Are You Confused About 1099-MISC vs 1099-NEC? Here’s What You Must Know. Form 1099-MISC and Form 1099-NEC are essential for accurate tax reporting, yet their differences often puzzle accountants, business owners, and freelancers. This guide clears up confusion by breaking down each form’s purpose, filing requirements, deadlines, and common usage scenarios with facts directly from the IRS. By the end, you’ll effortlessly know which form to file—avoiding costly mistakes and penalties during the 2026 tax season and beyond.

What Is IRS Form 1099-MISC?

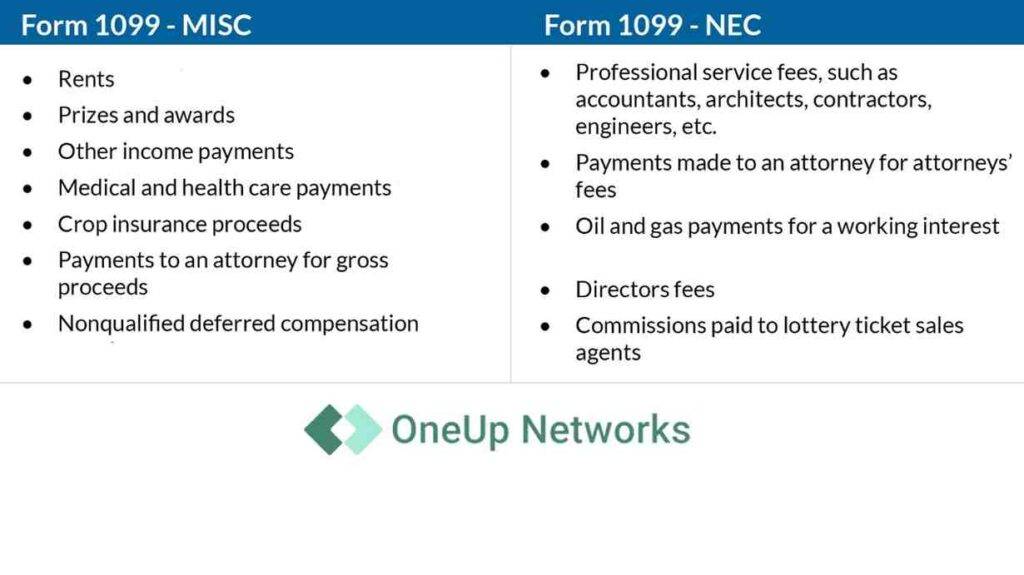

Form 1099-MISC reports various miscellaneous payments that are not considered nonemployee compensation. Initially, it included contractor payments, but since 2020, its scope is more specific. It covers payments such as:

- Rent payments (office space, equipment leasing)

- Royalties ($10 or more)

- Prizes and awards (not for services)

- Medical and health care payments

- Crop insurance proceeds

- Payments to attorneys for services or sometimes legal settlements

- Fishing boat proceeds

- Other miscellaneous income of $600 or more

Note: Payments reported on 1099-MISC generally do not incur self-employment tax.

Reference: IRS Instructions for Form 1099-MISC (2023), available on IRS.gov

What Is IRS Form 1099-NEC?

Reintroduced by the IRS starting tax year 2020, Form 1099-NEC is explicitly for reporting nonemployee compensation—payments of $600 or more for services rendered by independent contractors, freelancers, consultants, and other nonemployees. Previously, these payments appeared in Box 7 of 1099-MISC.

Payments reported include:

- Fees to independent contractors or freelancers

- Consulting fees

- Commissions to nonemployee salespeople

- Legal fees paid to attorneys (for services)

- Honorariums, guest lecturer fees, commissions

Important: Nonemployee compensations reported on 1099-NEC are subject to self-employment tax.

Reference: IRS Instructions for Form 1099-NEC (2023), IRS.gov

Comparison: 1099-MISC vs 1099-NEC

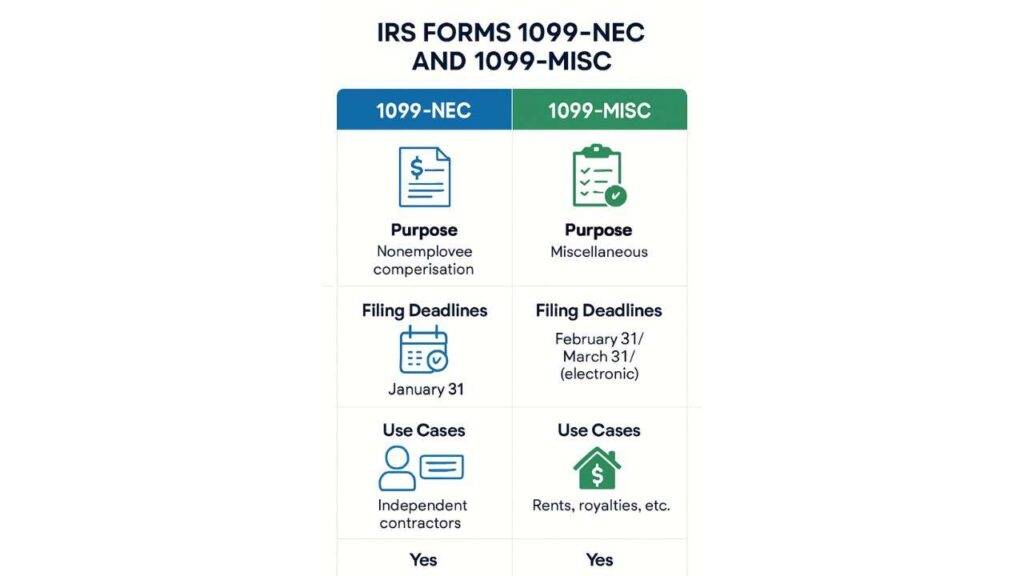

To clearly understand the key distinctions between Form 1099-MISC and Form 1099-NEC, review the following side-by-side breakdown highlighting their main features, filing requirements, and usage.

| Criteria | 1099-MISC | 1099-NEC |

|---|---|---|

| Purpose | Reports miscellaneous income (rent, royalties, prizes) | Reports payments for contract work and services |

| Who Receives It | Landlords, prize winners, medical providers, some attorneys | Independent contractors, freelancers, consultants |

| Common Use Cases | Rent, royalties, awards, medical payments, legal settlements | Freelance projects, consulting fees, commissions |

| Filing Threshold | $600 or more (except royalties $10+) | $600 or more (increasing to $2,000 in 2026) |

| IRS Filing Deadline | Recipient by Jan 31; IRS by Feb 28 (paper) or Mar 31 (e-file) | Both recipient and IRS by Jan 31 (no extensions) |

| Tax Treatment | Generally not subject to self-employment tax | Subject to self-employment tax |

| Backup Withholding | Applies | Applies |

| Penalties | $50-$290 per form (2025 IRS rates) | Same, strict Jan 31 deadline, no extensions |

| Notes | Captures all miscellaneous except services | Replaces old Box 7 of 1099-MISC for nonemployee payment |

When Should I Use 1099-MISC Instead of 1099-NEC?

- Use 1099-MISC for payments not related to services, like rent, royalties, awards, and healthcare payments.

- Use 1099-NEC to report $600+ payments made for services to nonemployees, including independent contractors and freelancers.

Examples:

- Paying $1,500 rent → 1099-MISC

- Paying a freelance web designer $2,000 → 1099-NEC

- Paying attorney $1,200 for services → 1099-NEC

- Paying $700 for medical services → 1099-MISC

Important Filing Deadlines for Tax Year 2025 (Filing in 2026)

Timely filing is critical to avoid IRS penalties. The table below summarizes important recipient and IRS filing deadlines for Forms 1099-NEC and 1099-MISC for the 2024 tax year.

Be aware of these IRS deadlines for timely submission and to avoid penalties:

| Form | Recipient Copy Due | IRS Filing Deadline | Notes |

|---|---|---|---|

| 1099-NEC | Jan 31, 2026 | Jan 31, 2026 (no extension) | Strict deadline, both paper & electronic filings due same day |

| 1099-MISC | Jan 31, 2026 | Feb 28, 2026 (paper) Mar 31, 2026 (e-file) | Deadlines shift to next business day if weekend/holiday |

State Filing: Laws vary; many states require filings aligned with the federal due dates. Verify your state’s requirements for accurate compliance.

IRS Penalties for Late or Incorrect Filing — Updated for 2026

Failing to file accurate 1099 forms on time can lead to substantial penalties. The following table outlines the current IRS penalty structure based on the lateness and severity of filing errors.

| Filing Date | Penalty per Form (Small Business) | Maximum Annual Penalty |

|---|---|---|

| Filed within 30 days after deadline | $60 | $664,500 |

| Filed 31 days to August 1 late | $130 | $1,993,500 |

| Filed after August 1 or not filed | $330 | $3,987,000 |

| Intentional disregard of filing requirements | $660 (no max) | No Maximum |

Note: These updated penalties reflect the current IRS publication rates effective for tax year 2024 filings (2026 submission). Always consult IRS.gov for confirmations before filing.

Practical Tips to Avoid Costly 1099 Mistakes

- Identify payment types clearly. Categorize payments as services (NEC) or miscellaneous (MISC) early.

- Collect Form W-9 from payees at the beginning of the calendar year or contract.

- File all 1099-NEC forms promptly by January 31.

- Leverage electronic filing: Required if filing 10+ forms, reduces processing time, and minimizes errors.

- Use IRS TIN Match service or authorized software to prevent rejections.

- Track both federal and applicable state deadlines carefully.

- Update filing workflows yearly—IRS rules and thresholds can change.

- Retain copies of forms and payment records for at least 3 to 4 years as per IRS retention requirements.

- Integrate cloud-based filing software like OneUp Networks for secure, compliant, and efficient management of filings.

FAQs Related 1099-MISC vs. 1099-NEC

1099-NEC reports payments made to independent contractors for services, while 1099-MISC covers other miscellaneous payments like rent, prizes, and royalties.

If you’re reporting rent, awards, royalties, or similar payments, 1099-MISC is the right form. Contractor payments belong on 1099-NEC.

1099-NEC is due to recipients and the IRS by January 31. 1099-MISC recipient copies are also due by January 31, but IRS filing deadlines differ by filing method: February 28 for paper and March 31 for electronic filing.

Independent contractors, freelancers, and self-employed workers paid $600 or more in a year.

Penalties range from $60 to $660 per form based on how late they are and increase for intentional disregard.

If you file 10 or more 1099 forms, the IRS requires electronic filing starting with the 2024 tax year.

Examples include 1099-MISC (miscellaneous income), 1099-NEC (nonemployee compensation), and 1099-R (retirement distributions).

Submit a corrected form to the IRS and recipient as soon as you discover the error.

Conclusion

Understanding the difference between 1099-NEC vs 1099-MISC is crucial for accurate tax reporting. Correctly filing these forms on time not only ensures IRS compliance but also avoids costly penalties. Whether you’re an accountant, small business owner, or freelancer, knowing when and how to use each form will save time and stress every tax season.

For seamless, secure cloud hosting and managed accounting solutions designed specifically for finance teams, trust OneUp Networks. Their expert infrastructure safeguards your sensitive data and streamlines compliance so you can focus on growing your business.

Get started with OneUp Networks today— Try for Free and discover how we make secure accounting easy and reliable.

Don’t Miss These Helpful Blogs:

- 1099 Tax Tips Every Independent Worker Needs to Know

- All About Tax Season: What to Expect in 2025 and How to Prepare?

- Why Is UltraTax Downtime a Critical Issue for Tax Firms?

- Mastering Tax Season 2025: A Comprehensive Guide

- Which integrations are most popular among QuickBooks users?