Ransomware attacks jumped 126% in Q1 2025, and more than 83% of organizations faced at least one cloud security incident last year. If you’re an accountant or finance professional relying on cloud hosting, these numbers highlight the urgent need for robust protection. With governments raising the regulatory bar and cybercriminals targeting client records, how safe is your cloud data really—and what steps must you take to keep client trust, avoid breaches, and stay compliant?

This blog delivers everything you need: industry stats, expert insights, actionable strategies, and real-life case studies, layered for both beginners and advanced readers.

1: Cloud Hosting Security—Definitions & Fundamentals

What Is Cloud Hosting Security?

Cloud hosting security refers to a suite of technologies, policies, and controls employed to protect cloud-stored data from unauthorized access, loss, and breaches. For accountants, this means safeguarding client tax records, payroll, audits, and sensitive financial documents.

Key Terms (Explained Simply)

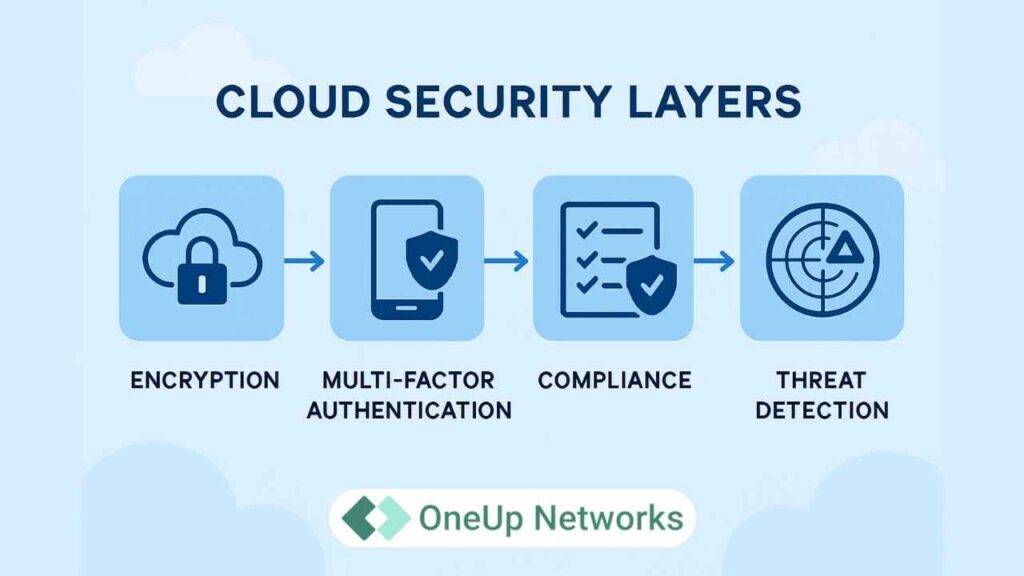

- Encryption: Converting data into unreadable text unless you have a key.

- Multi-factor Authentication (MFA): Requiring more than a password, such as codes sent to a phone.

- Zero Trust: No one is trusted by default; every request is verified.

- Compliance: Following industry rules (SOC 2, IRS 4557, FTC Safeguards Rule).

2: The State of Cloud Security for Accountants

- Cloud Attacks Soaring: Organizations see 1,925 attacks/week in 2025—a 47% lift over last year. Ransomware is up 126%.

- Data Breaches Linked to Cloud: 45% of breaches happen on the cloud, with 82% from human error.

- Unmonitored Assets: 32% of cloud assets remain unmonitored, each with ~115 known vulnerabilities.

- Public vs. Private Cloud Risks: 27% of public cloud users reported incidents vs. just 19% in private clouds.

- AI Adoption and Vulnerabilities: 84% of companies use AI in the cloud, but 62% of deployments have at least one vulnerability.

- Regulatory Pressure: By 2025, over 80% of firms adopt a “cloud-first” strategy, with stricter compliance requirements.

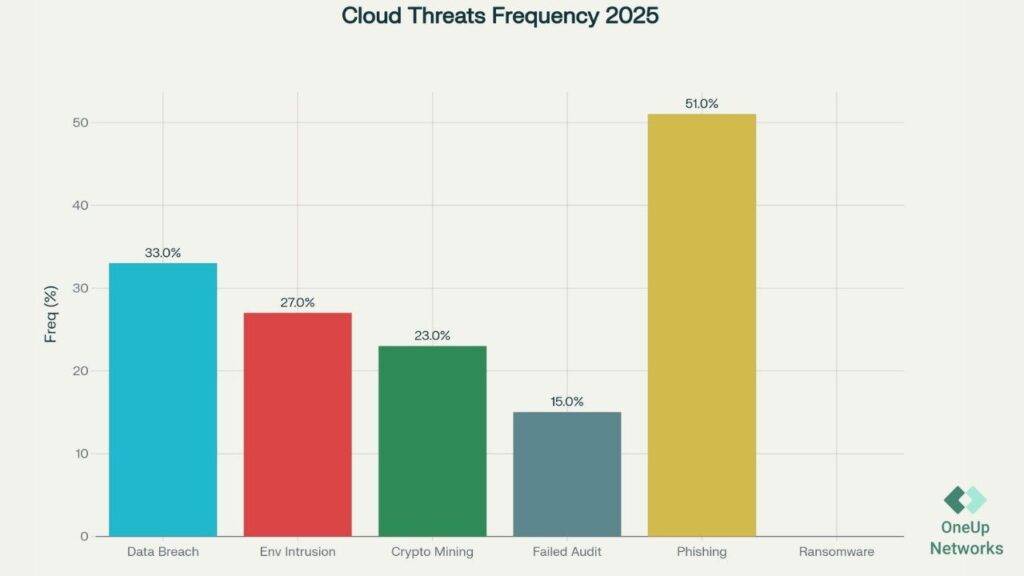

3: Common Cloud Hosting Threats in Accounting & Finance

4: Compliance—What Accountants Must Do

| Compliance Standard | Applicable To | Key Requirements | How to Check Your Host |

|---|---|---|---|

| SOC 2 Type II | Accounting/Finance | Data security, confidentiality, annual audit | Request current audit report |

| IRS Publication 4557 | US Tax Data Handlers | Encryption, secure disposal, incident response | Ensure encryption, MFA, incident plan |

| FTC Safeguards Rule | CPA/Financial Firms | Written security plan, monitoring, secure storage | Confirm security policies & docs |

Tip: Only choose hosting providers who pass annual SOC 2 audits and align to IRS/FTC standards.

Industry Insights—Expert Commentary

Joanna Krysińska, Cybersecurity Analyst –

“Cloud security isn’t just tech—it’s process and culture. Most breaches occur from basic errors, like sharing passwords or skipping regular audits. Strong cloud protection means investing in encryption, strict access controls, and continuous monitoring. Regulators expect evidence you’re actively securing all client data, not just trusting your provider.”

5: Advanced Strategies & Practical Examples (For All Reader Levels)

For Beginners:

- Always use MFA for all staff logins.

- Encrypt data at rest and in transit.

For Experts:

- Deploy real-time anomaly detection (AI-driven).

- Use Cloud Access Security Broker (CASB) to manage permissions and audit activity.

Example:

- A mid-sized CPA firm enabled MFA and implemented regular audits; successful phishing attempts dropped by 67% in one year.

6: Cutting-Edge Trends & Technologies

- Zero Trust Security: “Never trust, always verify”—saves firms up to $1 million per breach.

- AI for Threat Detection: Monitors cloud traffic and flags abnormal activities instantly.

- Green Cloud Hosting: Energy-efficient hosting is not just ethical—it often gets higher compliance ratings.

- Multi-cloud Answers: 79% of firms now use more than one cloud provider for resilience.

7: The Cloud Security Roadmap—Step-by-Step Checklist

- Inventory All Cloud Assets (know what’s exposed)

- Audit Permissions Regularly (update user access)

- MFA on Every Account

- Continuous Real-Time Monitoring (AI-based recommended)

- Encrypt Data—Always

- Document & Review Incident Response Plans Quarterly

- Stay Updated on Regulatory Changes

- Train Staff—Ongoing Cybersecurity Awareness

- Choose a SOC 2–certified Host

8: Tools & Platforms—How Hosting Providers Differ

| Provider Name | SOC 2 Type II | IRS 4557 Compliant | 24/7 Monitoring | Encryption (At Rest / In Transit) | Uptime SLA |

|---|---|---|---|---|---|

| OneUp Networks | Yes | Yes | Yes | Yes (end-to-end encryption) | 99.9% |

| Ace Cloud Hosting | Yes (compliance services) | (Aligned, implied) | Yes | Yes (implied via compliance) | 99.99% |

| Public Cloud (e.g. AWS, GCP, Azure) | Yes (SOC 2 reports available) | Varies by provider and setup | Yes (shared responsibility) | Yes | 99.9%+ |

| Verito | Yes | Yes | Yes | Yes | 99.99% |

FAQ on Cloud Hosting Security:

Today, cloud-stored financial data is generally safer—if the host uses modern encryption and passes annual security audits. Local servers more often suffer from ransomware and physical theft.

SOC 2 Type II, IRS Publication 4557, and FTC Safeguards Rule are the main standards; failing them risks fines and client lawsuits.

Quarterly at a minimum, or immediately after any staff turnover or technological upgrade.

Human error—mostly from weak passwords, skipped configuration steps, and poor internal training.

AI can detect and prevent attacks faster, but improperly managed AI deployments can introduce new vulnerabilities. 84% of firms use AI, 62% face new risks because of it.

Conclusion

In an era where cyber threats are growing more sophisticated and frequent, securing your accounting firm’s data in the cloud is not just a choice—it’s a necessity. By understanding the risks, adopting proven security measures like encryption, multi-factor authentication, and compliance frameworks, and partnering with trusted cloud hosting providers, you can safeguard your clients’ sensitive financial information effectively. Staying proactive with cloud security not only protects your firm from costly breaches and regulatory penalties but also builds lasting trust with your clients.

Ready to secure your firm’s data? Protect your clients’ financial data with robust cloud hosting security tailored for accounting firms. Contact Us to secure your cloud environment now. Partner with OneUp Networks for expert, reliable protection.

Also Read these helpful blogs: