Feeling lost when tax season hits? Most small business owners and freelancers dread tax time, especially without an accounting background. The good news: QuickBooks tax preparation reports can turn tax chaos into confidence—even for total beginners. Discover how simple reports in QuickBooks and cloud hosting make tax filing smooth, accurate, and way less stressful.

What Is QuickBooks?

QuickBooks is accounting software designed by Intuit that helps small businesses track income, expenses, payroll, and taxes. Think of it as your business’s financial hub—it organizes sales, bills, payments, and even connects to your bank.

There are two main versions:

- QuickBooks Online (cloud-based): Access anywhere, updates automatically, and easy to share with your accountant.

- QuickBooks Desktop (installed software): Feature-rich and powerful, especially for businesses with complex needs.

QuickBooks doesn’t directly file your taxes with the IRS. Instead, it organizes your financial data into neat reports so you can file accurately with tax software or your accountant.

How QuickBooks Helps During Tax Season

Here’s how QuickBooks makes tax prep simpler:

- Tracks Income & Expenses: Every sale and purchase gets categorized, making your records clean and ready.

- Creates Key Reports: QuickBooks generates profit & loss, balance sheets, 1099 reports, and more.

- Simplifies Contractor Payments: It automatically tracks who gets a 1099 at year-end.

- Prepares Payroll Data: If you run payroll, QuickBooks calculates withholdings and generates W-2s.

- Collaboration: Your accountant can log in and access everything directly.

In short, quickbooks tax preparation gives you organized numbers so you can file faster, easier, and with fewer mistakes.

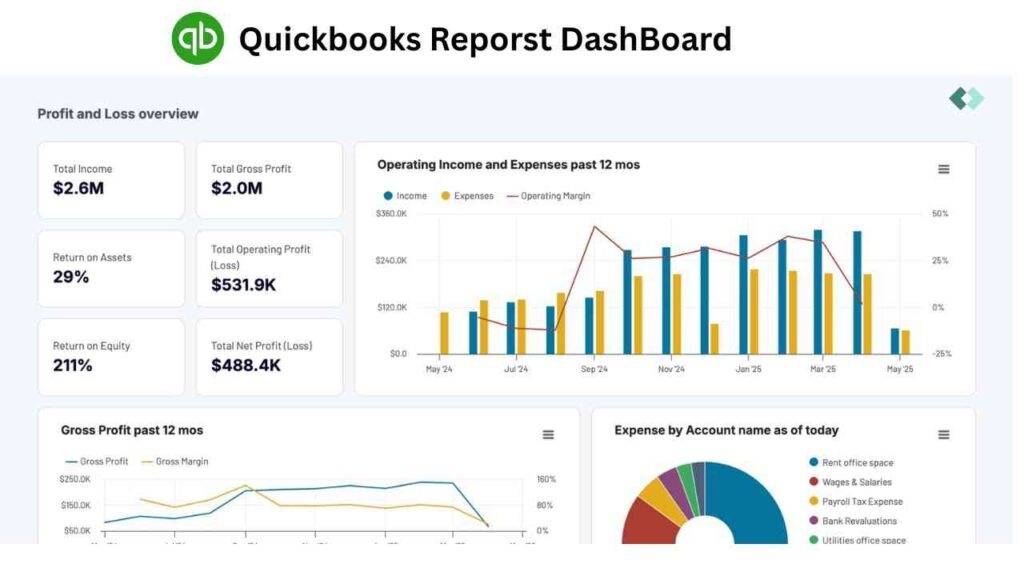

QuickBooks Reports for Taxes

When it comes to tax filing, QuickBooks makes it easy by generating key reports that show what you earned, spent, owe, and need to report to the IRS. Here are the most critical QuickBooks reports for tax prep in the USA:

1) Profit & Loss (P&L) Report

- Shows your total income earned and expenses paid during a specific period.

- The P&L (also called “Income Statement”) is the backbone of your tax return; it helps you (and your CPA) calculate taxable income and spot deductible expenses.

2) Balance Sheet

- Breaks down your company’s financial position: assets, liabilities, and equity at year-end.

- Essential for LLCs and incorporated businesses filing more complex returns; often required by lenders and the IRS as supporting docs.

3) 1099 Reports

- Lists all payments made to contractors and vendors that may require 1099 forms for the IRS.

- Easily identify who needs a 1099, the total paid, and filter by vendor or account—crucial for compliance.

4) Payroll Reports (Payroll Summary/Tax Liability)

- Summarizes staff wages, payroll taxes paid, and liabilities owed.

- Needed for IRS filings like Form 941/944, 940, and to double-check you withheld and paid the right amounts.

5) Sales Tax Reports

- Tracks sales tax collected and owed for various jurisdictions.

- Vital for businesses collecting sales tax in multiple states; simplifies reporting and compliance.

6) Revenue/Income Reports

- Shows income by customer, income type, or sales item.

- Helps you track which customers/vendors drive the most income, supporting business and tax decisions.

7) Year-End Closing Reports

- Wraps up all financials for accurate year-end tax prep.

- Includes P&L YTD (year-to-date), expense summaries, payroll summaries, and reconciliations that make closing out the year simple and IRS-friendly.

Other Essential Reports

- Expense By Vendor Detail/Summary

- Sales Tax Liability

- Bank Reconciliation

- Accounts Receivable Aging (unpaid customer balances)

- Accounts Payable Aging (overdue bills)

Benefits of QuickBooks Reports for Tax Filing

- Accuracy: Automatically organizes transactions so you don’t miss a deductible expense or count income twice.

- Time savings: Generates detailed, CPA-ready reports in seconds instead of hours—no manual number crunching needed.

- IRS compliance: Flags payments needing 1099s and helps you stay up-to-date with federal and state payroll taxes.

- Audit trail: Provides clear digital backup for every figure, making audits less stressful.

- Cloud convenience: Share reports securely with your accountant from anywhere—no paper stacks or email attachments needed.

Case Study: Fresh Baked Bakery

Meet Maria, owner of Fresh Baked Bakery. She runs her business using QuickBooks Online.

- Throughout the year, Maria logs sales, ingredient purchases, and contractor payments.

- In January, she runs a Profit & Loss report: $120,000 in sales, $90,000 in expenses, leaving $30,000 net profit. That number goes straight on her tax form.

- QuickBooks also generates 1099 reports for her delivery driver and graphic designer. Maria files the forms easily without missing anyone.

- Her Balance Sheet shows $15,000 in equipment and $5,000 in loans—data her bank requests for a small loan extension.

With QuickBooks, Maria’s tax prep took hours, not days. She focused more on baking, not bookkeeping.

Cloud-Hosted QuickBooks vs Local/Traditional QuickBooks for Tax Prep

Which QuickBooks Reports Do Small Businesses Use Most for Taxes?

- Profit & Loss Report: 36%

- Payroll Reports: 22%

- 1099 Reports: 14%

- Sales Tax Report: 10%

- Balance Sheet: 10%

- Other (AR/AP aging, reconciliation, etc): 8%

Tips for Using QuickBooks at Tax Time

- Enter income and expenses regularly (don’t wait until year-end).

- Reconcile bank accounts monthly to catch errors.

- Categorize expenses correctly for better deductions.

- Run Profit & Loss reports quarterly to spot anomalies.

- Mark contractors correctly for 1099s.

- Back up your books before closing the year.

- Use classes/tags to separate projects or locations.

These habits will save you stress when tax season arrives.

Frequently Asked Questions

No—QuickBooks itself does not send your accounting data to the IRS. It organizes the info you need, but you (or your CPA/tax software) file forms with the IRS directly.

At minimum: Profit & Loss, Balance Sheet, Payroll Summary, 1099 Summary, Sales Tax Liability. Some businesses will also need AR/AP Aging and bank reconciliation reports.

QuickBooks generates CPA/tax software-ready reports and integrates with online tax prep tools, but you’ll need to file your return on the IRS website or through your tax software.

Absolutely—it’s designed for small businesses, freelancers, and LLCs. QuickBooks makes it easy to track, organize, and export the reports needed for accurate tax filing.

Run all year-end reports (P&L YTD, payroll, 1099, sales tax), reconcile all accounts, categorize every expense, export supporting docs, and share them with your CPA—a few clicks in QuickBooks Online (QBO) makes this simple.

Conclusion

Tax season doesn’t have to be stressful or confusing. With quickbooks tax preparation, even beginners can turn messy receipts and scattered records into organized, accurate reports. From the Profit & Loss statement to 1099 forms and balance sheets, QuickBooks (QB) gives you the insights you need to file taxes confidently and efficiently.

By keeping your books up to date, categorizing expenses correctly, and running the right reports, you’ll save time, reduce errors, and make tax season far less overwhelming. Whether you’re a small business owner, freelancer, or LLC, QuickBooks (especially when hosted with OneUp Networks) can simplify the process and let you focus on growing your business instead of crunching numbers.

Take Action Today and Simplify Your Tax Season

Don’t let tax time overwhelm you. QB tax preparation, combined with OneUp Networks’ cloud hosting, makes organizing your finances simple, fast, and stress-free—even if you’ve never used accounting software before. Take control of your business finances and get ready for a smooth tax season by acting now. Don’t wait—contact us today to get personalized support and make your financial management effortless!

Here’s how you can get started:

- Schedule a Demo: See QuickBooks in action and learn how it can streamline your tax reporting.

- Start a Free Trial: Try QuickBooks risk-free and experience organized finances firsthand.

- Chat With Expert: Speak with our experts to find the best QuickBooks setup for your business needs.

With QuickBooks and OneUp Networks, tax season becomes easier, faster, and more accurate—giving you more time to focus on growing your business instead of crunching numbers.

Also Read These Helpfull Blogs:

- How Can P&L Analysis Unlock Sustainable Business Growth?

- Accounting for Dummies Cheat Sheet: Essential Guide for Beginners & Professionals

- Holiday Travel Made Easy: Access Your Tax Files from Anywhere with Cloud Hosting

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- All About Tax Season: What to Expect in 2025 and How to Prepare?