Want to reduce your federal taxes legally? Understanding the State and Local Tax (SALT) deduction can help almost any taxpayer save money. The SALT deduction lets you deduct certain state and local taxes—like income, property, and sales taxes—from your federal taxable income if you itemize. With recent changes under the One Big Beautiful Bill Act (OBBBA) 2025, the SALT deduction has expanded, offering new opportunities to lower your tax bill. Whether you’re an individual, a small business owner, or simply someone who pays state and local taxes, this guide breaks down how the SALT deduction works, who qualifies, and practical strategies to maximize your savings.

With the State and Local Tax (SALT) deduction cap remaining a hot-button issue in 2025, understanding how to optimize this deduction is more critical than ever for accountants, SMB owners, and tax professionals.

Table of contents

- What Is the SALT Deduction?

- Historical Context and Legislative Changes of the SALT Deduction

- How the SALT Deduction Works in Practice

- Strategic Planning for SMBs and High-Income Taxpayers: Maximizing SALT Deduction Benefits

- Case Studies & Expert Commentary: Real-World SALT Savings

- State-by-State Impacts

- Future Outlook and Policy Considerations

- FAQs on STATE & LOCAL TAX

What Is the SALT Deduction?

The SALT deduction stands for State and Local Tax deduction. It is a provision in the U.S. federal tax code that allows taxpayers to deduct certain taxes paid to state and local governments from their federally taxable income, provided they choose to itemize deductions instead of taking the standard deduction. The goal is to prevent double taxation—paying taxes to both the state/local government and the federal government on the same income.

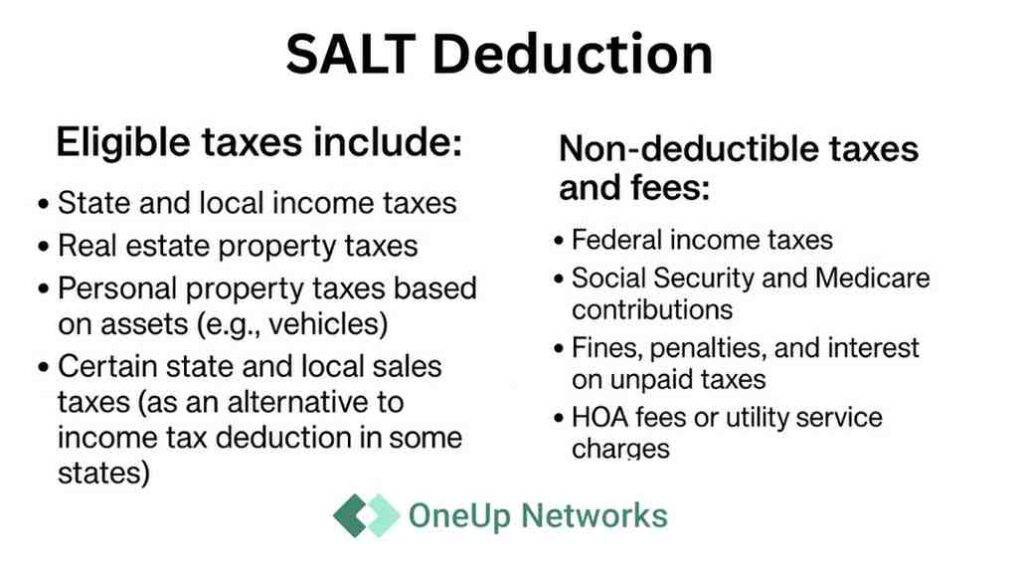

What Taxes Are Included :

The SALT deduction generally allows taxpayers to deduct:

- State and local income taxes – Taxes paid on wages, salaries, or other income.

- State and local property taxes – Real estate taxes on your home, and in some cases, taxes on personal property like cars.

- State and local sales taxes – Taxpayers can elect to deduct sales taxes instead of income taxes if it benefits them more.

Limits and Rules

- The Tax Cuts and Jobs Act (TCJA) of 2017 imposed a cap on the SALT deduction: $10,000 per year ($5,000 if married filing separately).

- The cap applies to the combined total of income, property, and other deductible state/local taxes.

- Only taxpayers who itemize deductions can claim the SALT deduction. Taxpayers taking the standard deduction cannot use it.

Why It Matters

- Reduces federal taxable income, which can lower your federal tax bill.

- Particularly beneficial for taxpayers in high-tax states like New York, California, and New Jersey.

- Impacts tax planning, including whether to prepay property taxes or time other deductible expenses.

Pro Tip: Keep detailed records of all state and local tax payments, for instance, using Cloud-based accounting solutions like QuickBooks, which make tracking SALT deductions simple and moreover accurate for Schedule A reporting.

Who Can Claim the SALT Deduction?

- Individuals filing Schedule A of Form 1040

- SMB owners and pass-through entities electing PTET (Pass-Through Entity Tax)

- Taxpayers in high-tax states whose itemized deductions exceed the standard deduction

Historical Context and Legislative Changes of the SALT Deduction

The State and Local Tax (SALT) deduction has long been a significant tax benefit for taxpayers who itemize, allowing them to deduct certain state and local taxes from their federal taxable income. However, its landscape has shifted notably over recent years due to major tax reform efforts.

Pre-2017: SALT Deduction Basics

Before 2017, taxpayers who itemized deductions on Schedule A of IRS Form 1040 could deduct unlimited amounts of state and local income, sales, and property taxes. This created substantial tax benefits, especially for taxpayers in states with high income and property taxes.

The Tax Cuts and Jobs Act (TCJA) of 2017

The TCJA, passed at the end of 2017, introduced a $10,000 cap on the SALT deduction for individuals and married filing jointly taxpayers. This was a landmark change aimed at limiting federal tax benefits for higher-income taxpayers in high-tax states like New York, California, and New Jersey.

Key legislative changes from TCJA:

- SALT deduction capped at $10,000 per tax year, regardless of the amount paid in state and local taxes.

- The cap applies to the total of state and local income, sales, and property taxes combined.

- This led to significant tax increases for many homeowners and high earners in states with heavy state and local taxation.

TCJA Developments and OBBBA 2025 Update

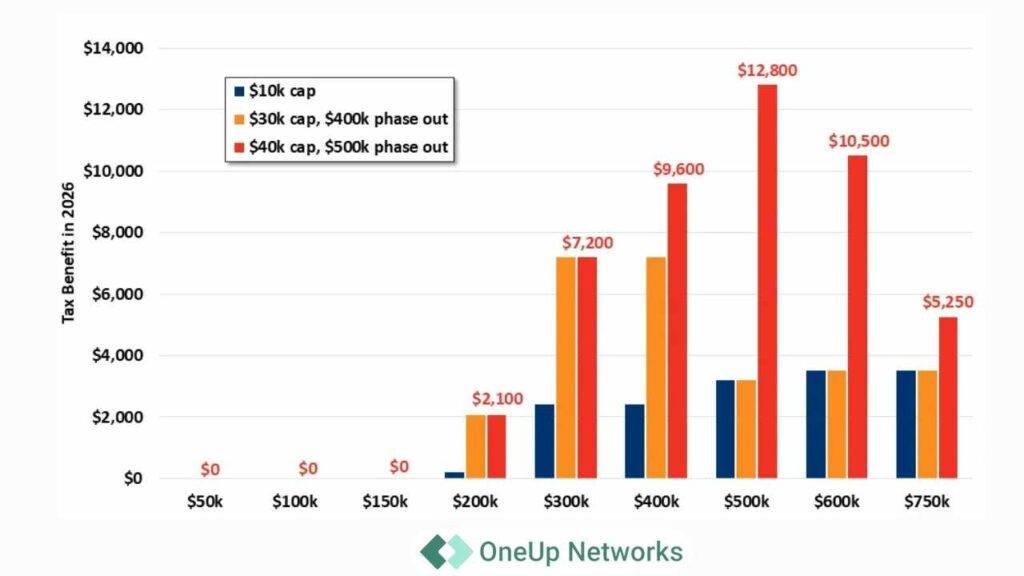

Since 2017, there has been continued debate and legislative efforts to modify or repeal the SALT cap, but major changes remained limited until the Omnibus Budget and Balanced Budget Act (OBBBA) updates around 2025:

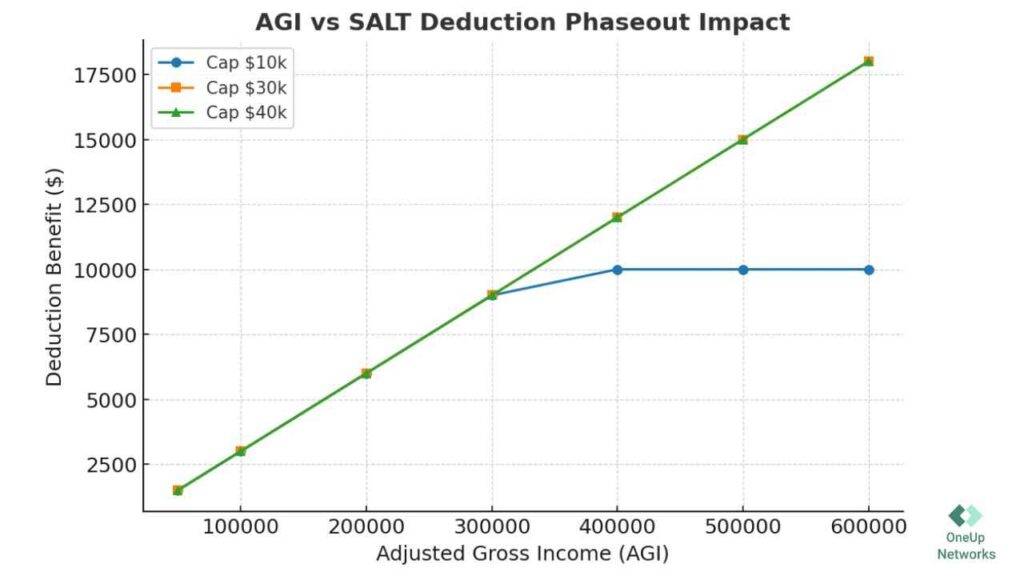

- The OBBBA introduced phaseout thresholds tied to Adjusted Gross Income (AGI), allowing a gradual reduction or modification of SALT caps for certain taxpayers.

- States increasingly adopted Pass-Through Entity Tax (PTET) elections, enabling businesses structured as partnerships or S-corporations to pay state taxes at the entity level, bypassing the cap for owners.

- Some slight increases or exceptions were allowed, especially for married filing separately statuses and specific taxpayer categories.

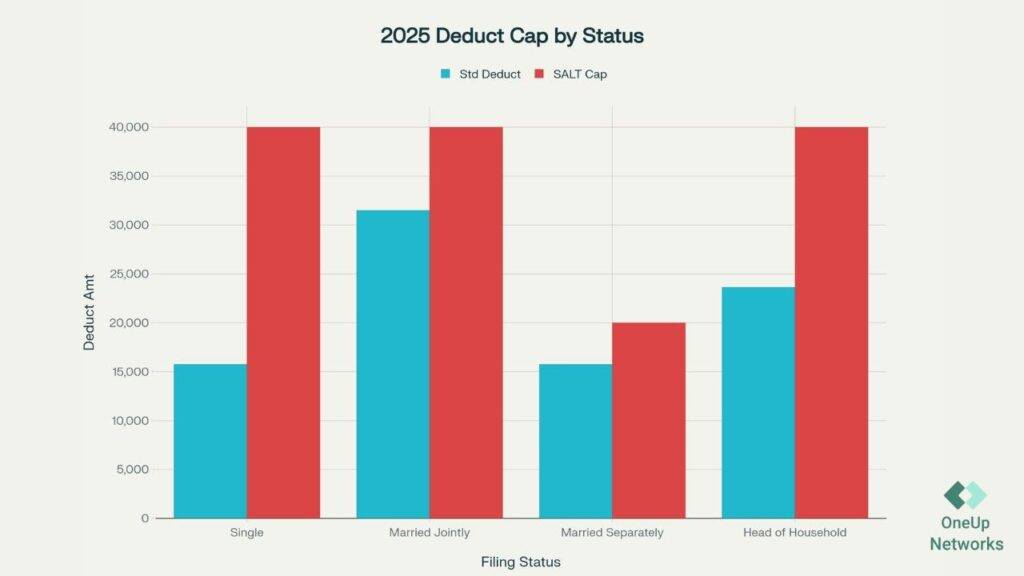

OBBBA 2025 (One Big Beautiful Bill Act)

- Raised the SALT deduction to $40,000 for individuals ($20,000 married filing separately) for 2025.

- Includes phase-down rules based on Modified Adjusted Gross Income (MAGI).

- Indexed increases: $40,400 in 2026, 1% incremental increases through 2029.

- PTET workaround still applies, allowing pass-through entities to bypass the cap.

- Future outlook: Returns to $10,000 cap in 2030 unless legislation changes.

Ongoing Legislative Proposals and Future Outlook

Efforts continue on Capitol Hill to:

- Raise or eliminate the SALT cap for middle-income taxpayers.

- Index the cap for inflation or link it to income levels for fairness.

- Provide more permanent and clear pass-through entity tax workarounds.

While no sweeping changes have been enacted in 2025, tax professionals and SMBs should stay alert to evolving policies that could reshape SALT deductions in the near future.

Legal Challenges

Several states—including New York, New Jersey, Connecticut, and Maryland—challenged the cap, claiming it was unconstitutional, and consequently courts upheld the cap, and in 2022 the Supreme Court declined to review the Second Circuit decision (New York v. Yellen), thus confirming the constitutionality of the SALT cap.

OBBBA : Expanded SALT Cap

The One Big Beautiful Bill Act of 2025 substantially increased the SALT deduction:

| Tax Year | SALT Cap (Individual) | SALT Cap (Married Filing Separately) | Notes |

|---|---|---|---|

| 2024 | $10,000 | $5,000 | TCJA cap |

| 2025 | $40,000 | $20,000 | OBBBA expansion, phasedown based on MAGI |

| 2026 | $40,400 | $20,200 | Cap indexed to 1% increase |

| 2027–2029 | Incremental 1% yearly | Incremental 1% yearly | Gradual phaseout adjustments |

| 2030 | $10,000 | $5,000 | Reverts to original TCJA cap |

MAGI Phaseout:

- Deduction begins phasing down for taxpayers with Modified Adjusted Gross Income (MAGI) above $500,000 (2025)

- Phaseout continues until capped at $10,000 for fully phased-out taxpayers

Pro Tip: Tax professionals should model SALT deduction impacts on high-income clients using accounting software, so as to anticipate phasedown effects.

How the SALT Deduction Works in Practice

Itemized vs. Standard Deduction

Taxpayers must decide whether itemizing deductions or taking the standard deduction is more beneficial.

| Filing Status | 2025 Standard Deduction | Typical SALT Paid (High-Tax States) | Benefit Comparison |

|---|---|---|---|

| Single | $14,700 | $18,000+ | Saves $3,300+ in taxable income |

| Married Filing Jointly | $29,400 | $35,000+ | Saves $5,600+ |

| Head of Household | $22,300 | $25,000+ | Saves $2,700+ |

Pro Tip: Combine SALT with mortgage interest as well as charitable contributions for optimal itemization benefits.

Calculating SALT Deduction

Example:

- State and local income taxes: $25,000

- Property taxes: $20,000

- Total taxes paid: $45,000

- SALT cap for 2025: $40,000

- Tax rate: 24%

- Tax savings: $40,000 × 24% = $9,600

Choosing Between Income and Sales Tax Deduction

- States with high income taxes: Income tax deduction is generally better

- States with high sales tax and low/no income tax: Sales tax deduction may be more advantageous

Strategic Planning for SMBs and High-Income Taxpayers: Maximizing SALT Deduction Benefits

For small business owners and high-income taxpayers facing the impact of SALT deduction limits, strategic tax planning is critical to minimize federal tax liabilities and optimize deductions. Here are key tactics and considerations tailored to these groups in 2025:

1. Utilize Pass-Through Entity Tax (PTET) Elections

Many states have introduced PTET elections allowing passthrough businesses (LLCs, S-Corps, Partnerships) to elect to pay state income tax at the entity level rather than the individual level. This:

- Converts personal SALT payments into a business expense, which is fully deductible on the federal return.

- Helps bypass the SALT cap on personal returns, beneficial for SMB owners and high earners with significant pass-through income.

- Requires careful compliance with state regulations and coordination with tax software like QuickBooks for accuracy.

2. Itemize Strategically with Other Deductions

Itemizing deductions beyond SALT can improve overall tax savings:

- Combine property taxes with mortgage interest and charitable contributions to exceed the standard deduction threshold.

- Plan timing of deductible expenses to maximize itemized deductions within a tax year.

- Leverage tax software to model different scenarios and identify the optimal mix of deductions.

3. Income Timing and AGI Management

Since SALT deduction phases out at higher AGI levels, controlling AGI can preserve SALT benefits:

- Use retirement plan contributions and health savings accounts (HSAs) to reduce taxable income.

- Consider deferring income or accelerating deductible expenses where possible to manage AGI thresholds.

- Review tax planning regularly throughout the year to adapt to income changes.

4. Leverage State-Specific Tax Incentives and Credits

Stay informed on state tax credits and incentives that can reduce overall state tax liability, indirectly mitigating SALT deductions’ impact.

5. Use Advanced Accounting and Tax Software Tools

- Integrate CPA-grade tax planning tools with QuickBooks and hosted accounting solutions to track SALT payments, model tax outcomes, and maintain compliance.

- Regular software-driven forecasting enables proactive adjustments and smart planning.

Expert Insight:

“Taxpayers and SMBs who actively engage in SALT planning, particularly through PTET elections and income management, can unlock substantial federal tax savings despite the SALT cap,” says tax strategist Laura Benson, CPA.

By combining these strategies, SMBs and high-income taxpayers can reduce the bite of SALT limitations, improve cash flow, and achieve better tax outcomes in 2025 and beyond.

Case Studies & Expert Commentary: Real-World SALT Savings

1: SMB Owner in New York

Susan owns an LLC with $1.2 million in revenue and pays $50,000 in state and local taxes annually. Using the PTET election, Susan’s LLC pays $40,000 directly to New York, reducing her personal SALT deduction exposure and allowing her to maximize itemized deductions on her return.

Expert insight: “PTET elections can be game-changers for pass-through business owners trapped by the SALT cap,” says CPA John Matthews, tax consultant with 25 years of SMB tax strategy experience.

2: Accountant Advises High-Tax State Client

David, a tax professional in New Jersey, uses tax planning software integrated with QuickBooks to model scenarios for clients. By maximizing real estate tax payments planned within tax year limits and leveraging charitable contributions, he helps clients reduce effective tax burdens despite the SALT limitation.v

State-by-State Impacts

| State | Avg SALT Paid (2025) | PTET Available? | Cap Impact |

|---|---|---|---|

| California | $18,000 | Yes | High |

| New York | $15,000 | Yes | High |

| New Jersey | $12,500 | Yes | High |

| Texas | $8,000 | No | Low |

| Florida | $6,000 | No | Low |

Future Outlook and Policy Considerations

- Legislative proposals may increase or permanently expand the SALT cap through 2029, and moreover indexing the cap to inflation or AGI thresholds could benefit middle-income taxpayers.

- Indexing the cap to inflation or AGI thresholds could benefit middle-income taxpayers, therefore helping clients plan more effectively.

- PTET expansions may continue in high-tax states, and as a result accountants should stay informed via IRS guidance, state tax bulletins, and congressional updates.

- Accountants should stay informed via IRS guidance, state tax bulletins, and congressional updates, so that they can proactively advise clients on potential SALT impacts.

Strategic Tip: Proactively modeling SALT deductions with future legislative scenarios ensures clients are prepared for changes.

FAQs on STATE & LOCAL TAX

$40,000 for individuals, $20,000 for married filing separately; phasedown applies for high MAGI.

Taxes paid at the entity level bypass individual SALT limitations, preserving full deduction value.

High-income taxpayers in high-tax states; SMB owners using pass-through entities.

Compare total itemized deductions (SALT, mortgage, charitable contributions) to the standard deduction.

Automatically records state/local payments, applies PTET elections, and generates reports for Schedule A.

Conclusion

Mastering the SALT deduction in 2025 requires a combination of legislative knowledge, strategic planning, and moreover workflow efficiency. By leveraging PTET elections, prepaying taxes strategically, as well as using cloud accounting platforms like QuickBooks, accountants and SMBs can save thousands annually.

Optimize your SALT workflow—explore QuickBooks Cloud and hosted accounting solutions in order to simplify deduction tracking, ensure compliance, and consequently maximize tax savings for 2025.

Empower Your Business with OneUp Networks

At OneUp Networks, we provide secure, reliable, and scalable cloud hosting solutions designed to help businesses, accounting firms, and professionals work smarter, collaborate seamlessly, and access critical applications anytime, anywhere. Whether you’re managing day-to-day operations, optimizing workflows, or scaling your business for growth, our infrastructure ensures your technology keeps pace with your ambitions. We offer hosting for QuickBooks, Thomson Reuters software, and other critical accounting and productivity tools, giving you centralized, secure access without sacrificing performance or compliance.

Take Action Today:

- Explore Our Hosting Solutions: Secure remote access for QuickBooks, Thomson Reuters, and other essential business software.

- Schedule a Consultation: Learn how OneUp Networks can optimize your accounting and workflow operations.

- Chat with Our Experts: Get real-time guidance on cloud hosting for QuickBooks, Thomson Reuters platforms, and business productivity tools.

- Get Started Now: Experience secure, flexible, and future-ready cloud infrastructure that scales with your business.

Also Read these Helpful Blogs: