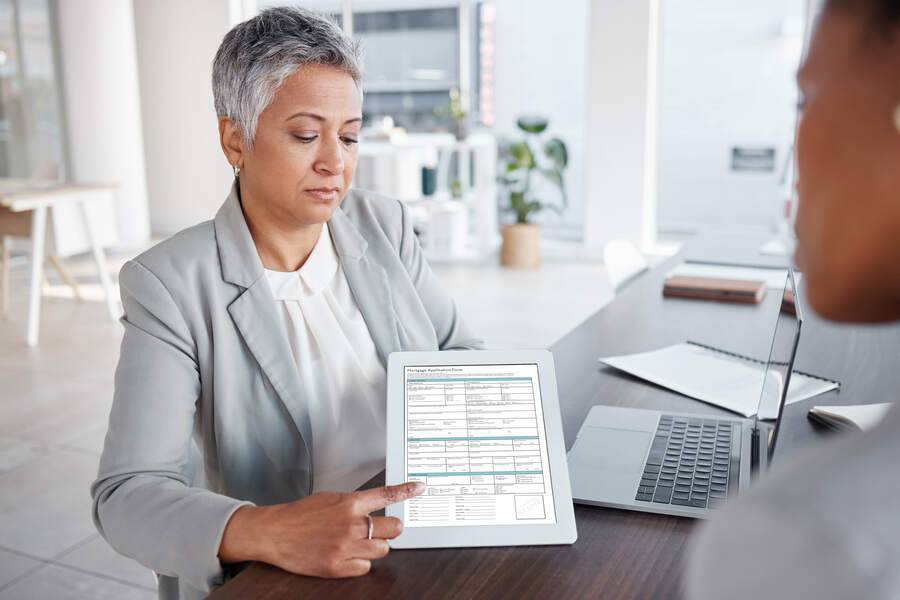

Manual data entry is the bane of every accountant’s existence—tedious, time-consuming, and prone to errors. But what if you could slash hours off tax prep while boosting accuracy? With Thomson Reuters UltraTax CS, automation takes the grunt work out of data entry, letting you focus on high-value tasks instead of repetitive keystrokes and simplify tax preparation work for accountants. In this blog, we’ll explore how UltraTax CS streamlines workflows, reduces manual effort, and helps accountants work smarter—not harder. Here’s how it accomplishes this:

Automated Data Import and Integration:

- UltraTax CS can import client data directly from accounting systems (such as QuickBooks), payroll software, and prior-year tax returns. This eliminates redundant manual entry and minimizes the risk of human error, allowing staff to focus on higher-value advisory work instead of data input.

Integration with the CS Professional Suite:

- The software seamlessly integrates with other Thomson Reuters products like Accounting CS and Practice CS. This interconnectedness ensures that financial data is consistent and up-to-date across all platforms, further reducing manual data transfers and the need for duplicate entries.

Customizable Templates and Defaults:

- Accountants can set default preferences for data entry, tailor print options, and create templates for recurring scenarios. These customizations streamline repetitive tasks and make the process faster and more consistent.

Automated Calculations and Error Checking:

- Thomson Reuters UltraTax CS handles complex calculations automatically and performs built-in error checks. This not only reduces the time spent on manual calculations and reviews but also helps prevent costly mistakes before filing and UltraTax CS simplifies tax work for accountants.

E-Filing and Digital Workflows:

- The software supports electronic filing (e-filing) for federal and state returns, as well as digital signatures. This eliminates the need for manual paperwork, printing, and mailing, speeding up the filing process and reducing administrative overhead.

Client Portals and Secure Data Sharing:

- With integrated client portals, accountants and clients can securely exchange documents and information. Clients can even input data directly into specific forms, further reducing the preparer’s workload.

Automated Reminders and Checklists:

- UltraTax CS allows for the creation of automated checklists and reminders for clients who have not yet submitted necessary information for tax preparation. This keeps the workflow moving efficiently and reduces the time spent on follow-ups.

By leveraging these features, UltraTax CS transforms tax preparation from a manual, error-prone process into a streamlined, automated workflow, advanced features enabling accountants to handle more clients with greater accuracy and less effort.

Read Also:

- QuickBooks Desktop FAQs: Guide to Resolving QuickBooks Queries

- UltraTax CS Tax Software Hosting on Cloud for Tax Professionals

- Why Should Your Business Choose UltraTax CS Hosting?

- Thomson Reuters UltraTax CS Cloud Hosting

- UltraTax Virtual Office CS Downtime Fixes: Key Strategies for Tax Professionals