If you’re managing money—whether it’s for your household, a side hustle, or a full-fledged business—you’ve probably come across both Quicken and QuickBooks. They may sound alike, and both help track finances, but that’s where the similarities end. These two tools serve very different purposes, with Quicken geared more toward personal finance and investments, while QuickBooks is built for serious business accounting.

In this blog, we’ll break down the key differences between Quicken and QuickBooks, share real-world use cases, and help you figure out which one makes the most sense for your financial goals.

What is Quicken?

Quicken is a robust personal finance management tool originally developed by Intuit, but later owned by Quicken Inc. It is designed primarily for individuals and families who want to track their personal budgets, investments, and expenses. Over the past four decades, more than 20 million people have used Quicken to manage their finances.

Specifically, Quicken’s core features include:

- Expense Tracking: Categorize and monitor spending to better identify patterns and trends.

- Budgeting: Set up budgets based on income and expenses in order to avoid overspending.

- Bill Payment: Schedule and track bills so as to ensure timely payments and avoid late fees.

- Investment Tracking: Monitor investment portfolios and also generate performance reports.

- Tax Planning: Estimate taxes, track deductions, and export data for tax preparation.

- Rental Property Management: Track leases, collect rent, and manage rental income and expenses (in Home & Business version).

Moreover, Quicken is available in several versions, including Simplifi (mobile-focused), Classic (desktop), and Business & Personal (for small businesses and landlords).

What is QuickBooks?

QuickBooks, developed and marketed by Intuit, is a comprehensive accounting software suite tailored for small and medium-sized businesses. Currently, QuickBooks is widely recognized as the most popular accounting software in the United States and globally, with over 6.5 million QuickBooks Online subscribers as of 2025.

In particular, QuickBooks’ key features include:

- Sales and Expense Tracking: Record daily transactions, manage sales, as well as track expenses.

- Invoicing: Create and send unlimited invoices, and manage accounts receivable.

- Payroll Management: Process payroll and manage employee payments (available as an add-on or in higher-tier plans).

- Inventory Management: Track inventory levels and manage stock.

- Advanced Financial Reporting: Generate detailed reports such as profit and loss, balance sheet, and cash flow statements.

- Integration: Connect with over 750 third-party apps, including payment processors, time-tracking tools, and payroll services.

- Cloud-Based Access: Access your financial data from anywhere, anytime, with QuickBooks Online.

Furthermore, QuickBooks is available in several plans, including Simple Start, Essentials, Plus, and Advanced, each offering different levels of functionality and user access.

Quicken vs. Intuit QuickBooks: Comparison

To help you visualize the differences, here’s a detailed comparison table:

| Feature | Quicken | QuickBooks |

|---|---|---|

| Primary Use | Personal & family finance; small business (limited) | Small & medium business accounting |

| Expense Tracking | Yes | Yes |

| Budgeting | Yes | Yes (limited in business context) |

| Invoicing | Yes (limited in Business & Personal plan) | Unlimited |

| Payroll | No | Yes (add-on or higher-tier plans) |

| Inventory Management | No | Yes |

| Investment Tracking | Yes | No |

| Rental Property Tools | Yes (Home & Business plan) | No |

| Cloud Access | Yes | Yes |

| Mobile App | Yes | Yes |

| Integration | Limited (bank and investment connections) | Extensive (750+ apps) |

| Number of Users | 1 | Up to 40 (depending on plan) |

| Free Trial | No (30-day money-back guarantee) | Yes (30-day free trial or 50% off for 3 months) |

| Support | Phone & chat (limited hours) | Phone, chat, email (24/7 in Advanced plan) |

| Price Range | $3.99–$10.99/month (varies by plan) | $35–$235/month (varies by plan) |

QuickBooks vs Quicken: Which Financial Tool Fits Your Needs?

Quicken is best for:

- Individuals and families who want to manage personal budgets, track investments, and pay bills.

- Freelancers, contractors, or landlords who need to track both personal and business expenses in one place.

- Small business owners with very simple needs (e.g., invoice-based businesses or rental property management).

QuickBooks is best for:

- Small and medium-sized businesses that need comprehensive accounting, inventory, and payroll management.

- Businesses that require advanced financial reporting, as well as integration with other business software.

- Companies with multiple users who need simultaneous access to financial data.

Use Cases for Accountants and CPAs:

Use Case 1:

Sarah is a freelance graphic designer. She uses Quicken to track her personal expenses, manage her investments, and keep tabs on her business income and expenses. Because her business is simple and invoice-based, Quicken meets all her needs efficiently and effectively.

Use Case 2:

John owns a small retail store. He uses QuickBooks to manage inventory, process payroll, send invoices, and generate detailed financial reports. Moreover, QuickBooks’ integration with his point-of-sale system and payroll provider streamlines his operations, making day-to-day management much easier.

Market Share and Popularity

Intuit QuickBooks Online dominates the accounting software market, with a 0.73% market share in the accounting software category, in contrast to Quicken’s 0.01%. Furthermore, QuickBooks Online had 6.5 million subscribers in 2023, making it the most widely used accounting software for small businesses.

On the other hand, Quicken has served over 20 million users since its inception, primarily focusing on personal finance.

Ownership and History

QuickBooks is owned and developed by Intuit, a leading financial software company. In comparison, Quicken was originally developed by Intuit but was sold to H.I.G. Capital in 2016. It is now owned and operated by Quicken Inc. Over time, both products have evolved, with QuickBooks expanding into cloud-based solutions, whereas Quicken has focused on personal finance and small business needs but that can also be hosted on the cloud server.

OneUp Networks delivers secure, high-performance hosting tailored for finance pros—so Quicken or QuickBooks is always at your fingertips. Let’s talk about how we can simplify your workflows and keep your data safe.

Practical Considerations

Cost:

Quicken is generally more affordable, with plans starting at $3.99 per month (billed annually).

In contrast, QuickBooks is more expensive, with plans starting at $35 per month, but offers more advanced business features.

Ease of Use:

Quicken is easier to set up and use for personal finance.

However, QuickBooks has a steeper learning curve but is more intuitive for business accounting tasks once mastered.

Scalability:

Quicken is limited to one user and basic business features.

Meanwhile, QuickBooks supports multiple users and scales with your business as it grows.

Transitioning Between Quicken and QuickBooks

If your business grows beyond the capabilities of Quicken, you may need to transition to QuickBooks. Indeed, many small business owners start with Quicken for its simplicity and affordability. Eventually, as their accounting needs become more complex, they move to QuickBooks to take advantage of its broader feature set.

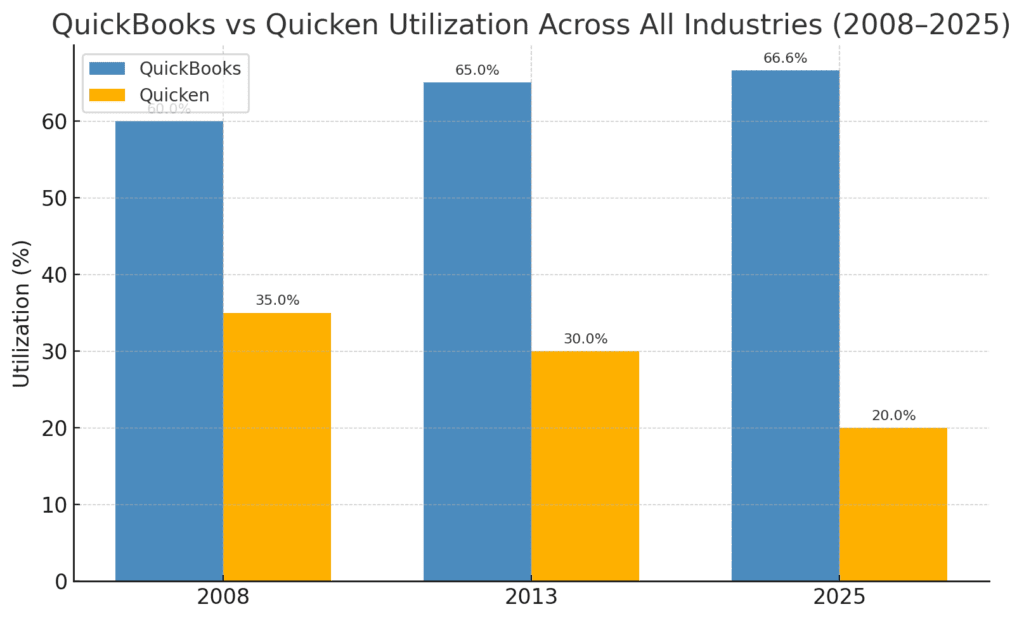

Here is the bar chart showing estimated utilization of QuickBooks and Quicken across all industries from 2008 to 2025. The data reflects QuickBooks’ growing dominance in both business and general finance sectors, while Quicken’s usage has declined due to limited business capabilities and the rise of modern finance tools.

Summary Table: Quicken vs. QuickBooks

| Aspect | Quicken | QuickBooks |

|---|---|---|

| Target Audience | Individuals, families, landlords | Small & medium businesses |

| Core Focus | Personal finance, small business | Business accounting |

| Pricing | $3.99–$10.99/month | $35–$235/month |

| Payroll | No | Yes |

| Inventory | No | Yes |

| Investment Tracking | Yes | No |

| Rental Property Tools | Yes | No |

| Cloud Access | Yes | Yes |

| Mobile App | Yes | Yes |

| Integration | Limited | Extensive |

| Number of Users | 1 | Up to 40 |

| Free Trial | 30-day money-back guarantee | 30-day free trial or 50% off 3 months |

Frequently Asked Questions (FAQ)

No, Quicken and QuickBooks are not the same. Quicken is designed for personal finance and very small businesses, while QuickBooks is built for small and medium-sized business accounting.

QuickBooks is owned by Intuit. Quicken was originally developed by Intuit but is now owned by Quicken Inc.

No, Quicken does not offer payroll features. QuickBooks does, either as an add-on or included in higher-tier plans.

Quicken is better for rental property management, offering tools to track leases, collect rent, and manage rental income and expenses.

While possible, QuickBooks is not designed for personal finance. Quicken is a better choice for individuals and families.

Quicken is generally less expensive, with plans starting at $3.99 per month. QuickBooks plans start at $35 per month.

Quicken allows only one user. QuickBooks supports multiple users, depending on the plan.

Quicken does not offer a free trial but has a 30-day money-back guarantee. QuickBooks offers a 30-day free trial or 50% off for the first three months.

Quicken Simplifi is a mobile-focused personal finance app that helps users track spending, create budgets, and manage their money on the go.

Quicken is generally easier to use for personal finance. QuickBooks is more intuitive for business accounting tasks but has a steeper learning curve.

Conclusion

Choosing between Quicken and QuickBooks comes down to what you need to track—and how far you plan to grow.

- Quicken shines for personal budgeting, landlords, and micro-businesses that only need basic income-and-expense tracking.

- QuickBooks is built for small and mid-sized companies that demand deeper features like payroll, inventory, and custom reporting.

By weighing these differences, you can pick the tool that streamlines your finances today and scales with tomorrow’s goals.

Read Also:

- QuickBooks Desktop FAQs: Guide to Resolving QuickBooks Queries

- Sage vs QuickBooks : Which Accounting Software Will Supercharge Your Firm?

- QuickBooks for Personal Use: A Guide to Simplify Your Finances

- QuickBooks Online vs QuickBooks Desktop: Which is Best for Your Accounting Needs?

- QuickBooks Online vs Desktop: Which Intuit Accounting Solution Is Best for Your Business?