Overtime work means extra dollars—but those extra dollars usually come with taxes. In 2025, that equation is changing. The new No Tax on Overtime provision, introduced through the One Big Beautiful Bill Act (OBBBA) signed into law on July 4, 2025, creates a tax deduction for qualified overtime pay.

This landmark change promises higher take-home pay for millions of workers, while presenting a new compliance chapter for employers and accountants. This blog covers everything professionals and taxpayers need to navigate this shift: timelines, legislative background, eligibility, state-specific questions, payroll tips, and expert insights for 2025 and beyond.

Table of contents

- What Is “No Tax on Overtime”?

- When Does “No Tax on Overtime” Start — And Is It Already in Effect?

- Eligibility for the No Tax on Overtime Deduction

- Pros and Cons of No Tax on Overtime

- How Would “No Tax on Overtime” Work?

- State-Specific Tax Variations

- Impact on Workers, Employers, and the Economy

- Federal vs. State Treatment

- Comparison: No Tax on Overtime vs. No Tax on Tips

- Expert Insights

- FAQs on No Tax on Overtime

What Is “No Tax on Overtime”?

Overtime wages are generally taxed in the same way as regular income, which means that putting in extra hours still results in a portion of your paycheck going to the government.

The proposed no-tax-on-overtime policy aims to exempt these additional earnings from federal income tax, allowing employees to keep their full overtime pay rather than having part of it reduced through deductions.

The “No Tax on Overtime” rule is a federal income tax deduction enacted under the One Big Beautiful Bill Act (OBBBA) of 2025 that allows eligible employees to deduct some or all of their qualified overtime pay from taxable income for tax years 2025 through 2028. Importantly, this applies only to the overtime “premium” pay — the additional 50% paid over base hourly wages for time worked beyond 40 hours per week under the Fair Labor Standards Act (FLSA).

History and Legislative Background

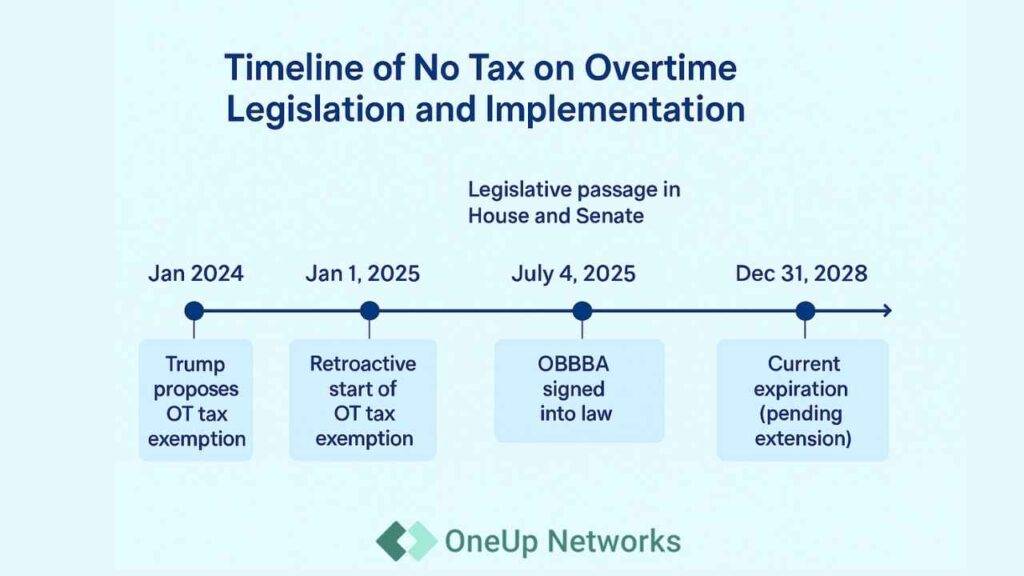

- The idea gained prominence during President Donald Trump’s 2024 campaign as a promise to reward hard-working Americans and stimulate work incentives.

- The proposal took legislative form in the 119th U.S. Congress, passing as part of broader tax reform bills such as the OBBBA signed into law on July 4, 2025.

- Key legislation includes House Bill H.R. 561 and Senate Bill S.1046, which emphasize excluding overtime premiums from gross income for federal tax purposes.

- Congress set the exemption’s effective date retroactively to January 1, 2025, ensuring taxpayers who already worked overtime that year benefit when they file in 2026.

Did Trump Pass No Tax on Overtime?

One of the most common questions online is: “Did Trump pass no tax on overtime?” The answer is yes, but with important details.

President Donald Trump proposed the “No Tax on Overtime and Bonus Bill of 2025” (OBBBA), which Congress debated throughout early 2025. After passing both the House and Senate in mid-2025, Trump signed the bill into law on July 4, 2025.

So, when people ask “did Trump sign no tax on overtime?” or “did Trump approve no tax on overtime?” — the answer is yes, and it is now law.

When Does “No Tax on Overtime” Start — And Is It Already in Effect?

The no-tax-on-overtime provision officially became law on July 4, 2025, under the One Big Beautiful Bill Act (OBBBA). However, Congress set the start date retroactively to January 1, 2025.

That means:

- Yes, it’s already in effect — if you worked overtime anytime after Jan 1, 2025, those hours qualify for the exemption.

- The rule applies to federal tax years 2025 through 2028, unless Congress extends it.

- You’ll claim the deduction on your 2025 return (filed in 2026).

- Employers are required to track and report qualifying overtime separately on W-2s, starting with tax year 2025.

- Payroll systems may take time to update, so some workers may see adjustments or refunds later in 2025.

In short: the law is already active, but its full impact on paychecks and payroll reporting will phase in throughout 2025.

Eligibility for the No Tax on Overtime Deduction

- Must be a W-2 employee, not independent contractors or gig workers.

- Overtime pay must adhere to federal labor standards—paid at least at 1.5 times the hourly rate after 40 hours/week.

- Must have a valid Social Security number and file a joint return if married.

- Income limits phase out the deduction:

- Single filers start phase-out at $150,000 Modified Adjusted Gross Income (MAGI).

- Married filing jointly phase-out begins at $300,000 MAGI.

- Maximum deductible amount:

- $12,500 for most filers.

- $25,000 for married filing jointly.

Who Does Not Qualify?

- Independent contractors (1099 workers).

- Salaried employees exempt from overtime under FLSA.

- Married individuals filing separately.

Phase-Out Income Levels

- Joint: begins at $300,000; phases out by ~$550K.

- Single: begins at $150,000 MAGI; phases out entirely by ~$400K.

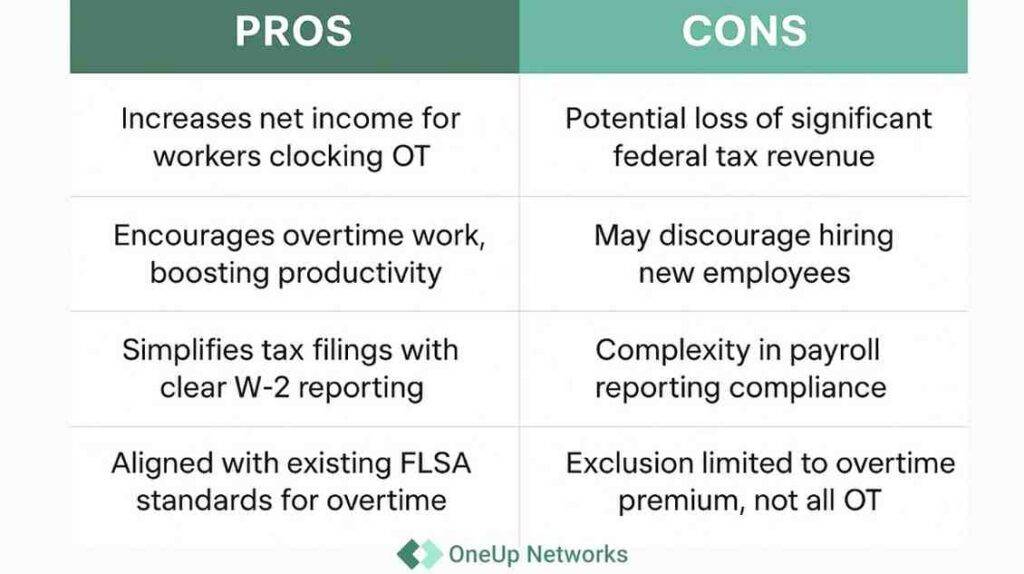

Pros and Cons of No Tax on Overtime

How Would “No Tax on Overtime” Work?

- Qualified overtime pay is the FLSA-mandated premium (the extra half of the 1.5x hourly overtime rate).

- Taxpayers may deduct up to $12,500 (single filers) or $25,000 (married filing jointly) in overtime pay per year.

- The deduction phases out starting at $150,000 for single filers and $300,000 for joint filers, reduced by $100 for every $1,000 income over those limits.

- Employers must report qualified overtime separately on IRS information returns (W-2).

- The deduction applies only to federal income tax; Social Security, Medicare, and FUTA taxes still apply.

- Independent contractors and gig workers do not qualify because they are not W-2 employees.

Example Paycheck Calculation

Imagine a worker earning $20/hour. Their overtime rate is $30/hour (1.5x). The overtime “premium” portion is $10/hour.

- If they work 10 OT hours, the premium = $100.

- Under old rules, that $100 was taxed as ordinary income.

- Under the new law, that $100 is tax-deductible, reducing taxable income and saving the worker around $22–$24 in federal tax (depending on bracket).

This example makes the rule easy to understand for employees and employers alike.

State-Specific Tax Variations

| State | Does No Tax on Overtime Apply to State Income Tax? |

|---|---|

| Texas | No state income tax; no state-level overtime income tax |

| Florida | No state income tax; no state-level overtime income tax |

| California | State income tax still applies to overtime pay; no state exemption currently |

| Michigan | State income tax applies; no specific state exemption |

| Ohio | State income tax applies; no specific state exemption |

Most states continue to tax overtime earnings at the state level unless separate state legislation enacts exemptions. Employees should consult local tax advisors for state-specific impacts.

Impact on Workers, Employers, and the Economy

- Workers: More take-home pay for overtime hours worked, boosting disposable income.

- Employers: Need to update payroll software and systems to track/report overtime distinctly.

- Economy: Potential incentive for more workers to take on overtime hours, possibly affecting labor market dynamics, productivity, and federal revenue (estimated revenue loss approx. $145 billion over a decade).

Federal vs. State Treatment

It’s important to remember that while the federal government now exempts overtime premiums from income tax, most states still tax them as ordinary wages. For instance:

- A Texas worker owes nothing since Texas has no state income tax.

- A California worker still owes state income tax on overtime, even though it’s exempt federally.

This distinction is crucial for employees who live in high-tax states.

Comparison: No Tax on Overtime vs. No Tax on Tips

| Feature | No Tax on Overtime | No Tax on Tips |

|---|---|---|

| Applies to | Overtime premium pay (extra half-time rate) | Tips reported and qualified under IRS rules |

| Tax benefit type | Federal income tax deduction | Federal income tax deduction |

| Eligibility | W-2 employees earning OT according to FLSA | Service employees reporting tips |

| Effective 2025–2028 | Yes | Yes |

| Payroll Reporting Required | Yes (separate OT premium reporting on W-2) | Yes (tip reporting on Form 4137 or W-2) |

Expert Insights

- IRS Fact Sheet FS-2025-03 clarifies the tax treatment and reporting changes for qualifying overtime wage deductions.

- Economists note the provision could boost labor supply but warn about the federal revenue impact and potential shift to more overtime instead of hiring.

- The Department of Labor continues enforcing FLSA overtime pay rules, which are foundational to the tax deduction eligibility.

FAQs on No Tax on Overtime

As of 2025, the legislation has passed both chambers of Congress and was signed into law on July 4, 2025, as part of the Overtime Bonus and Breakthrough Benefits Act (OBBBA). However, implementation details are still being finalized by the IRS and Department of Treasury.

The law is retroactive to January 1, 2025, meaning eligible overtime wages earned from that date forward will qualify for the tax exemption. Employers are expected to adjust payroll reporting accordingly.

The exemption removes federal income tax from qualifying overtime wages. Employees will still see Medicare and Social Security taxes withheld unless otherwise amended. Employers must properly classify overtime wages and report them separately.

Yes, the exemption applies nationwide as a federal law. However, individual states may still apply state income tax unless they choose to align with the federal exemption. Workers should check their state tax agency for updates.

Currently, the exemption is set to expire on December 31, 2028, unless Congress votes to extend it. Lawmakers have signaled that extensions or expansions could be debated in upcoming sessions.

Conclusion: What “No Tax on Overtime” Means for You

The No Tax on Overtime Act marks one of the most significant tax changes for working Americans in years. By exempting overtime premium pay from federal income tax, it delivers higher take-home pay, rewards hard work, and reshapes payroll reporting for employers. While the law is already in effect retroactively from January 1, 2025, its true impact will unfold over the coming years as payroll systems adapt, workers adjust, and Congress debates whether to extend it beyond 2028.

For employees, this means more money in your pocket without changing how you work. For employers and payroll professionals, it means new reporting responsibilities and compliance requirements. And for accountants, CPAs, and tax advisors, it opens the door to valuable client guidance and strategic planning opportunities.

Stay Ahead of the Change with OneUp Networks

At OneUp Networks, we specialize in cloud hosting solutions built for accountants, CPAs, and Thomson Reuters Hosting who need reliable, compliant, and future-ready platforms to manage evolving tax rules like the No Tax on Overtime provision.

Whether you’re an employee tracking deductions, an employer updating payroll systems, or a tax professional guiding clients, our secure cloud solutions keep you one step ahead.

Take action today:

- Visit Quickbooks Enterpreise hosting to explore our tailored Enterprise hosting services.

- Schedule a free consultation with our team to learn how we can streamline your tax and accounting operations.

- Subscribe to our newsletter for ongoing updates on tax law changes, payroll compliance, and cloud technology insights.

Also Read These Helpful Blogs:

- W-2 vs. W-4: The Essential Guide for Accounting and Tax Professionals

- Essential 1099 Tax Tips Every Employee Should Know

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- Top Strategies for Using SALT Deduction to Reduce Taxes in High-Tax States

- 3-2-1 Backup Strategy: Why It’s Still the Best Backup Method in the Cloud Era?