Is your accounting workflow stuck on a local desktop? Did you know that over 85% of small businesses now rely on cloud accounting for day-to-day operations, reducing downtime and boosting collaboration? Migrating QuickBooks to the cloud isn’t just a tech upgrade—it’s a strategic move to improve efficiency, security, and industry compliance. Whether starting out or running a mature CPA firm, this guide reveals what accountants need to know to migrate QuickBooks and future-proof their practice.

Why Accountants Are Moving QuickBooks to the Cloud

Imagine you’re working late and need to check client records, but the office computer is shut off—or worse, someone spills coffee and wipes out years of financial data. These scenarios show the biggest pain points accountants face: limited access, risk of data loss, and endless IT headaches. The cloud solves these problems by keeping QuickBooks safe online, making client books available anywhere and letting teams work together—even if no one is in the same room.

What Is Cloud Migration ?

Cloud migration means taking QuickBooks and moving it from your office computer to a secure “virtual” space on the internet, managed by experts. You log in the same way, but now QuickBooks works from any laptop, tablet, or phone with internet. Your files are always protected by automatic backups and top-level security, so your practice runs smoothly without worrying about hardware breakdowns or ransomware.

6 Key Steps to Move QuickBooks Desktop to the Cloud

Considering the transition from Intuit QuickBooks Desktop to QB cloud hosting provides a significant advantage over QuickBooks Online. Here are some essential steps to move QuickBooks Desktop to the cloud:

Step 1: Assess Your Needs and On-Premise Obstacles

Before deploying the desktop software in the cloud, you should assess your current on-premise environment and identify any potential obstacles in advance. This includes evaluating your hardware and software requirements, understanding your security needs, and deciding if remote access to your financial data is necessary. A comprehensive assessment will help you select the right cloud hosting provider and ensure a smooth migration to the cloud.

Step 2: Select a Cloud Hosting Provider

The next step in moving QuickBooks to the cloud is picking the appropriate cloud hosting provider. A cloud hosting provider supplies businesses with the infrastructure and services required to store and manage applications securely online. With numerous providers available, each with unique features and pricing plans, choosing the right one is essential.

When reviewing providers, prioritize aspects like security, reliability, and cost. Choose a provider with proven experience in hosting QuickBooks in the cloud and a strong track record of dependable service delivery.

OneUp Networks stands out as a top company in this field, combining over 15 years of expertise, industry-leading certifications, and a dedication to customer satisfaction. Selecting this provider ensures your QuickBooks hosting is safe, efficient, and backed by a trusted leader.

Step 3: Secure Your Data Backup

The most important step before moving to the cloud is backing up all your data. Hosting QuickBooks in the cloud ensures you have a secure backup of all your financial records in case of any issues.

You can use QuickBooks’ built-in backup feature or a third-party backup solution to safeguard your data. Additionally, you may store the backup file on an external hard drive or a cloud storage platform like Dropbox or Google Drive.

Step 4: Install QuickBooks on the Cloud Server

After choosing a QuickBooks hosting provider and securing your backup, the next step is installing QuickBooks on the cloud server. Most cloud hosting providers offer a virtual desktop environment where QuickBooks can be installed.

To set up QuickBooks on the cloud server, log into the virtual desktop provided by your hosting company. Make sure you have a valid QuickBooks license, or obtain one directly from your cloud provider to complete the installation.

Step 5: Adjust QuickBooks Settings

Once QuickBooks is installed on the cloud server, the next step is configuring the QuickBooks settings. This involves entering company information, tax settings, and other preferences.

Proper configuration ensures QuickBooks runs smoothly and meets your company’s operational requirements.

Step 6: Transfer Your Data

The final step in moving QuickBooks to the cloud is data migration. This requires transferring your financial information from the desktop version of QuickBooks to the cloud-hosted version.

You can utilize QuickBooks’ built-in data migration tool to move your records. This tool will transfer all your financial data, including customer, vendor, and supplier details.

Migrating QuickBooks to the cloud allows you to leverage the robust features of QuickBooks Desktop while enjoying the flexibility and convenience of cloud access.

The Biggest Worries (And How Cloud Hosting Solves Them)

- Data Loss: Hardware trouble, fire, or viruses can wipe out local files instantly. Cloud hosting keeps daily backups and quick recovery options so you never lose critical data.

- Limited Access: Forget driving to the office or emailing files. You and your team can log in securely from home, a client’s site, or on-the-go, anytime, anywhere.

- Security: Hosting providers use strong encryption, firewalls, and monitoring to lock out hackers and keep client books confidential. That’s far stronger than an unprotected desktop.

- Compliance: Cloud hosts help accountants meet legal requirements for protecting sensitive data, avoiding fines, and proving compliance during audits.

- Collaboration: Multiple team members can work on QuickBooks at the same time—no more waiting for someone to finish.

- Scalability: If your practice grows, the cloud grows with you. Add users, apps, and features instantly, without buying new hardware or worrying about storage.

What to Double-Check

- Always backup before starting.

- Get support from cloud experts (don’t try to do every step alone).

- Check every report and customer record after the move to be sure nothing is missing.

- Choose a provider who answers questions fast and is trusted in the accounting industry.

Migrating QuickBooks to the cloud transforms your practice from vulnerable and limited to secure, flexible, and future-proof. Whether just starting out or moving a large firm, the biggest benefit is confidence—knowing your client records and financial reports are safe, up-to-date, and always available.

From Desktop to Online: Technical and Expert Details

Moving QuickBooks Desktop to Online involves a specialized checklist. CPAs should prepare by:

- Cleaning up data, reconciling accounts, archiving inactive suppliers/customers, and mapping the chart of accounts.

- Backing up files and using QuickBooks migration tools or third-party solutions for advanced needs (e.g., historical data migration).

- Verifying compatibility (not all features/custom customizations transfer seamlessly).

How long does QuickBooks migration take?

- Typical migrations take 45–60 days for complex files, but small firms or simple setups can transition in just a few hours.

- End-of-month or off-peak periods yield the best results with minimal business disruption.

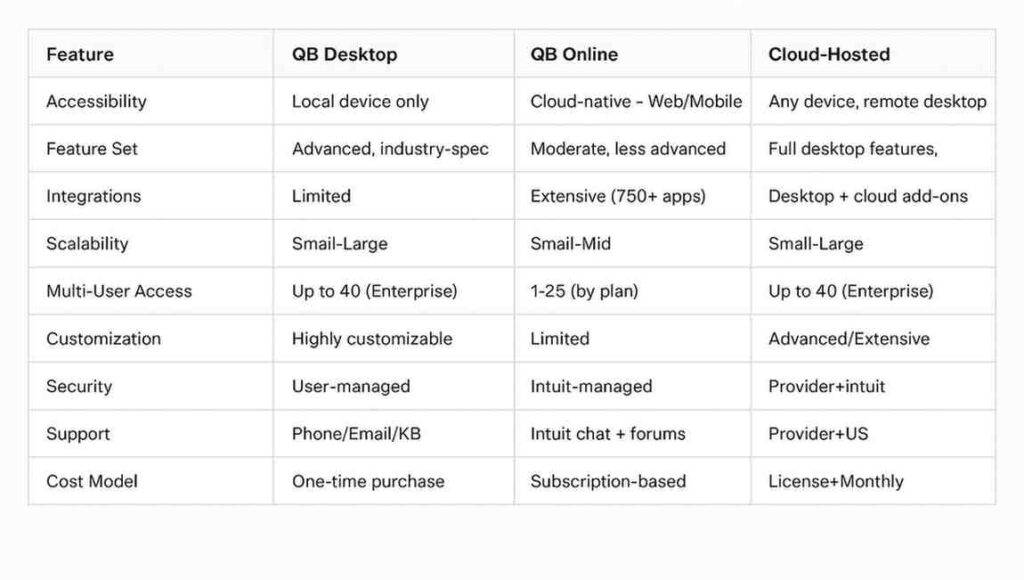

QuickBooks Desktop vs Online vs Cloud Hosting

Below is a comparison chart that summarizes the key differences accountants need to know:

Cost of QuickBooks Cloud Migration

- Pricing: Hosted QuickBooks ranges from $19.50–$75 per user/month (plus license); QuickBooks Online subscriptions from $38 to $275 per month as per requirements.

- Factors that affect cost: Number of users, version, storage space, additional apps, customizations, security, and premium support.

- Avoid hidden fees—choose bundled plans and review SLA details for migration and disaster recovery.

Stat: 81% of buyers rank price as their top consideration—clarify upfront costs, avoid surprises.

Real-World Examples & Best Practices for CPA Firms

- Case Study: An accounting firm eliminated 8 hours/week in manual IT tasks by migrating to cloud-hosted QuickBooks—now supporting 20+ remote staff with zero downtime, enhanced security, and automatic daily backups.

- Historical data and legacy systems can be migrated using expert services, preserving years of financial records for compliance and audit purposes.

- Training staff for QuickBooks Online transition is essential; reputable hosting partners offer onboarding, user guides, and ongoing support.

FAQs on QuickBooks (QBD) Migration

Yes. Intuit began phasing out Desktop versions in July 2024, ending support for 2022 editions in May 2025 and for the final version in 2027. Live support, security updates, and integrations will stop, making continued use risky for compliance and data integrity.

Most migrations take 45–60 days for complex files; smaller firms may complete within a few hours, especially with expert tools or batch migration offerings.

Risks include data loss, corruption, downtime, and security vulnerabilities if poorly managed. Partnering with expert providers, careful planning, and proper backup procedures eliminate most migration risks.

Typical pricing is $19.50–$75 per user/month, with additional fees for licenses, storage, and premium support. Bundled plans for CPA firms include daily backups, compliance, and migration support.

No. Leading cloud hosting providers (like OneUp Networks) offer 24/7 support and handle migrations, backups, and updates, saving firms time and cost on in-house IT.

Conclusion

Migrating QuickBooks to the cloud is more than just a technology upgrade—it’s a strategic move that significantly boosts productivity, security, and flexibility for accountants and finance professionals. By moving to the cloud, you safeguard client data with automatic backups, ensure quick disaster recovery, and enable your team to collaborate from anywhere, anytime. The cloud also streamlines compliance and reduces costly IT headaches, freeing accountants to focus on what matters most: delivering exceptional financial services. No matter the size of your firm or level of tech experience, cloud migration prepares you for the future of accounting with confidence.

Take Action Today

Ready to migrate QuickBooks to the cloud and unlock the full potential of your accounting practice? Partnering with a trusted cloud hosting provider like OneUp Networks ensures a secure, efficient, and seamless transition. Here’s why you should act now:

- Expert Guidance – Over 15 years of experience in hosting QuickBooks for accountants and CPAs.

- Secure & Reliable – Advanced encryption, disaster recovery, and compliance with industry standards.

- Cost & Time Efficiency – Reduce IT overhead and eliminate downtime during migration.

- Full QuickBooks Access – Enjoy the features of QuickBooks Desktop with the flexibility of cloud access.

- Dedicated Support – 24/7 assistance to keep your accounting operations running smoothly.

Take the first step toward a smarter, more agile accounting workflow — contact OneUp Networks today and migrate your QuickBooks to the cloud with confidence.

Also Check Out These Related Articles:

- How to Move UltraTax CS to the Cloud: A Step-by-Step Guide for Accounting & Finance Firms

- How to Host a QuickBooks Desktop Company File?

- QuickBooks for Small Businesses: A Step-by-Step Guide to Success

- Navigating to the Cloud: A Step-by-Step Guide by OneUp Networks

- The Ultimate Guide to QuickBooks Hosting