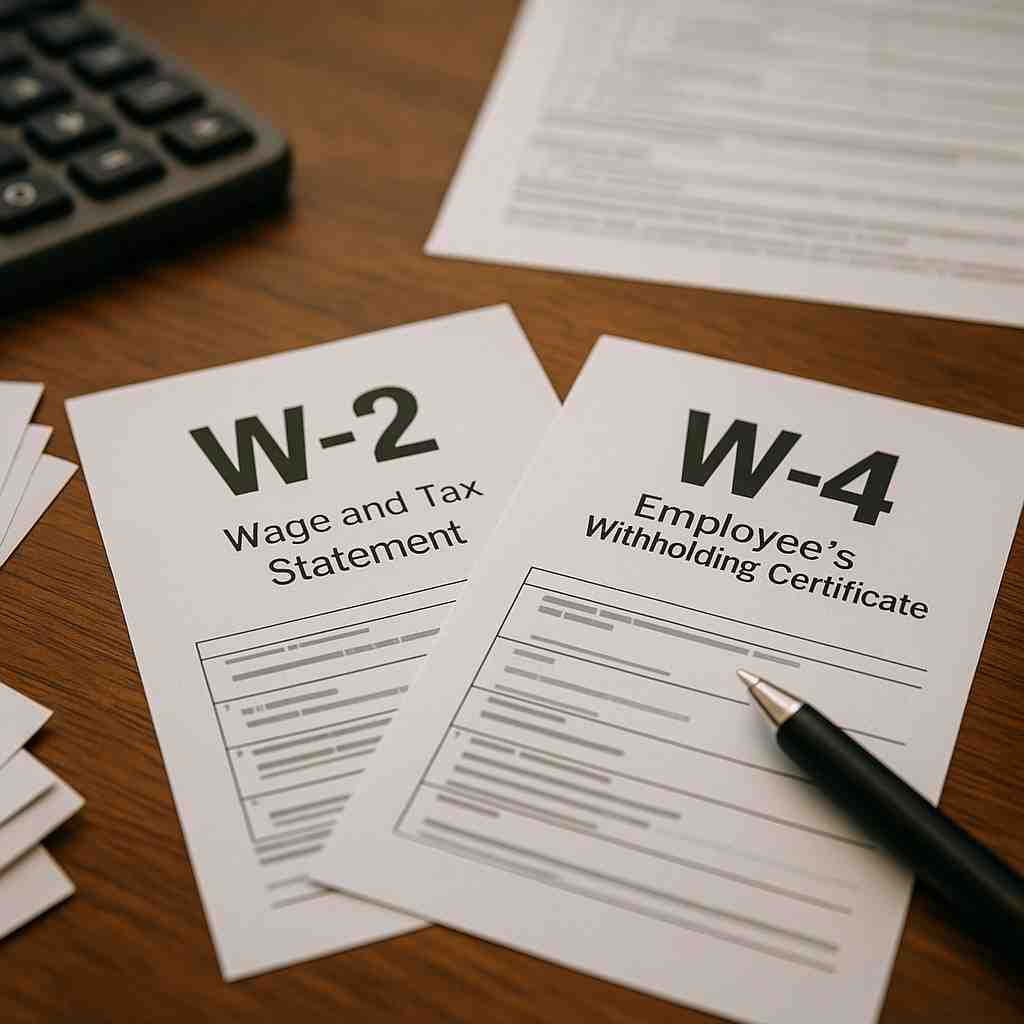

Starting a new job usually means handling several tax forms, and two of the most confusing ones are the W-2 and W-4. Many people mix them up, and that confusion often creates problems—like surprise tax bills, smaller paychecks, or delays during tax season. When you understand the basics of w2 vs w4, these forms become much easier to manage. The W-4 guides your employer on how much tax to take from each paycheck, and the W-2 shows your actual earnings and taxes for the year. When both forms make sense, you gain more control over your paycheck and your tax filing.

Key Takeaways

- The difference between w2 and w4 centers on timing. The W-4 guides how much tax comes out of each paycheck, and the W-2 summarizes your wages and taxes at the end of the year.

- You complete the W-4 when you start a job or when your tax situation changes, so your withholding stays accurate.

- Your employer creates the W-2 every January so you can file a correct tax return.

- Clear and accurate forms help you avoid surprise tax bills, smaller paychecks, or refund delays.

- Strong payroll habits start with understanding both forms and how they support year-round tax accuracy.

What is a W-2 Form?

A W-2 form, also called the Wage and Tax Statement, reports how much money you earned during the year and how much tax your employer withheld from each paycheck. Your employer prepares this form at the end of the year and sends it to you every January. You use the W-2 when you file your tax return because it shows your wages, federal and state taxes withheld, and your Social Security and Medicare totals.

People who search for the difference between w2 and w4 often learn that the W-2 does not guide withholding at all. Instead, it summarizes the results of your payroll for the entire year. You never fill out a W-2—your employer handles it based on your actual income.

Your W-2 includes:

- Total wages you earned

- Federal, state, and local taxes withheld

- Social Security and Medicare amounts

- Employer and employee identification details

- Retirement contributions (if your plan applies)

What is a W-4 Form?

A W-4 form, officially called the Employee’s Withholding Certificate, tells your employer how much federal income tax to take out of each paycheck. You complete the W-4 when you start a job, and you update it whenever your tax situation changes—such as marriage, having a child, or taking a second job. People who look up w4 vs w2 usually start by learning that the W-4 controls your withholding throughout the year.

The W-4 asks for your filing status, the number of dependents you claim, and any extra withholding you want your employer to take. When you update your W-4 correctly, you keep your paycheck accurate and avoid surprise tax bills during filing season. The W-4 stays with your employer, and you do not send it to the IRS. Its only purpose is to guide your employer in calculating the right amount of tax to withhold from each paycheck.

Your W-4 includes:

- Your filing status

- Dependents and credits

- Extra withholding requests

- Income adjustments (if you have multiple jobs)

Who Fills Out Each Form?

Employees complete the W-4 because it guides their employer on how much tax to withhold from each paycheck. When an employee gets married, has a child, or takes on a second job, they update the form so their withholding stays accurate. Employers handle the W-2. They create this form at the end of the year to show the employee’s total wages and taxes withheld. Anyone searching for the w2 versus w4 difference often learns that the W-4 shapes payroll during the year, while the W-2 supports the employee during tax filing.

Employers send the W-2 to each employee every January, and employees use it to complete their tax returns. When both sides handle their responsibilities correctly, payroll runs smoothly and tax reporting stays accurate.

When and Why They Are Used

You use the W-4 when you start a job or when a major life change affects your tax situation. This form guides your employer on how much tax to take out of each paycheck. Accurate withholding helps you avoid unexpected tax bills, and it improves your cash flow throughout the year. Many people who research the difference between w4 and w2 learn that the W-4 has the most impact on every paycheck.

You use the W-2 at the end of the year when you prepare your tax return. The W-2 lists your wages, the taxes withheld, and other important details that support accurate filing. When you review the W-2 carefully, you confirm that your withholding and earnings match your records and your tax return.

W-2 vs W-4: Essential Facts for Employees and Employers

| What Users Need to Know | W-2 Form | W-4 Form |

|---|---|---|

| Who Completes It | Employer | Employee |

| When You Receive It | Annually by January 31 | At job start or whenever you change withholding |

| Why It Matters to You | Shows your total income and taxes paid | Determines how much tax is taken from your paycheck |

| What Happens If Incorrect | Can delay tax refunds or trigger IRS issues | May cause under- or over-withholding leading to tax bills or smaller paychecks |

| Your Action Steps | Review for accuracy; report errors ASAP | Fill out carefully; update with life changes (marriage, kids, second job) |

| Use for Tax Filing? | Yes, mandatory for filing your tax return | No, kept by employer for payroll calculations |

| How Often to Update | Once per year or if you find errors | Whenever your tax situation changes |

How Errors Affect Tax Refunds & IRS Compliance

- Incorrect W-4 forms might lead to too little tax withheld → unexpected tax bills or penalties in April.

- Over-withheld taxes mean smaller paychecks but larger refunds.

- Errors or omissions on W-2 forms can delay refunds or trigger IRS audits.

- Payroll/accounting software that integrates tax forms helps prevent many common mistakes.

Case Study: IRS Example of Incorrect Withholding and W-4 Update

The IRS shares an example in Publication 505 that shows what happens when someone keeps an outdated W-4. In the example, an employee takes a second job but leaves the W-4 unchanged. Their employer withholds too little tax because the form no longer reflects the employee’s income. When the employee files their return using the W-2, they owe money because the year’s withholding falls short. The employee fixes the problem by updating the W-4 with the IRS multiple-jobs worksheet so future withholding stays accurate.

(Sources: IRS Publication 505; IRS.gov W-4 Instructions)

W-2 vs W-4 Comparison Table

| Aspect | W-2 Form | W-4 Form |

|---|---|---|

| Who Completes It | Employer | Employee |

| Purpose | Report annual wages and taxes withheld to IRS and employee | Determine tax withholding amount from paycheck |

| When It Is Used | End of tax year (Jan 31 deadline) | At hiring and when updates are needed |

| What Information It Contains | Wages, federal/state/local taxes withheld, Social Security, Medicare contributions, employer/employee info | Filing status, dependents, additional withholding preferences |

| IRS Deadline | January 31 (to employee and IRS) | Not generally submitted to IRS; kept by employer unless requested |

| How Employers Use It | Report and reconcile annual payroll taxes | Calculate correct tax withholding per paycheck |

Latest Updates on W-2 and W-4 for 2025

W-2 Updates : The Social Security Administration set the 2025 Social Security wage base at $176,100. Employers use this updated limit when they calculate payroll taxes. The IRS did not change the W-2 form layout for 2025.

(Sources: SSA 2025 Wage Base Update • IRS W-2 Instructions 2025)

W-4 Updates : The IRS adjusted tax brackets and withholding tables for 2025. Employees can use the IRS Tax Withholding Estimator to choose accurate withholding. The 2020 W-4 design stays in place for 2025.

(Sources: IRS Publication 15-T (2025) • IRS W-4 Instructions 2025 • IRS Withholding Estimator

Frequently Asked Questions (FAQs)

The W-4 guides your employer on how much tax to take out of each paycheck. The W-2 shows your total income and the taxes withheld for the year. People often search for what is the difference between w2 and w4 because both forms connect your payroll with your tax return, but they serve different purposes.

You complete the W-4 when you start a job or when your tax situation changes. Your employer creates the W-2 every January so you can file an accurate tax return.

Employees fill out the W-4 to specify their tax situation and withholding preferences; employers use it to calculate taxes withheld.

Yes, employees can update their W-4 any time to adjust withholding for life changes or tax planning.

Conclusion

The W-2 and W-4 each play a clear and important role in your tax life. The W-4 guides your withholding throughout the year, and the W-2 shows your final earnings and the taxes you paid when tax season arrives. When you understand how these forms connect, you stay in control of your paycheck, your planning, and your tax filing. Clear information and timely updates help you avoid surprises and make tax season feel more manageable.

Improve How Your Firm Handles Payroll and Year-End Tax Forms

If your firm manages W-2s, W-4 updates, or payroll workflows in desktop accounting software, a secure cloud setup can help your team work faster and reduce year-end stress. Cloud hosting supports smoother payroll processing, easier form management, and stronger data protection during busy seasons. Explore these options to see what works best for your firm:

- Request a Quote – Get pricing tailored to your firm’s size, workload, and compliance needs.

- Book a Demo – See how a hosted environment streamlines payroll and year-end reporting.

- Start a Free Trial – Test your accounting software in a secure, optimized cloud workspace.

References

- IRS.gov, About Form W-2 and W-4: official instructions and forms

- ADP 2025 Payroll Trends Report

- Gusto.com Payroll Guides and Resources

- TaxBandits.com, Form W2 vs W4: Key Differences

- Investopedia, Explanation and Tax Filing Uses of W-2 and W-4 Forms

- SHRM, Payroll Compliance Guidelines 2025

- FreshBooks.com, Detailed W2 vs W4 Comparison

- IRS — Form W-2 Instructions

- IRS — Form W-4 Instructions

- IRS Publication 15-T: Federal Income Tax Withholding Methods (2025)

- Social Security Administration — 2025 Wage Base Update

- IRS Tax Withholding Estimator

Also Check Out These Related Articles: