Is your accounting or tax firm quietly dreading another chaotic tax season because of sluggish, unreliable, or outdated software? You’re not alone: Over 60% of firms cite software performance and workflow breakdowns as their No. 1 peak-season stressor. As 2025 brings record e-filing volumes and rising client expectations, clinging to systems like Virtual Office CS could cost you more than just sleep — it could mean missed deadlines with downtime, compliance headaches, and dissatisfied clients.

Let’s break down the warning signs you can’t afford to ignore — and how smart CPA firms are future-proofing their tech stacks before busy season crunches their ROI.

What Is Virtual Office CS and Why Do Firms Outgrow It?

Virtual Office CS became popular for providing remote access to UltraTax and the CS Professional Suite — a major leap for firms in the 2010s. But as accounting moves into the cloud-first era, legacy virtual desktops struggle to keep up with the growing demand for automation, security, and seamless collaboration.

- Cloud-native platforms excel at agility, secure access, and collaborative workflows.

- Virtual Office CS often means patching together old workflows for new challenges, risking process breakdowns and lost billable hours.

7 Early Warning Signs Your Virtual Office CS Is Holding You Back

Before your next busy season hits, take a closer look at your firm’s technology foundation. Many accounting teams stick with legacy setups like Virtual Office CS or on-premise UltraTax hosting simply because “it still works.” But beneath the surface, small cracks can quickly turn into major productivity, compliance, and client satisfaction issues.

If your firm has faced downtime, sluggish support, or growing costs — these could be early warning signs it’s time to move to a modern, secure, and scalable cloud hosting platform.

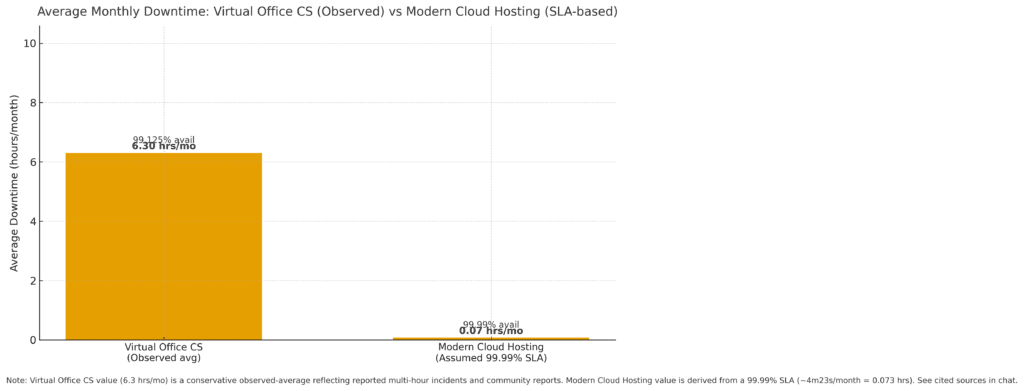

1. Unreliable Performance and Outages

If your team lost access to UltraTax or CS modules mid-crunch in the last 12 months, you’re not alone facing downtime issues.

“Several times per year the software goes down completely… Often during busy season, with little communication from support.”

- Impact: Productivity hits, client trust erodes, risk of late filings skyrockets in complex returns.

- 2025 Stat: 53% of accounting firms list “system downtime” as a major tech concern during peak deadlines.

2. Growing, Hidden Costs and Surprise Fees

Virtual desktop models often tack on:

- Extra charges for storage/storage-boosts

- Added support costs (sometimes outsized for urgent tickets)

- Third-party security or backup add-ons

Expert commentary: “What looks like a cheaper package up front can quickly balloon — and those hidden fees eat into firm margins.”

3. Painful Support and Poor Responsiveness

“When support is needed, you’re stuck in long phone queues or talking to reps unfamiliar with US taxes. E-mail support has been reduced or eliminated.”

- Average support response time for legacy products like Virtual Office CS is now often hours or days not minutes.

- Modern cloud hosts maintain 24/7/365 responsive support with accounting-trained engineers.

4. Security Risks and Compliance Gaps

With IRS, SOC, and state data privacy obligations rising, security gaps become business-ending threats.

- Virtual Office CS depends on manual updates & multi-point patching.

- Modern hosts enforce automatic security patches, tier-4 datacenter standards, and multi-factor authentication.

2025 stat: Multi-cloud and hybrid security compliance is now a top priority for 64% of accounting/tax firms.

5. Lack of Workflow Automation & Modern Integrations

- Manual uploads/downloads, toggling between portals, and chasing down documents remain daily headaches for many firms on legacy platforms.

- Cloud systems now automate recurring tasks, reminders, and provide true client dashboards — essential for scaling and audit-readiness.

Stat: Over 75% of US firms using workflow automation report significant time savings and error reductions during tax season.

6. Poor Scalability and Seasonal Stress

- On Virtual Office CS, adding staff or storage before tax season can require lengthy provisioning and configuration.

- Leading cloud providers scale users/resources up or down on-demand.

Stat: 87% of US CPA firms expect workload surges and want instant scaling pre-tax season, yet fewer than half find it easy on legacy virtual platforms.

7. Negative Client Impact — Missed Deadlines, Bad Communication

- Slow logins, UltraTax downtime, or lost data aren’t just in-house problems; they fuel client complaints, late returns, and potential regulatory penalty exposure.

- In 2025, client experience is a top competitive differentiator for accounting and tax firms — poor tech is a fast way to lose business.

Tired of Virtual Office Downtime? Let’s Fix That.

Experience faster performance, zero downtime, and 24/7 support with OneUp Networks cloud hosting. We understand how stressful tax season can be when your systems slow down or stop working. You’ll get a secure, always-on cloud built for accountants — backed by experts who care about your uptime as much as you do.

Our Clients Case Study: Switching Off Virtual Office CS

A Texas-based CPA firm with 18 staff relied on Virtual Office CS for UltraTax, Accounting CS, Practice CS access and client file sharing. Each busy season, they faced RDP disconnects, slow load times, and had a costly 4-hour outage right before a key IRS deadline. One missed client extension triggered a prospect lost to a rival as a result.

The Pivot:

They started researching for a cloud-native hosting provider specializing in tax software. Features enabled real-time collaboration, automated backups, and instant user scaling. As a result, they reached to us and got:

- Reduced e-filing time by 40%.

- Maintained 100% uptime during tax deadlines.

- Improved customer satisfaction scores (CSAT) from 78% to 95% post-migration.

Expert insight: “Migration upfront took just few hours, but they gained years of stress-free operations and new client wins — an investment that paid for itself during the next peak season.”

Virtual Office CS vs. Modern Cloud Hosting — Which Suits 2025 Firm Needs?

| Feature/Need | Virtual Office CS | Modern Cloud Hosting |

|---|---|---|

| Performance During Peak | Prone to lag and downtime | 99.99+% uptime, built for tax crunch |

| Support Availability | Limited, slow, offshored | 24/7/365 U.S.-based CPA expertise |

| Automation & Workflows | Manual, few integrations | Automated, dashboard-driven |

| Security & Compliance | Patchwork, outdated controls | Tier-3/4 datacenters, SOC/IRS ready |

| Pricing Transparency | Hidden fees, support charges | All-inclusive, flat pricing |

| Scalability | Manual, slow to adjust | Instant, self-serve portal |

| Client Experience | Disjointed, slow file share | Real-time, secure portal, e-signature |

| Backup & Disaster Recovery | Manual or 3rd party needed | Built-in, automated, frequent |

Virtual Office CS Downtime: Lessons from September’s SaaS Outage

Anatomy of the September 2025 Incident

On September 16, 2025, Thomson Reuters’ Virtual Office CS, relied upon by thousands of accounting and CPA firms, suffered a high-impact login outage. Beginning at 11:23 AM EDT, users across the US experienced blocked or severely delayed access to the platform. According to official incident reports, the widespread disruption lasted for approximately 44 minutes, though “degraded performance” and elevated error rates continued intermittently throughout the afternoon. Hundreds of firms found themselves locked out at a critical mid-month deadline window, with support lines flooded and a persistent “healthy but monitored” status shown on status trackers well into recovery.

Timeline of the Outage and Recovery

- 11:23 AM EDT: Login failures and session drops reported en masse.

- 11:27 AM: Thomson Reuters’ status dashboard escalates to a “Warn” state.

- 12:07 PM: Recovery efforts implemented, partial logins resume.

- 12:45 PM: Outage officially resolved for most users (total duration: 44 minutes).

- Post-incident: Monitored status and degraded performance alerts linger for several hours, with full normalcy restored by late afternoon.

Impact and Industry Response

During the incident, firm administrators urgently sought workarounds for payroll deadlines, return filings, and client advisory sessions. For many, this event underscored the risks of single-vendor dependency and the importance of robust contingency plans. Notably, status monitoring platforms logged a spike in warnings for NetClient CS and related services on the same day, suggesting infrastructural stress beyond just one product.

Preparing with Backup Workflows & Offline Alternatives

To mitigate operational risk from future SaaS outages:

- Document Manual Backup Protocols: Maintain paper or Excel-based client lists, deadline trackers, and template correspondence outside Virtual Office CS.

- Offline Data Exports: Schedule regular exports of essential client data and current workpapers, ensuring business continuity even during service interruptions.

- Staff Training: Prepare staff on alternative logins (if any), escalation paths, and downtime communication protocols.

- Cloud-to-Cloud Backups: Use third-party tools to automate cloud-to-cloud backups and ensure point-in-time recovery options.

Why Switch to OneUp Networks? End Downtime Worries for Good

When every minute of client service counts—especially at peak tax season—OneUp Networks delivers a level of performance, reliability, and security that legacy SaaS and traditional virtual office environments simply can’t match. Here’s why a growing wave of top-performing accounting firms are moving their CS Professional Suite, UltraTax, Accounting CS, Practice CS and other mission-critical applications to OneUp Networks:

- True 99.9% Uptime, Proven in Busy Season: OneUp Networks’ managed cloud hosting consistently delivers near flawless uptime for your CS Professional Suite, far outpacing the recurring outages and performance bottlenecks seen on Virtual Office CS platforms. Real-world case studies show zero unplanned downtime for major clients even during tax rush.

- Expert Support, On Demand: Dedicated, U.S.-based support is available 24/7—no more waiting for status page updates or struggling through SaaS vendor tickets. Firms praise OneUp Networks for proactive customer service and technical depth, resolving disruptions fast and minimizing workflow interruptions.

- Built-In Security & Compliance: Bank-level security, AES-256 encryption, and automatic, cloud-to-cloud backups ensure data safety and audit readiness at all times. SOC-certified data centers and regular vulnerability shields help you pass client and regulatory audits without stress.

- Instant Scalability & Flexible Workflows: Effortlessly scale users, apps, and storage as your business grows, with no disruptive migrations or IT bottlenecks. Seamless integration with workflow tools (QuickBooks, Sage, NetSuite, GoFileRoom) delivers hybrid flexibility—keeping your team productive whether on-site, remote, or in hybrid work models.

- No More Hidden Costs: One transparent monthly fee covers hosting, backups, security, and support—eliminating hidden downtime and maintenance costs that add up fast in SaaS. Some customers have reported over 60% operational savings compared to legacy virtual office setups.

- Stress-Free Migration: Certified migration experts ensure a smooth, rapid transition from Virtual Office CS to a high-availability cloud environment with minimal risk of disruption or lost data—even if you switch before the next tax season.

What Are Leading Firms Doing Instead?

Best-in-class firms prioritize:

- Cloud-native solutions over RDP emulation

- End-to-end automation for workflow, client reminders, digital signatures

- Multi-layer security, built for finance & tax regulatory needs

- Strong US-based support, especially during deadlines

- Transparent, usage-based pricing with true scaling

Cloud Adoption in 2025: 85% of all US firms are now cloud-first (or multi-cloud), up from 72% in 2022, per Gartner.

FAQs On Why Firm Should Move Off Virtual Office CS

A: Downtime and delayed support often hit at the worst time, risking late filings and lost client trust — two things you can’t afford when tax deadlines are non-negotiable.

A: With the right vendor, migrate from virtual office takes between 7–20 days. Many offer white-glove migration, minimizing disruption and training your team for a seamless transition.

A: Yes. Leading providers offer bank-level encryption, continuous backups, and compliance-grade security. Security is managed by experts, not left to an in-house IT generalist.

A: Firms routinely report faster turnaround, real-time document sharing, and improved satisfaction scores. Clients notice the speed and reliability — and so will your staff as soon as you migrate from virtual office to dedicated cloud hosting provider.

A: Virtual Office CS may look cheap upfront, but surprise support fees, upgrade charges, and troubleshooting add-ons pile up. Modern cloud hosts offer flat-rate pricing that scales with your needs, making costs predictable and controllable.

Conclusion: Why Hybrid Hosting Mitigates SaaS Risks

The September outage serves as a vivid lesson in the value of hybrid hosting strategies:

- Hybrid environments—combining on-premises backup or independent cloud hosting with SaaS—offer instant failover and local access continuity when core SaaS platforms stumble.

- For firms already investing in advanced cloud hosting (like OneUp Networks), redundancy, off-site backups, and dedicated resources mean a single SaaS failure can’t grind all operations to a halt.

- Modern hybrid approaches are especially vital in a compliance-heavy, always-on tax environment where one outage can mean lost clients, missed filings, and reputational harm.

In 2025, single-source SaaS dependence is no longer a safe bet for accounting firms with complex client portfolios and time-critical deliverables – then migrate from virtual office could be the solution. Strategic hybrid hosting not only mitigates downtime but also forms the core of a resilient, future-ready tax practice. OneUp Networks lets accountants and CPAs future-proof their technology stack while providing a premium client experience—not just compliance or cost savings. Say goodbye to revenue-sapping outages and hello to always-on productivity with OneUp’s fully managed hosting.

References:

- 6 Cloud Trends to Watch in 2025 — InformationWeek

- UltraTax CS Reviews From Verified Users — Capterra

- UltraTax CS Reviews & Product Details — G2

- 2024 Tax Firm Technology Report — Thomson Reuters

- How Technology Is Transforming CPA Firms — PracticeERP

- https://taxprofessionals-status.hostedtax.thomsonreuters.com/history

- https://statusgator.com/services/thomson-reuters-tax-professionals/virtual-office-cs–saas

Also Check Out These Related Articles:

- Accounting CS Hosting | Thomson Reuters Hosting

- Top 7 Reasons Why Accounting Firms Are Moving Away From Virtual Office CS in 2025

- UltraTax Virtual Office CS Downtime Fixes: Key Strategies for Tax Professionals

- Are You Facing Downtime With UltraTax Virtual Office CS?

- What Caused The Major Outage On June 12, 2025, In Thomson Reuters Virtual Office CS?