Are you struggling to pick between QuickBooks vs Square? Choosing the right financial and point-of-sale (POS) software is crucial for any small business striving to optimize operations, drive sales, and stay compliant with tax and accounting rules. Two of the most popular options in the U.S. market right now are QuickBooks and Square. But which one is better for your small business?

This comprehensive guide walks CPAs, accountants, QuickBooks users, Square users, small business owners, and taxpayers through a robust comparison of QuickBooks and Square. It covers key features, pricing, usability, payroll options, POS capabilities, integrations, and tax handling. By the end, you’ll understand the pros and cons of each platform so you can make a smart choice that boosts your business growth — and be confident enough to book a demo, sign up, or recommend with trust.

What Is QuickBooks?

QuickBooks is a powerful, full-featured accounting and financial management software developed by Intuit. It helps small to medium-sized businesses manage their bookkeeping, invoicing, payroll, expenses, tax filing, and financial reporting all in one place. QuickBooks is widely used by accountants, CPAs, and service-based businesses that require detailed tracking of income, expenses, and employee payroll. It offers both cloud-based and desktop versions and integrates with hundreds of business apps to streamline financial workflows.

QuickBooks is especially favored by businesses looking for robust accounting controls, customizable invoicing, advanced reporting, and seamless integration with tax services and payroll systems.

What Is Square?

Square is an all-in-one payment processing and point-of-sale (POS) platform designed to help small businesses, retailers, restaurants, and mobile vendors accept payments easily and efficiently. Square combines hardware (like card readers) and software (mobile apps, POS systems) to enable in-person, online, and mobile sales.

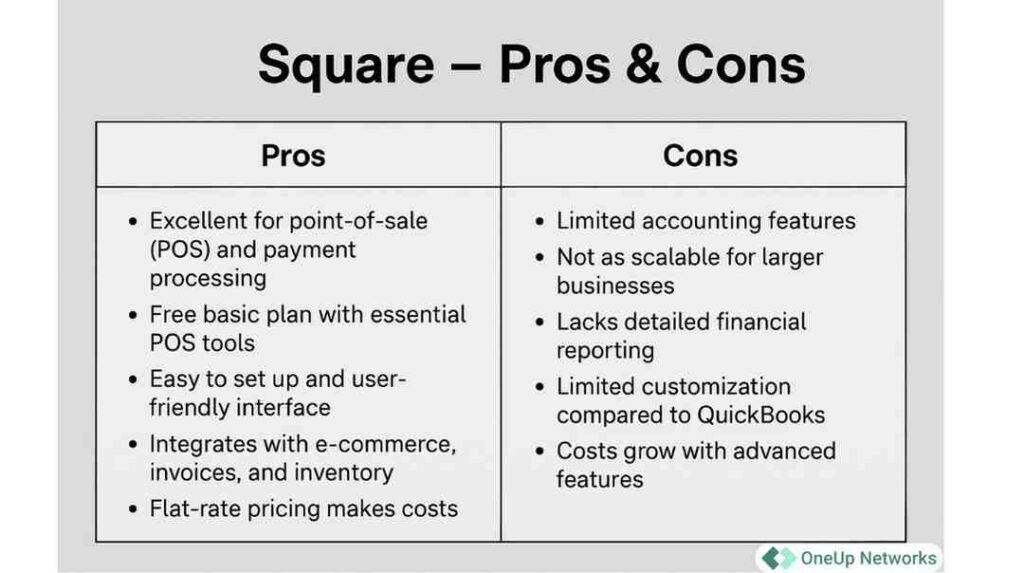

Square’s strength lies in its simplicity and speed of setup, making it ideal for businesses that want to start accepting payments quickly, manage inventory at retail locations, and integrate sales with e-commerce platforms. It also offers payroll, marketing, and financing tools geared toward retail and service industries.

Quick Summary

| Platform | What It Does Best | Typical Users |

|---|---|---|

| QuickBooks | Comprehensive accounting and payroll | Service businesses, accountants |

| Square | Payment processing and point of sale (POS) | Retailers, restaurants, mobile vendors |

Why This Comparison Matters to Small Businesses and Financial Pros

Selecting QuickBooks vs Square impacts more than just accounting or payments. It shapes efficiency, compliance, customer experience, and cash flow management. For accountants and CPAs, advising clients on which tool fits best can streamline tax prep, audit readiness, and financial forecasting. Taxpayers and business owners want straightforward payroll, intuitive bookkeeping, and smooth sales processing—all without costly errors.

QuickBooks and Square at a Glance

| Feature | QuickBooks | Square |

|---|---|---|

| Primary Use | Comprehensive accounting, invoicing, payroll, and tax reporting | Payment processing with POS, payroll, and business management tools |

| Best For | Small to mid-sized businesses needing full accounting and tax solutions | Small businesses focusing on sales and payment processing |

| Pricing (Starting) | From $25/month (Simple Start plan) | Free POS software; transaction fees apply; payroll starts at $35/month |

| POS Capabilities | QuickBooks POS (additional fee) | Robust, integrated Square POS system |

| Payroll Integration | Native QuickBooks Payroll subscription | Square Payroll (separate subscription) |

| Tax Filing Assistance | Extensive accounting and tax reports | Limited; focus on payments and payroll withholding |

| User Interface | Accounting-focused, moderate learning curve | User-friendly, simple for sales staff |

| Integrations | Wide range of accounting, banking, tax, and third-party apps | Integrates well with e-commerce and payment apps |

| Mobile Apps | QuickBooks mobile app for accounting | Square POS and Seller apps |

In-Depth Feature Comparison of QuickBooks VS Square

1. Accounting and Bookkeeping

- QuickBooks: Industry leader in small business accounting, offering invoicing, expense tracking, bank reconciliation, and customizable reports. Ideal for keeping your books fully tax-ready.

- Square: Basic sales and payment tracking features. Limited bookkeeping outside of sales. Its accounting features rely on integrations with QuickBooks or other platforms for full accounting.

2. Point of Sale (POS)

- QuickBooks POS: A separate product with added costs, built for retail businesses with inventory management but requires extra setup.

- Square POS: Native and included for free, designed for ease with features like inventory, sales reporting, and offline mode. Works for retail, restaurants, and service industries seamlessly.

3. Payroll Capabilities

- QuickBooks Payroll: Integrated with accounting for smooth tax filing, direct deposits, benefits management. Plans start at $45/month plus $4 per employee.

- Square Payroll: Separate subscription with features for full-service payroll and tax filings. Plans start at $35/month plus $5 per employee.

4. Pricing & Fees

- QuickBooks: Subscription-based pricing by tier. Additional costs for payroll and POS system.

- Square: Free POS. Transaction fees are typically 2.6% + 10¢ per swipe for in-person sales. Payroll billed separately.

5. Ease of Use & Support

- QuickBooks: Powerful but steeper learning curve. Robust online help and telephone support.

- Square: Very intuitive, minimal training needed. Good mobile support and in-person training resources.

6. Tax Filing & Compliance

- QuickBooks: Designed for tax-ready bookkeeping, supporting CPA workflows and direct connections with tax software.

- Square: Handles payroll taxes and filings but limited for broader income tax reporting.

Which One Fits Your Business Model?

| Business Type | Best Choice | Why? |

|---|---|---|

| Service-Based Small Business | QuickBooks | Invoicing, time tracking, full accounting |

| Retail & Food Service Businesses | Square | Easy POS, quick setup, integrated payments |

| Businesses Needing Expert Accounting | QuickBooks | Real accounting depth, tax prep ready |

| Startups & Very Small Businesses | Square | Minimal costs and easy payments |

| Businesses Wanting Payroll Built In | Choose based on payroll features and pricing preferences |

QuickBooks vs Square: Which One Wins for Small Business Accounting?

QuickBooks stands out with robust accounting features that Square doesn’t offer natively. For small businesses needing detailed financials, tax-ready books, and CPA collaboration, QuickBooks is the gold standard. Square users often need to integrate QuickBooks to handle complex bookkeeping, which can add cost and complexity.

Square vs QuickBooks: POS & Payment Processing Battle

In this, Square wins the POS duel. It’s designed for sales first with a native POS that’s free to start using, packed with features for checkout, inventory, and sales reporting. QuickBooks POS exists but costs extra, and is less widely used.

QuickBooks POS vs Square POS: Which Is More Efficient?

Square POS is easier to set up and more flexible for multiple business types. QuickBooks POS suits inventory-heavy retail but comes at higher cost and complexity.

Square Payroll vs QuickBooks Payroll: Payroll Showdown

Both offer payroll tax filing and direct deposits, but pricing and integration options differ. QuickBooks integrates payroll tightly with accounting; Square offers simplicity through its payroll service, often preferred by businesses already using Square POS.

Practical Advice: Making Your Decision

- Assess which features your business relies on most: accounting intricacy or payment flexibility

- Consider your budget for software plus transaction fees

- Think about scalability, tax preparation needs, and software learning curve

- Consult with your accountant or CPA for personalized advice

- Try free trials and demos to experience the interfaces before committing

FAQs on QuickBooks vs Square

Yes, they integrate natively, allowing efficient syncing of sales and payment data, easing bookkeeping efforts.

No, QuickBooks discontinued its POS and partners with Shopify for retail POS needs.

Yes, both comply with PCI DSS and deploy enterprise-level encryption and fraud detection.

QuickBooks tends to offer better transaction rates for larger volumes due to negotiated fees.

Square’s aggregated merchant accounts may lead to occasional holds or freezes under unusual activity patterns.

Conclusion: Choosing Between QuickBooks and Square for Your Small Business

Both QuickBooks and Square offer powerful solutions tailored to different small business needs. If comprehensive accounting, tax readiness, and detailed financial management are top priorities, QuickBooks is the clear winner. Conversely, if ease of use, integrated point-of-sale, and streamlined payment processing are more important, Square provides excellent value and simplicity.

Ultimately, the best choice depends on your business model, budget, and growth plans. Consulting with your accountant or CPA can help ensure you pick the platform that maximizes efficiency and compliance. With the right tools and expert support—like what OneUp Networks offers—you can confidently manage your business finances and focus on what matters most: growing your business.

Take Control of Your Business Finances Today

Choosing between QuickBooks and Square doesn’t have to be overwhelming. Whether you need robust accounting, seamless payroll, or an intuitive POS system, OneUp Networks can help you find the right solution for your business.

Contact Us – See QuickBooks hosted in action and discover how it can streamline your accounting.

Get Expert Advice – Our team will guide you to the platform that fits your business model, budget, and growth plans.

Start a Free Consultation – Learn how to integrate accounting and payments effortlessly.

Don’t wait—empower your small business with the right tools today! Book Your Demo Now

Sources

Here is a complete list of all the main sources, each with the name and its direct link for reference:

QuickBooks vs Square: Main Sources with Links

- Square vs QuickBooks: 2025 Comparison – QuickBooks.intuit.com

- Square vs QuickBooks 2025 Showdown – TechRepublic

- QuickBooks vs Square Invoices: Detailed Comparison – Ace Cloud Hosting

- Square vs QuickBooks – Payroll Software – HumanResource.com

- Quickbooks vs Square (2025) | Which Is HONESTLY Better? – YouTube

- QuickBooks POS vs Square – Loman AI

- QuickBooks vs Square Payroll – TryFondo.com

- Square VS QuickBooks Comparison – Merchant Maverick

- QuickBooks Vs Square: Which Is Best for Your Small Business? – Envoice.eu

- Square Payroll vs QuickBooks Payroll: Which Is Best? – Fit Small Business

- QuickBooks Enterprise vs Square for Retail – SoftwareAdvice.com

- Square Vs. QuickBooks Comparison – Forbes Advisor

- Quickbooks Payroll vs Square Payroll – Technology Evaluation

- Compare QuickBooks Money vs Square Point of Sale 2025 – Capterra

- Square POS vs QuickBooks POS – Loman AI

- QuickBooks Payroll vs Square Payroll – 2025 Comparison – Software Advice

- Compare Square for Retail vs QuickBooks Enterprise 2025 – SoftwareWorld.co

- Compare QuickBooks Point of Sale vs. Square Point of Sale – G2

- Compare QuickBooks Online vs Square Payroll – SoftwareSuggest

- QuickBooks vs Square Payroll – Technology Evaluation

These links provide direct access to each resource for further research and verification.

Also Read These Helpful Blogs: