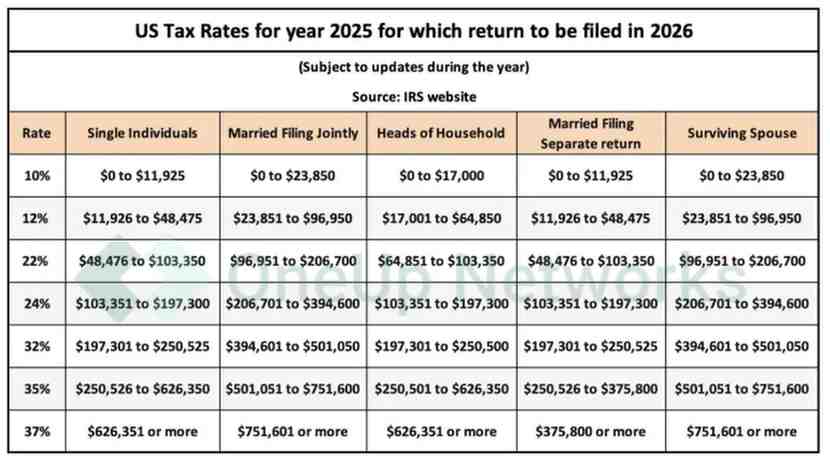

The One Big Beautiful Bill (OBBB), signed in July 2025, marks a major overhaul of the U.S. tax code. From families and retirees to freelancers and small businesses, these changes could significantly impact how much you owe—or save—starting with the 2025 tax year (filed in 2026) and continuing into 2026.

This guide breaks down what you need to know, how it affects your finances, and strategies to maximize deductions and credits.

Table of contents

- 1. What is the One Big Beautiful Bill (OBBB)?

- 2. Senior Tax Deduction: Extra Savings for Retirees

- 3. No Tax on Tips: Relief for Service Workers & Creators

- 4. Expanded Child Tax Credit

- 5. Charitable Giving Changes (2026 Onward)

- 6. End of the EV Tax Credit

- 7. Permanent QBI Deduction for Small Businesses

- 8. Bonus Depreciation & R&D Expensing

- 9. Social Security Trust Fund Concerns

- 10. Technology & Automation: QuickBooks and AI Tools

- FAQs

1. What is the One Big Beautiful Bill (OBBB)?

The OBBB extends many provisions from the 2017 Tax Cuts and Jobs Act while adding new deductions, credits, and incentives.

| Provision | Details | Effective Date | Suggested Visual |

|---|---|---|---|

| QBI Deduction | Permanent 20% deduction for pass-through entities | 2025 onward | Flowchart of eligibility |

| Senior Deduction | Extra $6,000 standard deduction ($12,000 married) | 2025 | Bar graph comparing old vs new deduction |

| No Tax on Tips | Up to $25,000 in tips exempt from federal tax | 2026 | Pie chart of taxable vs tax-free tips |

| Child Tax Credit | Increase from $2,000 → $2,200 per dependent | 2025 | Table with credit per number of children |

| Charitable Giving | Above-the-line deductions for non-itemizers | 2026 | Infographic of “donation timing” |

| EV Tax Credit | Ends after September 30, 2025 | 2025 | Timeline of deadlines |

| Bonus Depreciation & R&D | Full expensing for qualifying businesses | 2025 onward | Flowchart of deduction process |

2. Senior Tax Deduction: Extra Savings for Retirees

Taxpayers aged 65+ qualify for an extra $6,000 standard deduction ($12,000 for joint filers).

| Filing Status | Phaseout Starts | Fully Phased Out |

|---|---|---|

| Single | $75,000 | $175,000 |

| Married Joint | $150,000 | $250,000 |

Mini Case Study:

- Robert & Linda, Retirees: Coordinate IRA withdrawals to stay under senior deduction phaseouts → save $4,500 in 2025.

Planning Tip: Coordinate retirement account withdrawals to maximize deductions.

3. No Tax on Tips: Relief for Service Workers & Creators

Starting in 2026, up to $25,000 of tip income per taxpayer is federal tax-free.

Eligible Groups (Preliminary):

- Hospitality workers

- Rideshare & delivery drivers

- Digital creators and online performers

Mini Case Study:

- Jessica, Restaurant Worker: Tracks tip income diligently → avoids $18,000 in federal taxes in 2026.

Planning Tip: Maintain detailed tip logs for both cash and digital payments.

4. Expanded Child Tax Credit

- Credit increase: $2,000 → $2,200 per child

- Adjusted income limits include more middle-class households

| Number of Children | Credit Amount |

|---|---|

| 1 | $2,200 |

| 2 | $4,400 |

| 3 | $6,600 |

Mini Case Study:

- The Smith Family: With three children, the $2,200 credit per child adds $6,600 in tax relief in 2025.

5. Charitable Giving Changes (2026 Onward)

New Rules:

- Non-itemizers: up to $1,000 (single) / $2,000 (married) above the line

- Itemizers: Deduct contributions only above 0.5% of AGI

- High earners (37% bracket): deduction capped at 35%

Planning Tip: Donate in 2025 to maximize deductions before the 2026 rule change.

6. End of the EV Tax Credit

- Deadline: September 30, 2025

- Applies to newly purchased electric vehicles

Mini Case Study:

- John buys a Tesla Model 3 in August 2025 → claims full credit.

- John waits until October 2025 → misses federal credit entirely.

7. Permanent QBI Deduction for Small Businesses

- Applies to LLCs, S Corps, partnerships, and sole proprietors

- Covers freelancers and consultants

- Provides long-term tax planning stability

| Business Income | Deduction (20%) | Taxable Income Reduction |

|---|---|---|

| $50,000 | $10,000 | $40,000 |

| $100,000 | $20,000 | $80,000 |

| $250,000 | $50,000 | $200,000 |

Mini Case Study:

- Anna, 34, Freelancer: Uses QBI deduction and tracks expenses via QuickBooks AI → saves $12,000 in taxes.

8. Bonus Depreciation & R&D Expensing

- 100% bonus depreciation for equipment, vehicles, and technology

- Full R&D expensing upfront

Mini Case Study:

- Startup purchases $50,000 in software & laptops → deducts full amount in 2025, improving cash flow.

9. Social Security Trust Fund Concerns

- OBBB may worsen the funding shortfall

- Depletion projected to move from 2034 → 2032

- Potential 24% benefit cut if Congress doesn’t act

Planning Tip: Diversify retirement savings beyond Social Security.

10. Technology & Automation: QuickBooks and AI Tools

AI tools simplify complex tax compliance:

- QuickBooks AI Agents: Automate bookkeeping, payments, and forecasting

- TurboTax AI Assistants: Guide through deductions and credits

- 64% of accounting firms are investing in AI

Mini Case Study:

- Sarah, Freelancer: Uses QuickBooks AI to track tips, expenses, and QBI → saves 12 hours/month.

FAQs

Most provisions start with the 2025 tax year, meaning they will be filed in 2026. Some, like the No Tax on Tips rule, begin in 2026.

Taxpayers aged 65 or older qualify for an extra $6,000 standard deduction ($12,000 for married filing jointly). Income phaseouts apply: $75,000–$175,000 for single filers and $150,000–$250,000 for joint filers.

Up to $25,000 in tip income per taxpayer is exempt from federal tax starting in 2026. Eligible groups include hospitality workers, rideshare drivers, and digital creators earning tips.

Yes. The 20% Qualified Business Income deduction is now permanent for LLCs, partnerships, S Corps, and sole proprietors. Income thresholds still apply.

The credit ends on September 30, 2025. Vehicles must be delivered and placed in service by this date to qualify.

High-income earners may want to bunch donations in 2025 before 2026 limits take effect, to maximize deductions.

Conclusion

The OBBB is more than a tax update—it’s an opportunity to save thousands. older people, families, freelancers, and small businesses all have new tools at their disposal. Timing is critical: expiring incentives like the EV credit and new charitable rules require action before deadlines.

Mini Case Studies Recap:

- Anna, Freelancer: Saves $12,000 with QBI deduction

- Robert & Linda, Retirees: Save $4,500 via senior deduction planning

- Jessica, Restaurant Worker: Avoids $18,000 in federal taxes on tips

Act Now:

- Track income, tips, and expenses carefully

- Plan purchases and donations strategically

- Leverage AI tools for automation and accuracy

- Consult a tax professional for complex planning

Have questions or need expert guidance? The team at OneUp Networks is here to help. Whether it’s tax changes, cloud hosting, or Managed backup support, we’ll get you the answers you need. Contact us today and let’s build smarter solutions together.

Also Read These Helpful Blogs:

- New Tax Laws 2026: IRS Tax Changes to Maximize Your Refund

- The Ultimate Guide to UltraTax CS Hosting by OneUp Networks

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- All About Tax Season: What to Expect in 2025 and How to Prepare?

- Essential 1099 Tax Tips Every Employee Should Know