In the fast-paced world of business finance, the distinction between a bookkeeper and an accountant is often blurred. Yet, these roles—while complementary—serve different purposes and require different skill sets. Understanding these differences is critical for business owners aiming to make informed decisions about staffing, outsourcing, or improving financial workflows. Furthermore, with the rise of cloud-based accounting software and digital transformation, the roles are evolving, making clarity even more essential. This guide breaks down the responsibilities, qualifications, and strategic functions of bookkeepers vs accountants—supported by real-world examples, industry insights, and actionable advice for financial management.

Table of contents

What Is a Bookkeeper?

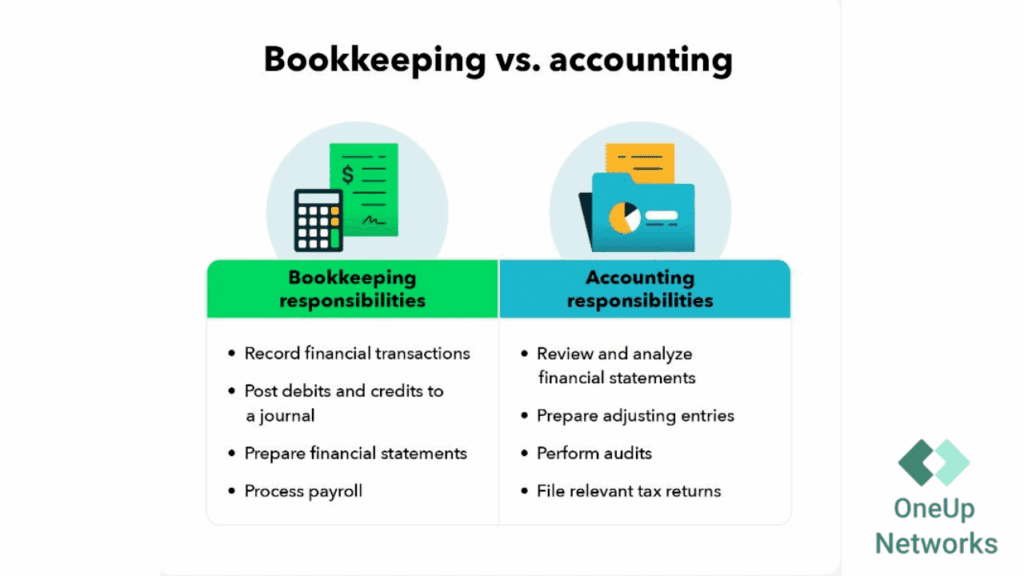

A bookkeeper is primarily responsible for recording and organizing a business’s day-to-day financial transactions. Their work lays the foundation for all financial reporting and analysis.

Key Responsibilities

- Recording transactions: Entering sales, purchases, payments, and receipts into the general ledger.

- Reconciling accounts: Ensuring transactions match bank and credit card statements.

- Managing accounts payable and receivable: Tracking incoming and outgoing funds.

- Processing payroll: Calculating wages and issuing paychecks.

- Generating basic reports: Producing profit and loss statements, balance sheets, and cash flow summaries.

- Maintaining ledgers: Keeping master records accurate and up to date.

Example:

A bookkeeper at a small retail store logs daily transactions in QuickBooks Hosting, reconciles weekly bank statements, and compiles monthly financial summaries for the owner.

What Is an Accountant?

An accountant takes the data compiled by bookkeepers and analyzes, interprets, and reports on it. Accountants provide strategic financial advice, ensure regulatory compliance, and help business owners make informed decisions.

Key Responsibilities

- Financial reporting: Preparing and interpreting financial statements.

- Tax planning and filing: Handling returns and optimizing tax strategy.

- Audit and compliance: Reviewing records for regulatory adherence.

- Strategic advice: Recommending ways to reduce costs and increase profit.

- Budgeting and forecasting: Projecting future financial performance.

Example:

An accountant reviews the annual books of a manufacturing company, files the corporate tax return, and provides insights into reducing production overhead for the next fiscal year.

Bookkeeper vs Accountant : Comparison

| Feature/Responsibility | Bookkeeper | Accountant |

|---|---|---|

| Main Focus | Recording transactions | Analyzing and interpreting data |

| Qualifications | No formal certification required | Often certified (e.g., CPA) |

| Typical Tasks | Data entry, reconciliations | Financial reporting, tax preparation |

| Software Used | QuickBooks, Xero, FreshBooks | QuickBooks, Sage, ERP systems |

| Regulatory Compliance | Limited | Extensive |

| Strategic Advice | Rarely | Frequently |

| Audit Preparation | Supports | Leads |

| Payroll Management | Often | Sometimes |

| Tax Filing | No | Yes |

| Salary Range (USA, 2025 avg.) | $45,000–$55,000 | $65,000–$85,000+ |

Key Differences Explained

1. Scope of Work

Bookkeepers ensure financial data is recorded correctly and organized logically. In addition, they provide the backbone for accurate financial tracking. Accountants, on the other hand, use that data to provide deeper analysis and insights, ultimately shaping business strategy.

2. Education & Certification

Bookkeepers may have certificates or on-the-job training, while accountants often hold degrees and credentials like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). As a result, accountants are qualified to handle more complex financial matters.

3. Business Impact

Bookkeepers help businesses stay organized and operational. Consequently, accountants offer strategic guidance that influences growth, tax efficiency, and compliance—making them invaluable as your business scales.

4. Tools and Software

Both roles use accounting software, but accountants typically leverage more advanced tools for forecasting, audits, and analysis. Furthermore, cloud-based solutions like QuickBooks Online and Xero are transforming how both bookkeepers and accountants work, enabling real-time collaboration and remote access.

When to Use a Bookkeeper or Accountant

- Startups & Small Businesses: Bookkeepers help manage everyday financial transactions, ensuring smooth operations from the start.

- Growing Businesses: As complexity increases, accountants become essential for tax planning, compliance, and strategic insights.

- Tax Season: Accountants are indispensable for accurate filing and tax strategy, minimizing liability and maximizing returns.

- Audits & Financial Planning: Accountants support audits and long-term planning, providing peace of mind and future-focused advice.

Example:

A boutique clothing store employs a bookkeeper for day-to-day operations. At year-end, an accountant steps in to prepare taxes and advise on inventory and cash flow improvements.

Industry Trends and Statistics

- Employment Outlook: According to the U.S. Bureau of Labor Statistics, jobs for accountants and auditors are projected to grow 4% from 2022 to 2032. Bookkeeping roles may decline slightly due to automation.

- Software Usage: Over 70% of small U.S. businesses use both bookkeepers and accountants, with cloud-based tools like QuickBooks and Xero playing a central role.

Frequently Asked Questions (FAQ)

No. Bookkeepers don’t typically handle tax filing. Accountants or CPAs are qualified for that.

Often, yes. Bookkeepers manage daily records; accountants handle higher-level analysis and compliance.

At least annually for tax purposes. Quarterly reviews are recommended for ongoing strategy.

Software automates tasks, but human oversight remains essential for accuracy and context.

CPA (Certified Public Accountant), CMA (Certified Management Accountant), and similar credentials signal credibility and expertise.

Bookkeeping is transactional and administrative. Accounting is analytical and strategic.

Conclusion:

Bookkeepers and accountants play distinct yet interdependent roles in financial management. While bookkeepers build and maintain the financial framework, accountants interpret that information to guide business strategy, tax planning, and regulatory compliance. Understanding these differences ensures more effective hiring decisions and more robust financial operations across all stages of business growth.

Ultimately, leveraging both roles—supported by modern cloud-based accounting tools—empowers businesses to achieve greater accuracy, efficiency, and strategic insight. Whether you’re a startup, a growing enterprise, or an established firm, aligning your financial team with your business needs is key to long-term success.

Ready to optimize your financial management? Download our free guide to choosing the right financial professional for your business, or schedule a consultation with an expert today. Share your experiences or questions in the comments below—we’d love to hear from you!

Read Also: