As we step further into 2025, the accounting industry is witnessing a profound transformation, shaped by rapid technological advancements and evolving client expectations. One of the most significant shifts is the growing migration of accounting firms away from legacy solutions like Thomson Reuters Virtual Office CS (TRVO), in favor of more robust, scalable, data security and reliable cloud-based alternatives. This blog explores the reasons behind this trend, the challenges firms face with Virtual Office CS, and the compelling benefits of modern managed TR cloud hosting platforms—especially for accounting and finance professionals.

Table of contents

- The Rise of Cloud Accounting: A Quick Overview

- Why Are Accounting Firms Moving Away from Thomson Reuters Virtual Office?

- Practical Examples: How Cloud Migration Transforms Accounting Firms

- Comparison: Thomson Reuters Virtual Office vs. Modern TR Cloud Solutions (OneUp Networks)

- The Human Side: Culture, Remote Work, and Client Relationships

- Key Trends Driving Cloud Adoption in Accounting

- Why 2025 Is the Tipping Point?

- 5 Frequently Asked Questions (FAQs)

The Rise of Cloud Accounting: A Quick Overview

Cloud accounting refers to the use of online platforms to manage financial data, automate processes, and access real-time insights from anywhere, at any time. This approach has become the industry standard, with 65% of accounting firms now utilizing external cloud providers, and 81% of enterprises either implementing or developing a multi-cloud strategy. The shift is driven by the need for greater efficiency, flexibility, and compliance with regulatory changes like Making Tax Digital (MTD).

Why Are Accounting Firms Moving Away from Thomson Reuters Virtual Office?

1. Downtime and Reliability Issues

Thomson Reuters Virtual Office CS, while popular for its remote access and convenience, has faced persistent challenges with system downtime. During peak tax season, firms have reported losing an average of 12 hours per month due to outages—translating to thousands of dollars in lost revenue and productivity. Downtime not only disrupts workflows but can also lead to missed deadlines and dissatisfied clients.

2. Limited Scalability and Flexibility

Legacy systems like TRVO often struggle to scale with the growing needs of modern accounting firms. As firms expand their client base or adopt new services, they require platforms that can dynamically allocate resources and support increased workloads. Many cloud alternatives offer superior scalability, allowing firms to adjust their usage based on demand3.

3. Security Concerns

While TRVO provides basic encryption, many firms are now prioritizing advanced data security features such as proactive monitoring, multi-factor authentication, and robust data backup protocols. Managed TR cloud hosting solutions often outperform TRVO in this regard, offering enhanced protection against data security breaches and cyber threats.

4. Support and Service Limitations

TRVO users frequently encounter limited support options, especially during critical periods. In contrast, leading cloud providers offer 24/7 expert support, ensuring that any issues can be resolved quickly and efficiently.

5. Cost Efficiency and Operational Savings

Frequent downtime and the need for emergency IT interventions can drive up operational costs for firms using TRVO. Modern cloud solutions, with their higher uptime guarantees and predictable pricing models, help firms reduce costs and improve profitability.

6. Integration with Modern Tools and AI

The accounting industry is rapidly embracing artificial intelligence (AI), automation, and advanced analytics. Many cloud-based platforms seamlessly integrate with AI-powered tools for data processing, predictive insights, and fraud detection. TRVO, as a legacy system, often lacks the agility to support these innovations.

7. Regulatory Compliance and Real-Time Reporting

With regulatory requirements like MTD expanding, firms need platforms that can ensure compliance with minimal effort. Modern Thomson Reuters cloud accounting solutions offer automated tax calculations, direct integrations with tax authorities, and real-time financial reporting—features that are essential for staying ahead in 20252.

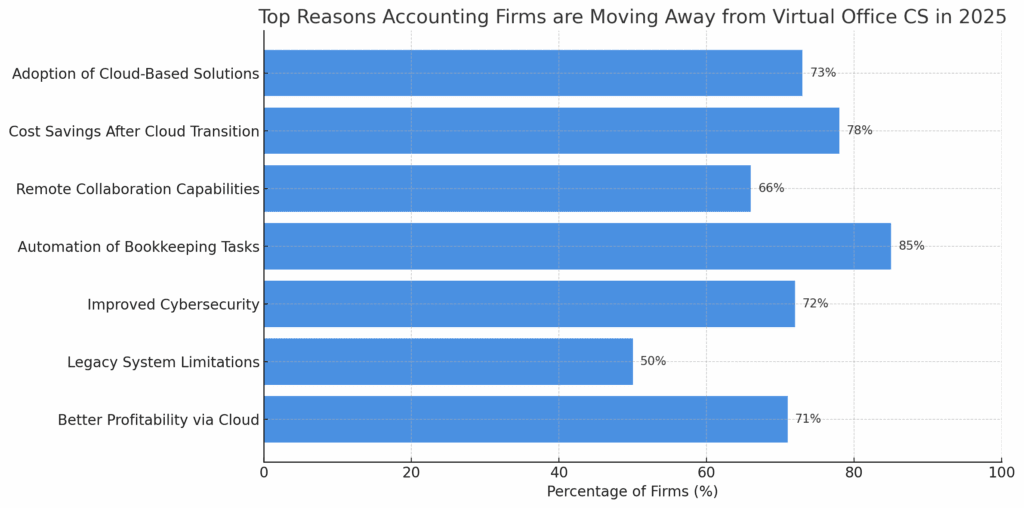

Here’s a bar chart visualizing the top reasons why accounting firms are moving away from Thomson Reuters Virtual Office CS in 2025. It clearly shows that automation, cost savings, and cloud adoption are the leading factors.

Practical Examples: How Cloud Migration Transforms Accounting Firms

Example 1: A Mid-Sized CPA Firm’s Journey

A mid-sized CPA firm in Chicago was facing challenges with frequent TR Virtual Office CS outages during tax season. After migrating to a managed Thomson Reuters (TR) cloud hosting solution, they experienced a 99.99% uptime, reduced IT costs, and improved client satisfaction. Their team could now access client data securely from anywhere, collaborate in real time, and leverage AI tools for faster tax preparation.

Example 2: Embracing AI and Automation

A boutique accounting firm in Texas adopted a cloud platform with built-in AI capabilities. This allowed them to automate 60% of their data entry tasks, identify tax-saving opportunities using predictive analytics, better data security and detect anomalies in client transactions—all while reducing manual errors and improving compliance.

Comparison: Thomson Reuters Virtual Office vs. Modern TR Cloud Solutions (OneUp Networks)

| Feature | Thomson Reuters Virtual Office | Modern Cloud Solutions (e.g., Managed TR Cloud Hosting) |

|---|---|---|

| Uptime Guarantee | No specific guarantee | 99.99% uptime guarantee |

| Security | Basic encryption | Advanced encryption, proactive monitoring |

| Scalability | Limited | Flexible, on-demand resource allocation |

| Support | Limited | 24/7 expert support |

| Cost Efficiency | Higher due to downtime | Lower with reliable performance |

| Integration with AI | Limited | Seamless integration with AI/automation tools |

| Regulatory Compliance | Basic | Advanced, automated compliance features |

The Human Side: Culture, Remote Work, and Client Relationships

Beyond technology, the shift to the cloud is reshaping firm culture. Remote work is now the norm, and firms must foster collaboration and engagement in a virtual environment. Cloud platforms enable seamless communication, secure file sharing, and real-time collaboration, helping firms maintain a strong culture and deliver exceptional client service6.

Key Trends Driving Cloud Adoption in Accounting

- AI and Automation: AI-driven tools are automating routine tasks, reducing errors, and enabling accountants to focus on strategic advisory roles.

- Real-Time Insights: Cloud platforms provide instant access to financial data, empowering firms to make proactive decisions.

- Enhanced Security: Advanced cloud solutions offer robust security features, protecting sensitive client information and enhanced data security.

- Regulatory Compliance: Automated compliance features ensure firms meet evolving regulatory requirements.

- Client Expectations: Clients demand faster, more transparent, and personalized services—delivered securely from anywhere.

Why 2025 Is the Tipping Point?

2025 marks a turning point for cloud adoption in accounting. With regulatory changes, client expectations, and technological innovation converging, firms that hesitate to embrace the cloud risk falling behind. Cloud accounting is no longer optional—it’s essential for staying competitive and delivering value in a fast-paced industry.

5 Frequently Asked Questions (FAQs)

Thomson Reuters Virtual Office is a cloud-based platform designed for accounting and tax professionals to access their practice management and tax software remotely. However, it has faced challenges with downtime and limited scalability.

Firms are seeking more reliable, scalable, and secure cloud solutions that offer better uptime, advanced security, and seamless integration with modern tools like AI and automation. Hence, they are avoiding the challenges within TR Virtual Office CS.

Benefits include higher uptime, enhanced security, 24/7 support, cost savings, and the ability to leverage AI and automation for improved efficiency and compliance.

Cloud migration enables firms to deliver faster, more transparent, and personalized services, strengthening client trust and satisfaction.

Yes, modern cloud solutions offer advanced encryption, proactive monitoring, and robust backup protocols, making them highly secure for handling sensitive financial information.

Conclusion

The accounting industry’s migration away from Thomson Reuters Virtual Office in 2025 reflects a broader shift toward innovation, efficiency, and client-centric service. By embracing modern cloud solutions with OneUp Networks to host Thomson Reuters Suite, accounting firms can overcome the limitations of legacy systems, unlock new growth opportunities, and position themselves for long-term success in a rapidly evolving landscape. As the digital clock ticks forward, the firms that adapt will thrive—while those that resist change risk being left behind. Contact us today for Free Consultation with the experts.

Read Also: