As accounting firms scale, software stops being a convenience and becomes infrastructure. The difference between a fragmented technology stack and an integrated ecosystem directly affects billing velocity, compliance exposure, staff efficiency, and long-term profitability. Thomson Reuters CS Professional Suite is not entry-level bookkeeping software. It is coordinated operational infrastructure designed for CPA firms managing layered engagements, multi-entity clients, recurring accounting services, and structured review workflows.

This guide evaluates the suite from a strategic perspective — not a feature rundown. It explains where it delivers measurable operational advantage, where it demands discipline, and how to determine whether your firm is ready for integrated infrastructure.

Why Infrastructure Now Defines Firm Performance

For many years, firms successfully operated with disconnected systems: tax software in one platform, bookkeeping in another, workflow tracked in spreadsheets, billing handled separately. That model works — until complexity increases.

Once firms reach certain thresholds — typically:

- 300+ annual engagements

- Multiple preparers and reviewers

- Recurring accounting clients

- Formalized review hierarchies

— fragmentation begins to create operational friction.

Symptoms often include:

- Billing cycles exceeding 20–30 days

- Limited WIP visibility

- Rework during review

- Duplicate data entry

- Reduced realization

At this stage, integration becomes a profitability issue — not a technology preference.

What Thomson Reuters CS Professional Suite Actually Is

Thomson Reuters CS Professional Suite is a modular ecosystem built specifically for professional accounting firms. Each module performs a specialized role, yet all share synchronized client data and workflow architecture.

The core suite typically includes:

- UltraTax CS for professional tax compliance

- Accounting CS for write-up and payroll

- Practice CS for time, billing, and engagement tracking

- Engagement and Workpapers tools for audit documentation

- Fixed Assets CS for depreciation tracking

- Secure client portals for structured collaboration

The strength is not isolated features — it is cohesion. When accounting records flow directly into tax preparation and billing updates reflect engagement status in real time, leadership gains operational clarity that fragmented stacks cannot provide.

Who This Platform Is Designed For

CS Professional Suite aligns best with firms that have developed structured internal processes and now require cross-department visibility.

It is particularly effective for firms that:

- Manage 300–3,000 engagements annually

- Offer tax and recurring accounting services

- Employ layered review structures

- Serve multi-entity clients

- Track realization and utilization metrics

It may not suit:

- Solo practitioners filing under 150 returns

- Bookkeeping-only firms

- Firms unwilling to standardize workflows

- Practices prioritizing minimal onboarding

Technology should align with operational maturity.

Core Modules in Practice

UltraTax CS :

UltraTax CS supports individual, corporate, partnership, fiduciary, and multi-state filings. Its diagnostic engine and structured review workflows reduce compliance risk while improving tax season efficiency through prior-year data carryforward.

Accounting CS :

Accounting CS centralizes write-up services, payroll, and financial reporting. Integration with tax preparation reduces manual year-end adjustments.

Practice CS :

Practice CS connects time tracking, WIP monitoring, billing, and profitability analytics. Firms often experience meaningful improvements in billing velocity once leadership actively uses its dashboards.

A Modeled Case Study: Quantified Operational Impact

Consider a realistically modeled mid-sized CPA firm:

Firm Profile

- 16 staff members

- 750 annual tax returns

- 95 recurring accounting clients

- Legacy stack: standalone tax software + QuickBooks + spreadsheets

Challenges

- 32-day billing lag

- Manual WIP tracking

- 18% rework during review

- Fragmented documentation

After implementing CS Professional Suite (UltraTax CS, Accounting CS, Practice CS, Workpapers) and redesigning workflows over six months, the firm achieved within 12 months:

- Billing cycle reduced to 14 days

- Rework reduced to 9%

- 22% increase in captured billable hours

- 11% improvement in realization

- Zero audit documentation gaps

The gains resulted from integration and workflow transparency — not increased staffing.

The Infrastructure ROI Equation

Software ROI in accounting firms is driven by operational velocity. A simplified infrastructure model: (Billing Velocity × Realization Rate × Engagement Volume) – Operational Friction

For example, a $2M firm improving realization by 8% while reducing billing lag by 15 days can generate six-figure annual impact without increasing headcount. Infrastructure return scales with engagement volume. Firms exceeding $1.5M in annual revenue often recover implementation cost within 12–18 months if operational metrics improve.

Security and Compliance Architecture

Accounting firms manage sensitive financial data. CS Professional Suite supports:

- AES-256 encryption

- Multi-factor authentication

- Role-based access controls

- Detailed audit trails

- Hosting environments aligned with SOC and ISO standards

Security is not optional infrastructure — it is client trust.

Market Positioning: Where It Fits

Technology selection depends on complexity. Small firm stacks often rely on QuickBooks paired with lightweight workflow tools. Mid-sized firms frequently transition to integrated ecosystems like Thomson Reuters CS Professional Suite. Enterprise-scale firms may adopt solutions such as GoSystem Tax RS for high-volume tax infrastructure.

CS Professional Suite vs QuickBooks vs Sage Intacct vs TaxDome

| Evaluation Criteria | Thomson Reuters CS Professional Suite | QuickBooks | Sage Intacct | TaxDome |

|---|---|---|---|---|

| Primary Focus | Integrated CPA firm infrastructure | Small business accounting | Financial management platform | Practice workflow automation |

| Tax Depth | Advanced multi-entity | Basic | Requires integrations | Not a tax engine |

| Workflow Automation | Structured engagement hierarchy | Minimal | Moderate | Strong task automation |

| Document Management | Integrated portals & structured storage | Basic | Moderate | Strong portal focus |

| Audit Readiness | Built for review documentation | Not audit-centric | Financial reporting focus | Workflow support |

| Scalability Ceiling | Mid-to-large CPA firms | Small firms | Mid-market | Small-to-mid CPA firms |

| Investment Profile | Mid-to-high | Low | High | Mid |

CS Professional Suite occupies the strategic middle ground — integrated without enterprise-only complexity.

The CPA Infrastructure Maturity Model™

Firms evolve through predictable stages.

1: Tool-Based Operations

Fragmented systems, manual oversight.

2: Process-Aware Growth

Defined workflows but limited integration.

3: Integrated Infrastructure

Need for cross-department visibility and structured control — prime adoption stage.

4: Strategic Intelligence

Data-driven forecasting and profitability modeling.

Misalignment occurs when complexity exceeds systems — or systems exceed discipline.

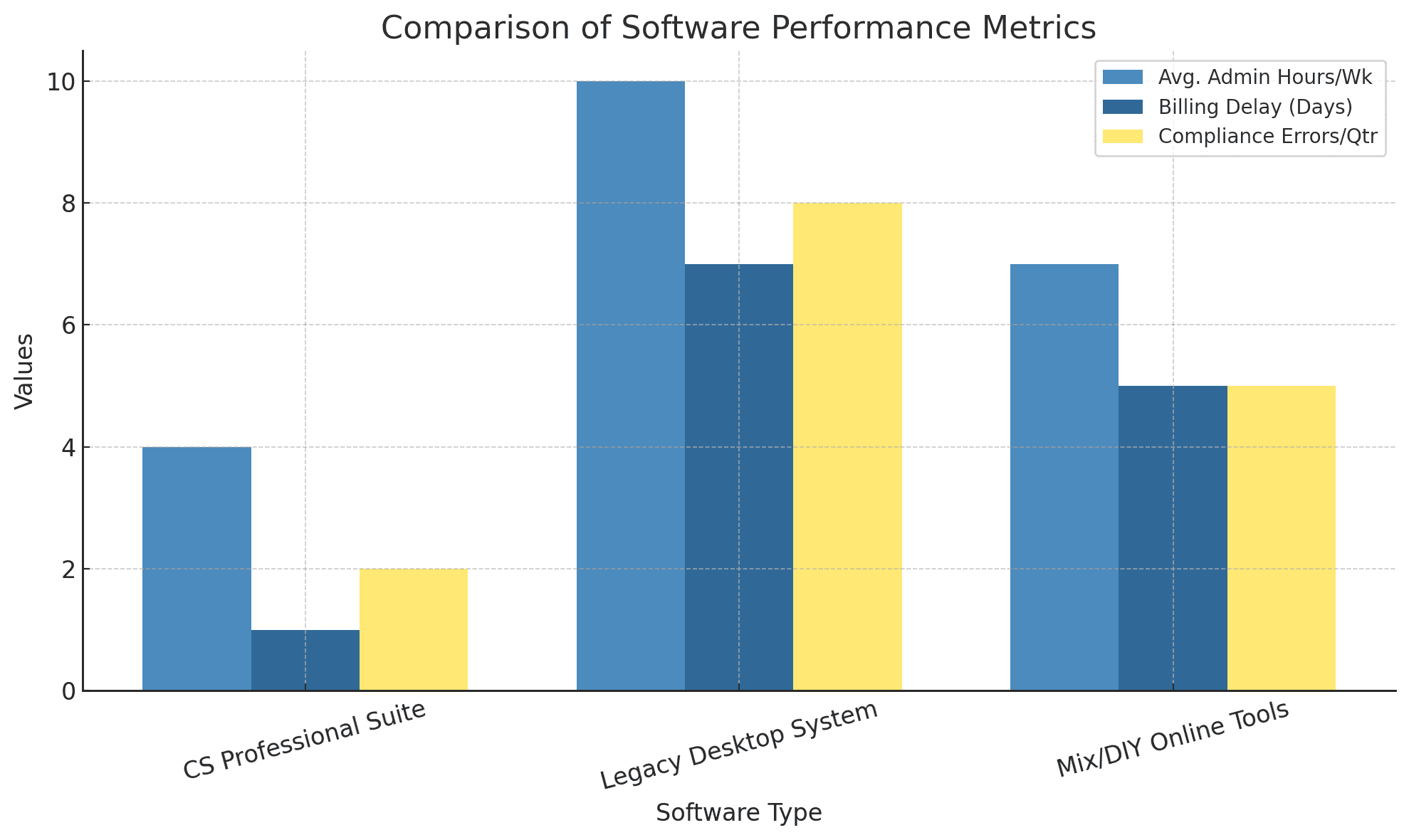

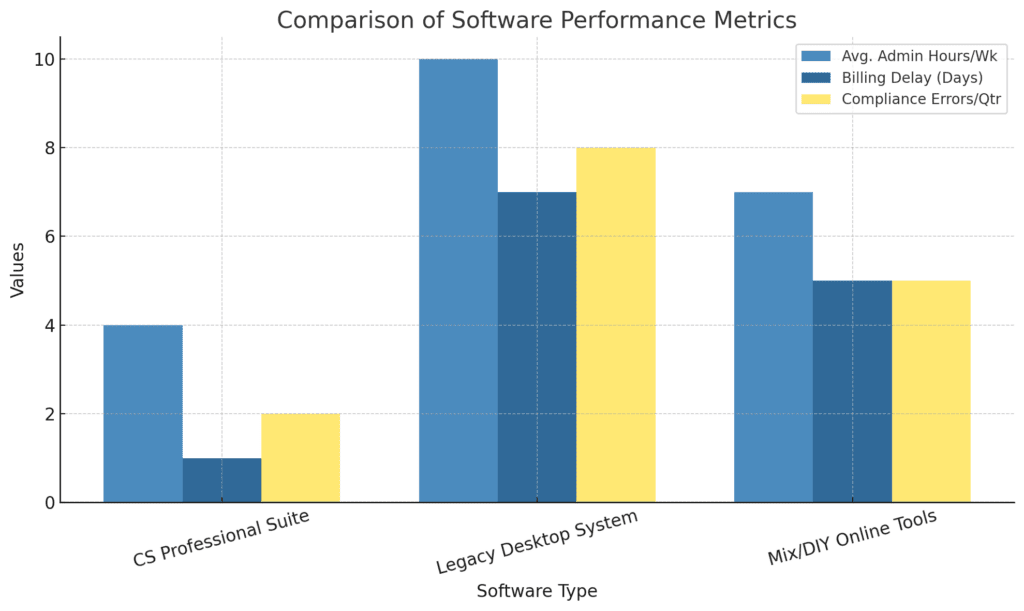

Chart: Workflow Optimization Impact

What Happens When Firms Delay Integration

Firms operating at Stage 3 complexity with Stage 1 systems often experience:

- Revenue leakage

- Partner oversight fatigue

- Growing rework

- Reduced staff morale

- Client delivery delays

Fragmentation accumulates hidden cost over time.

The Future of CPA Infrastructure

Accounting technology is shifting toward:

- AI-assisted diagnostics

- Automated document ingestion

- Predictive realization modeling

- Real-time client collaboration

- Heightened regulatory scrutiny

Firms with centralized data ecosystems will adopt AI more effectively than firms operating fragmented stacks. Infrastructure decisions today shape competitive position over the next five years.

Implementation Considerations

Successful deployment typically includes:

- Workflow mapping before migration

- Defined engagement stages

- Department-level training

- Phased rollout

- 90-day performance monitoring

Integration amplifies discipline.

Frequently Asked Questions

Yes — for firms managing complex workflows, multiple preparers, and recurring clients. When billing speed and realization improve, the investment usually justifies itself.

Mid-sized and growing CPA firms that need integrated tax, accounting, and workflow visibility. It is not built for solo or bookkeeping-only practices.

QuickBooks handles small business bookkeeping. CS Professional Suite manages firm-level tax preparation, engagement tracking, billing, and compliance in one ecosystem.

Typically 1–3 months depending on firm size and modules selected.

Operational clarity. Shorter billing cycles, less rework, and stronger control over workflow.

Final Strategic Assessment

Thomson Reuters CS Professional Suite is not just a collection of modules — it is integrated infrastructure for CPA firms that have moved beyond basic tools. As engagement volume, compliance demands, and internal complexity increase, fragmented systems quietly reduce efficiency and profitability. Integrated coordination restores visibility, strengthens billing control, and creates operational clarity across tax, accounting, and workflow management.

The real question is not whether the platform has enough features. The question is whether your firm has reached the stage where infrastructure matters more than convenience. For firms planning to scale, improve realization, and operate with structured discipline, CS Professional Suite becomes less of an option and more of a strategic progression.

Take the Next Step Toward a Future-Ready Firm

Transform the way your accounting or CPA firm operates with smarter, faster, and more secure technology solutions. At OneUp Networks, we help firms streamline workflows, strengthen data security, and maximize ROI with leading platforms like TR CS Professional Suite. Whether you’re optimizing tax workflows or scaling multi-entity operations, our experts are here to guide you every step of the way.

- Contact Us – Talk to our team about your firm’s specific needs.

- Book a Demo – See CS Professional Suite in action with a guided walkthrough.

- Start a Free Trial – Experience the platform’s full capabilities firsthand.

- Chat with an Expert – Get real-time advice on setup, pricing, and best-fit modules.

Your firm’s digital transformation starts here—with OneUp Networks by your side.

Also Check Out These Related Articles:

- CS Professional Suite Hosting | Thomson Reuters Hosting

- Thomson Reuters Practice CS Hosting – Practice Management Software

- How to Choose the Right CS Professional Suite Software for Your Firm?

- UltraTax CS Cloud Hosting, Thomson Reuters Hosting

- Confused by UltraTax CS? Your Complete Guide with FAQs, Costs, Hosting & Insights