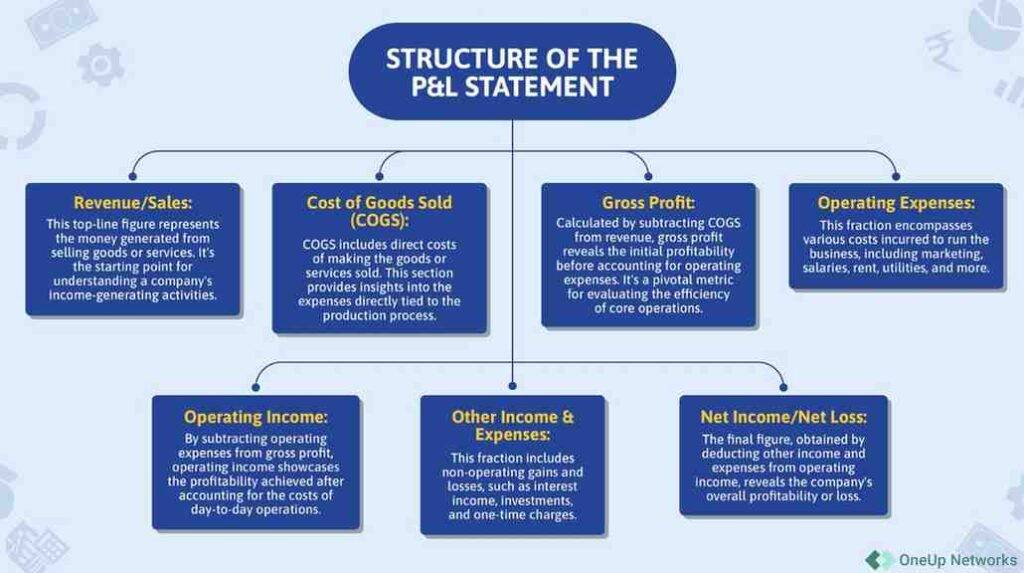

A profit and loss statement always follows a top-to-bottom structure:

Net income = revenue – expenses + gains – losses.

Types of P&L Reports & Variations

Profit and loss reports differ by business need:

- Single-step P&L: Aggregates all revenues, then subtracts all expenses in one calculation.

- Multi-step P&L: Segregates operating from non-operating activity, revealing gross and operating profit.

- Condensed or Summary P&L: High-level snapshot, useful for quick reviews.

P&L vs Income Statement: Are They the Same?

There’s no substantive difference between an income statement and a profit and loss statement. Both terms may appear in accounting reports and templates—sometimes as “statement of operations”—but refer to the same document.

How Do Businesses Use P&L Statements?

The business P&L statement is an indispensable tool:

- Tracking month-to-month results with a monthly profit and loss format prevents “flying blind.”

- Translating sales, cost, and expense data into actionable insight supports cash flow management and growth.

- Lenders, CPAs, and management require P&L reporting for compliance, tax filing, and investment analysis.

Business Scenarios Table

| Scenario | Challenge | Solution |

|---|---|---|

| Small business monthly review | Monitoring cash flow | Monthly financial summary |

| CPA client reporting | Standardizing client reports | Comprehensive earnings overview |

| Startup fundraising | Demonstrating profitability | Detailed income statement |

| E-commerce business review | Controlling expense growth | Performance analysis report |

| Franchise multi-location review | Reporting by business segment | Multi-level financial summary |

Profit and Loss Examples

1. CPA Firm (Small Accounting Practice)

Revenue: $300,000 (client retainers, tax filing fees, bookkeeping services)

COGS / Direct Costs: $40,000 (outsourced bookkeeping staff, tax software licenses)

Gross Profit: $260,000

Operating Expenses: $200,000 (salaries for partners, rent, insurance, utilities, marketing)

Net Profit: $60,000

Insight: Healthy profitability, but margins could improve if the firm adopts cloud-hosted software to cut IT costs and scale clients faster.

2. Tax Advisory Firm (Seasonal Revenue Model)

Revenue: $180,000 (mostly Jan–Apr tax season)

COGS: $25,000 (tax preparation tools, third-party consultants)

Gross Profit: $155,000

Operating Expenses: $160,000 (temporary staff hiring, advertising, compliance insurance, office rent)

Net Loss: –$5,000

Insight: P&L highlights how seasonality impacts profitability. Shifting to year-round services (e.g., payroll, business consulting) could balance cash flow.

3. Financial Advisory Firm

Revenue: $600,000 (wealth management fees, financial planning retainers)

COGS: $100,000 (third-party research tools, brokerage platforms, compliance software)

Gross Profit: $500,000

Operating Expenses: $350,000 (advisors’ salaries, client acquisition, events, office rent)

Net Profit: $150,000

Insight: Strong margins, but P&L suggests a high marketing spend. Investing in referrals and digital branding could reduce acquisition cost.

4. Bookkeeping Outsourcing Company

Revenue: $400,000 (outsourced bookkeeping and payroll clients)

COGS: $200,000 (staff salaries, cloud hosting costs, QuickBooks licenses)

Gross Profit: $200,000

Operating Expenses: $150,000 (management salaries, training, IT security, marketing)

Net Profit: $50,000

Insight: Profitability exists, but thin margins. P&L suggests automation + AI-based bookkeeping tools could cut manual costs and increase net profit.

5. Mid-Sized Audit Firm

Revenue: $1,000,000 (audit engagements, compliance services, consulting)

COGS: $250,000 (specialized audit software, subcontractors)

Gross Profit: $750,000

Operating Expenses: $600,000 (audit staff salaries, training, certifications, office leases, travel)

Net Profit: $150,000

Insight: Stable profits, but high travel and staff costs stand out. A remote audit model with cloud solutions could increase efficiency.

Profit & Loss Analysis for Business Growth

P&L analysis means dissecting your statement’s numbers:

- Gross margin, net margin, cost ratio, and revenue growth rates reveal hidden trends.

- P&L dashboards use visualizations to track monthly P&L, making patterns easy to spot and act on.

Metrics That Matter

- Net Profit Margin: Net Profit Margin=Net ProfitRevenueNet Profit Margin=RevenueNet Profit

- Operating Margin

- Expense Ratio

P&L Management Best Practices:

- Regular review of P&L metrics, segmentation by product/service.

- Leverage cloud accounting to automate profit and loss reports.

- Compare current and past periods to drive p&l optimization.

What are the key differences between a P&L and an income statement

The Profit & Loss (P&L) statement and income statement are actually two names for the same financial report—both summarize a company’s revenues, expenses, and net profit or loss for a specific period. There is no difference in the structure, content, or calculation between the two; the distinction is primarily in terminology, usage context, and sometimes regional preference.

Key Points of Distinction

- Terminology:

- Geographical usage:

- Presentation:

What matters most:

- Both provide an essential summary of business financial performance.

- Both are used for internal decision-making, attracting investors, and fulfilling compliance/reporting requirements.

Profit & Loss Statement vs. Income Statement

| Aspect | Profit & Loss (P&L) Statement | Income Statement |

|---|---|---|

| Meaning | A financial report showing revenues, expenses, and resulting profit or loss over a specific period. | The formal accounting report showing the same revenues, expenses, and net income for a period. |

| Common Usage | Widely used in business operations and day-to-day financial management. | More common in formal accounting, reporting, and compliance (e.g., GAAP, IFRS). |

| Structure | Revenue → Expenses → Net Profit (may include subtotals like gross profit, operating income). | Revenue → Expenses → Net Income (same subtotals possible). |

| Synonyms | P&L report, statement of profit or loss. | Statement of earnings, statement of operations. |

| Users | Managers, entrepreneurs, internal teams (focus on business performance). | Investors, regulators, auditors, financial analysts (focus on standardized reporting). |

| Key Insight | Helps business owners see if operations are profitable. | Provides external stakeholders with standardized financial performance metrics. |

Both terms refer to the same report — the difference is mostly in naming and context. Businesses often say P&L, while accountants and regulators typically say Income Statement.

Bottom line: There are no calculation or data differences—just terminology and context.

FAQs on Profit & Loss (P&L) statement

A profit and loss statement (P&L) is a financial document that summarizes a company’s revenues, expenses, and profits or losses over a specified period. It’s synonymous with “income statement” or “p and l statement

Businesses use the P&L report to track financial performance, guide strategic decisions, and fulfill tax or investor obligations. It’s essential for both small and large enterprises.

There is no difference; “income statement” and “profit and loss statement” refer to the same accounting report.

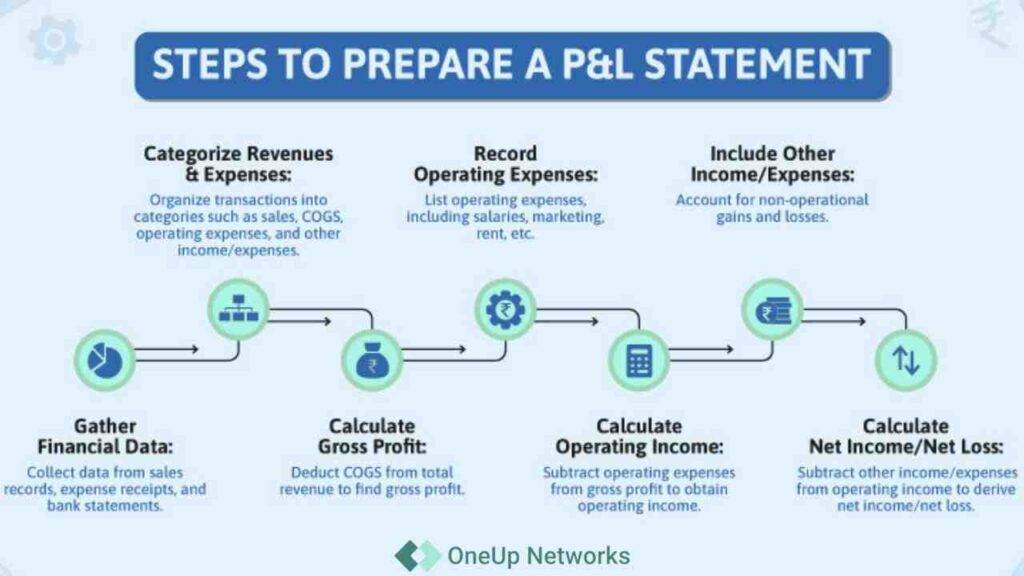

List all sources of revenue, subtract all costs (COGS, operating, and non-operating expenses), account for any gains or losses, and calculate net profit. Templates and accounting software streamline this process.

P&L analysis involves evaluating the profit and loss statement’s figures to identify trends, weaknesses, and opportunities for business improvement.

Monthly P&L documents enable businesses to spot problems early, manage cash flow better, and benchmark progress accurately.

Yes—P&L reporting is required for tax filings, deductions, and ensuring compliance with accounting regulations.

Conclusion

In summary, the Profit & Loss (P&L) statement is an indispensable financial tool that provides a clear, concise view of a business’s revenues, expenses, and profitability over any set period. Whether you are a small business owner tracking monthly cash flows or a large corporation presenting formal income statements, mastering P&L concepts fosters informed decision-making, strategic planning, and sustainable growth. By understanding key terms, structuring your monthly P&L carefully, and leveraging advanced analysis techniques, you can transform financial data into actionable insight that drives business success.

Take Action with OneUp Networks

Ready to simplify your financial management and unlock the full potential of your Profit & Loss statements? At OneUp Networks, we provide cutting-edge cloud accounting solutions tailored to your business needs, empowering you to automate P&L reports, perform real-time analysis, and optimize your financial health with ease.

Contact OneUp Networks today to explore our powerful tools and expert resources—and start turning your accounting data into a competitive advantage. Your path to smarter business finance starts here!

Also Read These Helpful Blogs:

- Accounting for Dummies Cheat Sheet: Essential Guide for Beginners & Professionals

- QuickBooks Cloud Hosting @ $9.99/User

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- QuickBooks Integrations

- UltraTax CS Backup and Restore: Preventing Lost Client Files During Crashes