Modern CPA and tax firms face tightening deadlines, rising client expectations, and unrelenting pressure to maximize productivity and compliance. Did you know over 85% of top-performing accounting practices now use integrated, cloud-based workflow software? Yet only a fraction fully exploit their technology’s power—leaving billable hours and revenue on the table. This guide reveals how Thomson Reuters CS Professional Suite can transform workflow, boost security, and grow profits—even for small firms.

What is CS Professional Suite?

Thomson Reuters CS Professional Suite is an integrated, modular software solution tailored for tax, accounting, and finance professionals—from sole proprietors to multi-office firms. Its core philosophy: Seamlessly connect every part of your practice—from tax prep to client communication—to minimize errors, duplicate entry, and wasted effort.

Key CS Suite Modules

- UltraTax CS: Advanced professional tax preparation and compliance across individual, corporate, partnership, and trust returns.

- Accounting CS: Write-up, trial balance, payroll, and financial statement analysis in a unified dashboard.

- Practice CS: Time and billing, project management, staff scheduling, profitability analytics.

- FileCabinet CS: Secure digital document management and e-signatures.

- Client Portals + Websites: Encrypted exchange and instant document delivery.

What Sets CS Suite Apart?

- Customizable workflows designed for complex, multi-entity firms—not individual businesses.

- Real-time data sharing across every module: UltraTax, Accounting CS, Practice CS, FileCabinet.

- Bank-level cloud security and compliance certifications, including AES-256 encryption, multi-factor authentication, SOC 2/ISO data centers, and routine threat monitoring.

Accounting CS

- What it does: Write-up/bookkeeping, trial balance, financial statement generation, recurring entries, payroll integration, etc. Used when you need to maintain clients’ regular accounting records, not just tax returns.

- Use Case: A mid-sized firm with 50-200 clients needing regular bookkeeping and statements. For example, a firm handling monthly or quarterly financial statements for small and medium business (SMB) clients; also useful when clients expect consolidated financial statements, or multiple entities.

- Strengths: Integrated with other CS modules; strong write-up, financial reporting, payroll additions; robust for accounting firms used to on-premise + hosted deployments.

Engagement Manager & Workpapers CS

- Engagement Manager: For audits / reviews — managing working papers, trial balance, documentation etc.

- Workpapers CS: Collaboration around tax workpapers, sharing, version management, etc. It allows multiple team members or clients to collaborate in real-time.

- Use Case: Larger firms with audit clients or clients needing formal review engagements; firms where multiple people work on a client simultaneously (e.g. senior accountant, manager, reviewer).

UltraTax CS

- What it does: Tax return preparation, review, delivery; automation of data capture; integration with other modules (for example, accounting, fixed assets). eSignature optional.

- Use Case: Firms preparing many individual, partnership, corporate tax returns; firms wanting to speed up the tax season with review workflows, accuracy checking, integrating client info from prior years.

GoSystem Tax RS

- A cloud-based professional tax software, more targeted at larger CPA firms (top 100, for example) who want scalability and remote access. Good for firms with high volume, needing managed infrastructure and performance.

Fixed Assets CS & Planner CS

- Fixed Assets CS: Manages depreciation, asset tracking, tax vs book differences, disposals etc. Useful for firms whose clients hold many fixed assets (manufacturing, construction, real estate).

- Planner CS: Used for tax planning: projections, scenario modelling, tax burden forecasts. Especially valuable in proactive advisory work.

Firm & Workflow, Document Management, Client Portal

- Document management: storing, versioning, sharing of documents, workpapers, tax docs.

- Firm management / workflow: assign tasks, track deadlines, manage staffing, review cycles.

- Client portals: secure exchange of documents, client access to some data, real-time collaboration.

Going Deeper: Fea tures, Workflow, and Efficiency

Deep Feature Highlights

- All-in-one integration eliminates data silos and version conflicts.

- Automated billing, payroll management, complex tax calculations.

- Customizable dashboards and up-to-the-minute client, staff, and project status.

- 24/7 cloud access, performance analytics, and client collaboration portals.

- Robust access controls and audit trails for user accountability.

Expert Commentary

“Unlike generic accounting solutions, CS Professional Suite lets accounting firms manage hundreds of clients, departments, and entity types simultaneously. The productivity gains from real-time collaboration and automated data flow are a game changer for growing practices.” — Practice Management Consultant

CS Suite Use Cases: Real Accounting and Tax Scenarios

Multi-Entity Firm Operations

Ideal for firms handling diverse tax structures, complex ownership, and sophisticated reporting needs.

- Multi-location inventory, departmental cost allocation, and sophisticated entity structures.

- Real-time project status tracking and e-billing shorten the revenue cycle.

- Supports remote and hybrid staff through secure online access and mobile updates.

Client Collaboration

- Accountants and clients share data instantly, reducing costly delays and version mismatches

- Encrypted portals and customizable workflows mean firms can offer world-class service across tax, audit, and advisory.

Regulatory Compliance and Security

- Managed in Tier 4/5 data centers, meeting SSAE-16, SOC 2, and ISO 27001 standards for cloud security.

- Supports CCSP-level best practices for legal, risk, and compliance domains.

Case Study: Transforming a Small CPA Firm with CS Professional Suite

T.C. Burgin, CPA, PC, a six-person firm in Oklahoma City, transformed its billing and workflow after implementing UltraTax CS, Accounting CS, and Practice CS. Before switching, billings took over a week; now, revenue cycles complete in a single day. The key? Integrated project monitoring, staff scheduling, and billing automation. Over time, client service quality rose, and compliance became easier—freeing partners to focus on growth.

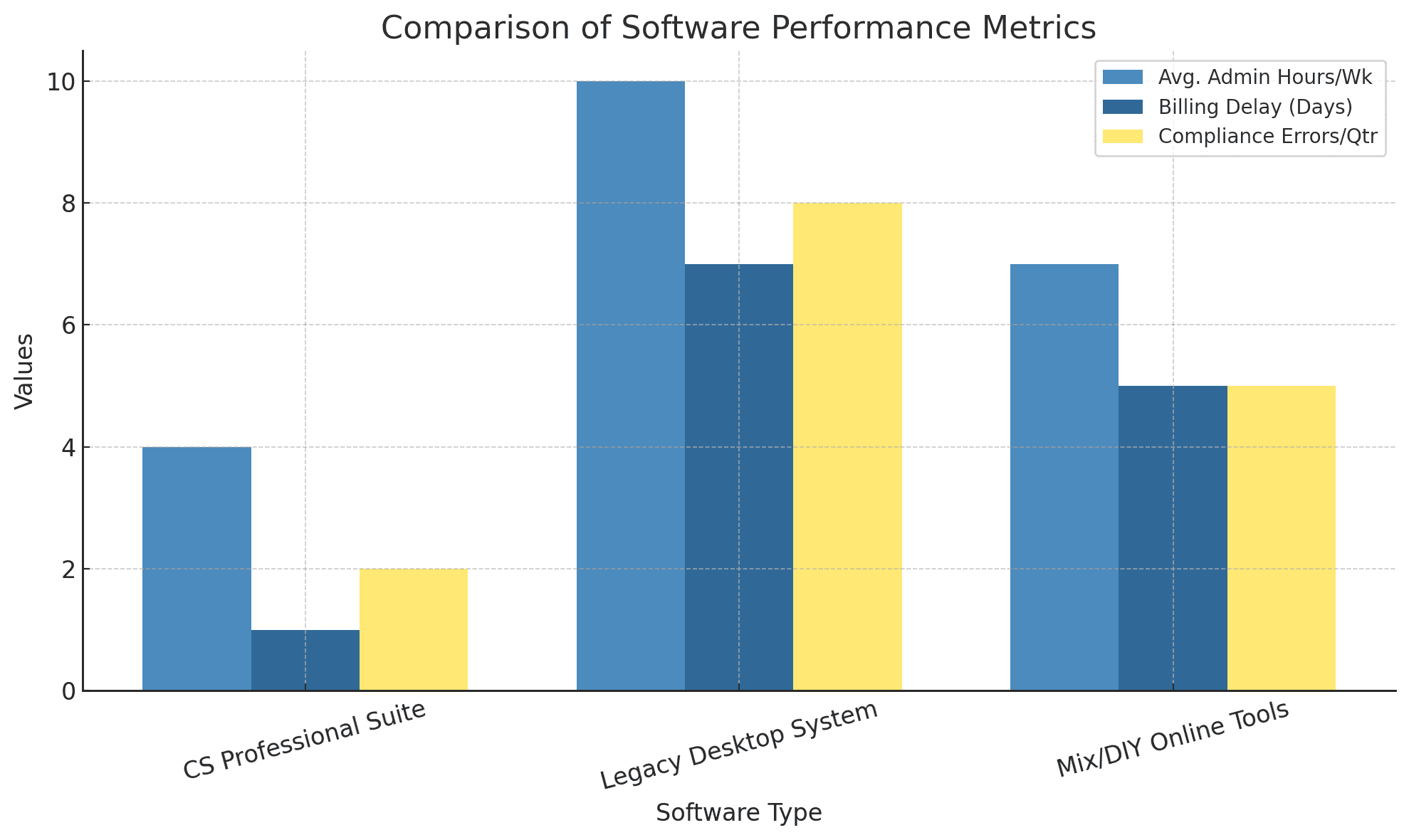

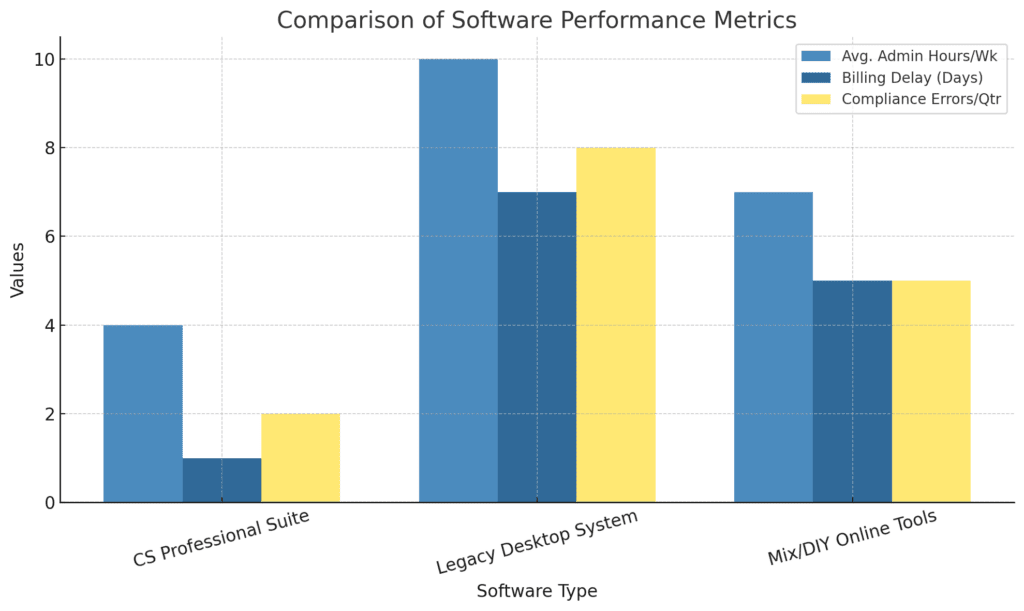

Comparison Table: CS Professional Suite vs Leading Alternatives

Strategic Trends and Statistics (2025)

- The global SaaS market is expected to hit $300 billion by 2025, with over 85% of SaaS budgets spent on renewals, not new applications. Firms are consolidating onto “platforms”—like CS Professional Suite—for efficiency.

- CS Suite market share is modest (0.32%), but it dominates niche professional firm workflows and multi-entity management, not the solo or “DIY” user segment.

- 50% of SaaS platforms are integrating real-time AI features, driving auto-reconciliation and task management forward.

How to Choose the Right CS Professional Suite Modules for Your Firm

- Audit your major pain points: Are you losing billable hours to manual tasks?

- List your compliance/security needs: Do you handle sensitive client data, multi-location, or regulatory reporting?

- Estimate growth: Is your client base scaling? More entities, departments, or remote staff?

- Prioritize real-time client collaboration and document management.

- Evaluate cost-benefit: Larger firms benefit most, but smaller firms should assess ROI carefully.

- Consult expert reviews on learning curve, onboarding, and training.

Chart: Workflow Optimization Impact

Practice Management: The Role of Practice CS

Practice CS transforms time and billing, project and staff management, with a central dashboard for every client and project status. Electronic invoicing, online bill payment, and detailed profitability analytics let partners maximize revenue without increasing staff hours.

Security and Compliance for the Modern CPA Firm

- AES-256 encryption, multi-factor authentication, SSAE-16, SOC 2, ISO-certified hosting.

- Audit trails, customizable user roles, and regular security monitoring surpass most off-the-shelf alternatives.

- Adopts CCSP-level standards and is compatible with major cloud security certifications, ensuring safety for sensitive financial data.

FAQs on Thomson Reuters CS Professional Suite

While designed for complex, multi-client firms, smaller practices can benefit—especially those planning to scale or needing strong compliance tools.

Pricing usually starts above $1,000 annually, varying by modules and user count. Free trials and demos are available. However, with TR cloud hosting you can save migration costs if you host as well.

It offers enterprise-grade security: AES-256 encryption, SOC 2/ISO-certified data centers, and 24/7 SOC monitoring.

Yes, it connects to Microsoft Office, Exchange, and can import/export from QuickBooks, among other platforms for smooth workflow.

Thomson Reuters provides onboarding, user training, and 24/7 support, plus thorough documentation, demos, and best practices resources.

Conclusion – Building a Future-Ready Accounting Practice

In 2025, firm success depends on more than financial expertise—it depends on how effectively technology powers that expertise. Thomson Reuters CS Professional Suite offers an integrated foundation for firms ready to streamline operations, enhance compliance, and strengthen client relationships.

By automating manual tasks and connecting every core process—from UltraTax CS to Practice CS—firms can reclaim valuable time and redirect it toward higher-value advisory work. The future belongs to practices that are secure, connected, and data-driven—and the CS Professional Suite is designed to get you there.

Take the Next Step Toward a Future-Ready Firm

Transform the way your accounting or CPA firm operates with smarter, faster, and more secure technology solutions. At OneUp Networks, we help firms streamline workflows, strengthen data security, and maximize ROI with leading platforms like TR CS Professional Suite. Whether you’re optimizing tax workflows or scaling multi-entity operations, our experts are here to guide you every step of the way.

- Contact Us – Talk to our team about your firm’s specific needs.

- Book a Demo – See CS Professional Suite in action with a guided walkthrough.

- Start a Free Trial – Experience the platform’s full capabilities firsthand.

- Chat with an Expert – Get real-time advice on setup, pricing, and best-fit modules.

Your firm’s digital transformation starts here—with OneUp Networks by your side.

References

SoftwareWorld—CS Professional Suite Features & Reviews

Ace Cloud Hosting—CS Suite Hosting and Security

Fondo—Accounting CS Market Share & Professional Use

Thomson Reuters CS Professional Suite official site

SelectHub—CS Professional Suite Pricing/Reviews

Thomson Reuters—Case Study: T.C. Burgin, CPA

Statista—Global SaaS Market Size 2025

Thomson Reuters—Practice CS features/awards

Also Check Out These Related Articles:

- CS Professional Suite Hosting | Thomson Reuters Hosting

- Thomson Reuters Practice CS Hosting – Practice Management Software

- How to Choose the Right CS Professional Suite Software for Your Firm?

- UltraTax CS Cloud Hosting, Thomson Reuters Hosting

- Confused by UltraTax CS? Your Complete Guide with FAQs, Costs, Hosting & Insights