Tax preparation can be complex and time-consuming, especially for CPA firms and tax professionals handling intricate returns. Lacerte tax software stands apart as a trusted, powerful solution designed by Intuit specifically for tax preparers, enrolled agents, and accounting firms requiring accuracy, speed, and compliance at scale. This guide provides a 360° view of Lacerte — its history, functionality, editions, pricing, pros and cons, integration options, tips for migration, and how it boosts firm efficiency.

Whether migrating from QuickBooks or other pro tax tools, considering cloud hosting for Lacerte, or evaluating alternatives, this pillar article arms tax firms with strategic insights and actionable resources to make the smartest decision. Ready to optimize your tax season? Explore below or book a tailored demo for your firm today.

What Is Lacerte Software? A History & Positioning

Developed by Intuit, the makers of QuickBooks and TurboTax, Lacerte software is a premium tax preparation tool crafted for professional tax preparers and accounting firms. Launched over 30 years ago, Lacerte has continually evolved to meet the demands of increasingly complex tax law and business structures. Its pedigree as an Intuit product assures robust integration with accounting solutions and continuous tax code updates.

Lacerte’s reputation is built on handling complex multi-entity tax returns, high-volume processing, and delivering rapid error-checking diagnostics to reduce costly mistakes. Unlike consumer tax tools, it is a market leader among CPAs, enrolled agents, and firm managers focused on scalability, compliance, and productivity.

How Lacerte Works — Core Modules Breakdown

Lacerte tax program offers a modular, workflow-driven design to streamline tax season tasks:

- Data Entry & Import

Input tax data manually or import client information directly from QuickBooks or other integrated systems, reducing manual entry errors. - Tax Forms & Returns Preparation

Covers 5,700+ federal, state, and local tax forms, automating calculations and compliance checks for individuals, corporations, partnerships, trusts, estates, and more. - E-filing

Supports electronic filing of federal and multi-state returns with built-in validation and submission tracking. - Client Organizer and Workflow

Efficient client portals for document sharing, secure communications, and collaboration through Intuit Link integration. - Return Review & Diagnostics

Advanced diagnostic engine flags missing information, calculation errors, and unusual deduction patterns to minimize errors before filing. - Reporting & Client Tax Plans

Generate customized tax savings reports and advisory plans directly from client returns to enhance client value and firm revenue.

These modules function seamlessly with either local desktop installation or cloud-hosted environments optimized for multi-user collaboration.

Installation, Access & Lacerte 2024 Download

Installing Lacerte software is straightforward:

- Sign in to your Lacerte account login portal on Intuit’s site.

- Download the Lacerte 2024 download installer or the silent updater for automated background updates.

- Follow prompts for recommended or custom installation configured for your firm’s modules and states.

- Import last year’s client prep files automatically using the built-in Proforma wizard.

- Manage access with multi-user role setups supporting firm scalability.

Lacerte supports Windows 10/11 and newer OS versions. Cloud hosting partners like OneUp Networks offer secure virtual desktop access that enhances mobility and disaster recovery.

Core Features & Benefits

- Tax Form Library: 5,700+ updated forms including complex entities and schedules.

- Multi-User Collaboration: Robust user management with simultaneous usage.

- Advanced Diagnostics: 25,000+ error checks across multiple returns.

- E-filing & Payment Integration: Supports federal/state e-filing plus QuickBooks Payment for electronic client payments.

- Client Portals & Data Import: Integrates with Intuit Link and QuickBooks for seamless client data sharing and importing.

- Built-in Time Tracking: Automatically tracks time on returns for efficient billing.

- Migration Utilities: Automatic conversion tools for importing data from ATX, Drake, or ProSeries to Lacerte.

- Security & Compliance: SOC 2 compliant with encryption for data security and backups, suitable for handling sensitive taxpayer info.

Integrations & Compatibility

- QuickBooks Integration: Direct import of accounting data.

- Document Management: Compatible with solutions like SmartVault for secure document storage.

- Cloud Hosting: Supported by OneUp Networks for efficient hosted Lacerte access and disaster recovery.

- Third-Party Practice Management: Syncs with Intuit Practice Management and Thomson Reuters tools to streamline workflows.

Lacerte Pricing & Licensing Overview

Lacerte offers multiple pricing models:

| Edition | Description | Price (Approx.) |

|---|---|---|

| Pay-per-return | Charge per individual return, good for low volumes | $499/year (starting) |

| Choice Plus | Bundles for 200+ returns with unlimited state filings | $636/year |

| Unlimited | Unlimited returns & multi-user access | $636/year |

| Remote Entry Processing (REP) Fees | Additional fees for returns prepared remotely | From $426 (varies) |

Prices vary by firm size and needs. Bulk and volume discounts apply. Contact Lacerte sales or OneUp Networks for custom quotes and demos.

Support & Resources

- Lacerte support number / customer service available via Intuit with live agent help.

- Knowledge base, training videos, and webinars provided by Intuit.

- Dedicated Lacerte phone number and email for technical and tax law updates.

- OneUp Networks offers enhanced Lacerte customer support, hosting, and migration assistance.

Security, Compliance & Data Handling

Lacerte ensures strong data protection with:

- SOC 2 certified hosting environments.

- Encryption in transit and at rest.

- Regular backups and disaster recovery protocols.

- In-product compliance updates aligning with IRS tax code changes.

Migration & Best Practices

Switching to Lacerte requires:

- Pre-migration audit of your existing tax data.

- Using Lacerte’s automatic data conversion utilities.

- Training staff with Lacerte onboarding resources.

- Testing returns in trial mode before full production.

- Leveraging OneUp Networks tax cloud hosting for smooth multi-user migration.

Case Study: A Mid-Size CPA Firm’s Success with Lacerte

A 12-user CPA firm transitioned from ProSeries to Lacerte with OneUp Networks hosting. Results included:

- 30% reduction in tax season processing time

- 60% fewer return errors due to advanced diagnostics

- Seamless remote access for mobile tax professionals

- Increased client satisfaction with customized tax planning reports

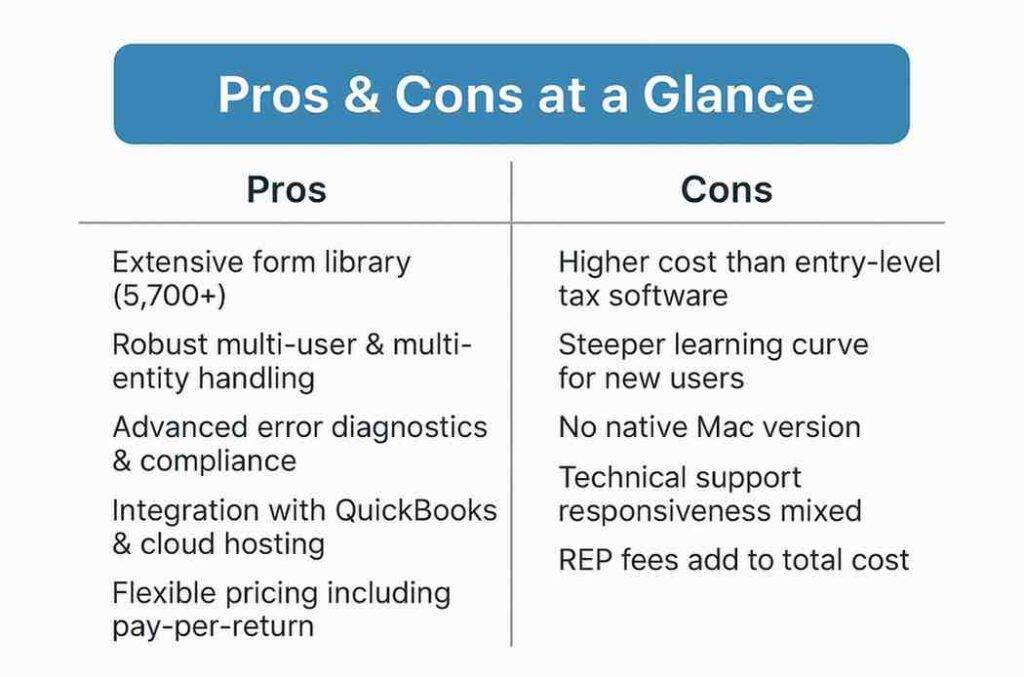

Pros & Cons on Lacerte Software

Lacerte software offers several advantages, including an extensive form library with over 5,700 forms, robust multi-user and multi-entity handling, advanced error diagnostics and compliance features, seamless integration with QuickBooks and cloud hosting, as well as flexible pricing options such as pay-per-return. However, it also has some drawbacks, including a higher cost compared to entry-level tax software, a steeper learning curve for new users, the absence of a native Mac version, mixed responsiveness in technical support, and additional REP fees that can increase the total cost.

Is Lacerte Right for Your Firm? Decision Checklist

- Handling complex or high volume tax returns?

- Need advanced diagnostics and error prevention?

- Require seamless integration with QuickBooks or cloud hosting?

- Ready to invest in premium, scalable tax software?

- Need multi-user access and remote work capabilities?

If yes, Lacerte is a strong candidate.

Lacerte vs Competitors Comparison Table

| Feature | Lacerte Tax Software | ProSeries Tax Software | UltraTax CS |

|---|---|---|---|

| Pricing | $499+ per year, pay-per-return & unlimited plans | $340+ with add-ons | Custom pricing, enterprise-level |

| Best For | Small-mid tax firms handling complex returns | Small to mid firms, simpler UI | Large firms, enterprise features |

| Tax Forms Supported | 5,700+ | 3,700+ | 7,500+ |

| E-file Limits | Unlimited | Limited | Unlimited |

| Integration | QuickBooks, Intuit, Document Mgmt | Limited | Multiple third-party integrations |

| Support Options | Phone, chat, training videos | Phone, training | Premium phone & onsite |

FAQs on Lacerte Software

Yes, Lacerte integrates seamlessly with QuickBooks, allowing tax preparers to import financial data and transactions directly to reduce manual data entry and improve accuracy.

Sign in to your Lacerte account on Intuit’s website, navigate to the Lacerte 2024 tile, and select “Download Product.” Follow installation prompts to complete setup.

Lacerte automates calculations, error checking, and e-filing tasks, covering thousands of tax forms. It streamlines workflows and improves accuracy for complex federal and state returns, saving time and reducing costly mistakes.

Yes, through cloud hosting providers like OneUp Networks, users can securely log in and operate Lacerte software remotely with multi-user support and disaster recovery features.

Absolutely. Lacerte supports filing for all 50 states and multiple local tax jurisdictions, ideal for firms handling clients with multi-state tax obligations.

Lacerte offers phone and chat support with dedicated tax software specialists, an extensive knowledge base, and community forums for peer assistance.

Conclusion

Lacerte tax software by Intuit remains a top choice for CPA firms, tax preparers, and accounting professionals who demand precision, comprehensive tax form support, and scalable multi-user capabilities. Its robust feature set—from advanced diagnostics to seamless QuickBooks integration—helps firms reduce errors, accelerate tax season workflows, and deliver enhanced client service. With flexible pricing options, including pay-per-return and unlimited packages, Lacerte accommodates practices both large and small.

Ready to Simplify Tax Season with Lacerte?

Don’t let complex returns, manual processes, or outdated tools slow your firm down. With Lacerte tax software, powered by Intuit and supported by OneUp Networks’ secure cloud hosting, your team can work smarter, faster, and more accurately—no matter where tax season takes you.

- Book a Free Demo to see how Lacerte can streamline your workflow.

- Schedule a Consultation with our experts to plan a seamless migration or hosting setup.

- Contact us for with reliable, compliant, and scalable tax software today.

Sources

Here are all the key sources used, each with a direct link as clickable anchor text:

- Lacerte Tax Software Overview (Intuit)

- Lacerte Software Packages and Pricing (Intuit)

- Lacerte 2024 Download and Installation Guide (Intuit Support)

- Lacerte System Requirements (Intuit Support)

- Lacerte Support, FAQs & Resources (Intuit)

- Lacerte Features and Benefits (Ace Cloud Hosting)

- Lacerte Hosting Services & Value-Add (CloudVara)

- Lacerte vs. ProSeries Comparison (Ace Cloud Hosting)

- Intuit Lacerte Tax Pricing (G2 Reviews)

- Lacerte Tax Software Explained (SalesTechScout)

These clickable links can be directly used as a reference list or pasted into your final content.

Also Read these Helpfull Blogs:

- What Accounting Firms Need to Know About Tax Software Hosting on Cloud?

- Facing Issues with Drake Tax Desktop Software? Find Answers To FAQs & Cloud Hosting Solutions

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- How Many Tax Returns Can Drake Software Handle?

- What Are The Benefits Of Using Drake Tax Software For Small Businesses?