Cloud technology is transforming the accounting and finance industry, offering unprecedented flexibility, security, and efficiency. In fact, Gartner predicts that by 2028, cloud computing will shift from being a technology disruptor to a business necessity, with more than 50% of enterprises using industry cloud platforms to accelerate their business initiatives. For firms relying on Thomson Reuters UltraTax CS, migrating to the cloud is not just a trend—it’s a strategic move to future-proof your practice. This guide will walk you through every step of moving UltraTax CS to the cloud, explain the benefits in detail, cloud cost savings and highlight how OneUp Networks can make your transition seamless and stress-free.

Table of Contents

- What Is UltraTax CS and Why Move It to the Cloud?

- Key Reasons to Migrate UltraTax CS to the Cloud

- Step-by-Step Guide: How to Move UltraTax CS to the Cloud

- What Features of UltraTax CS Are Enhanced in the Cloud?

- Real-World Benefits: Facts and Figures

- Case Study: A Mid-Sized Accounting Firm’s Cloud Journey

- Frequently Asked Questions (FAQs) on UltraTax CS Migration:

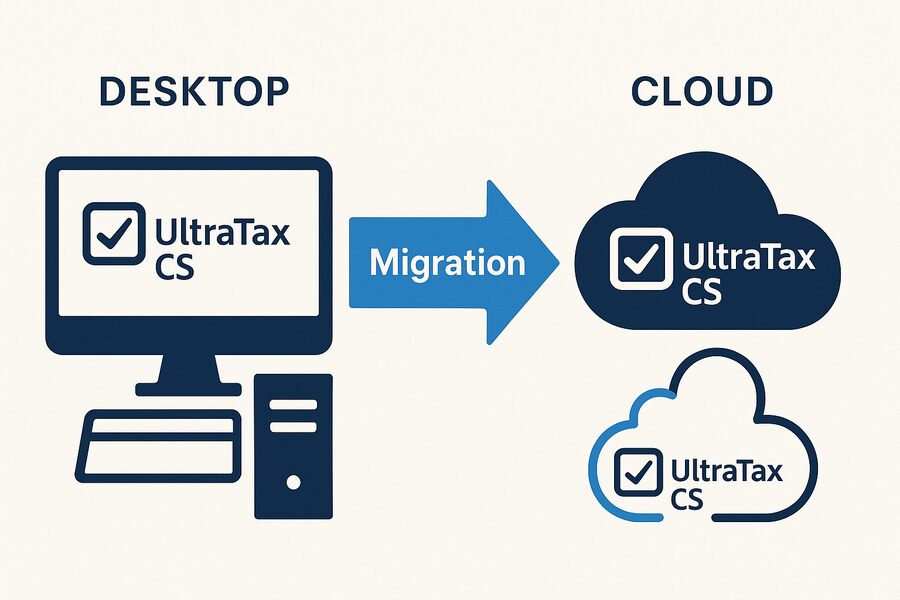

What Is UltraTax CS and Why Move It to the Cloud?

UltraTax CS is a leading tax preparation and compliance software used by accounting and finance professionals to manage federal, state, and local tax filings for individuals, corporations, partnerships, and trusts. It offers intelligent calculations, workflow optimization, advanced diagnostics, and seamless data sharing—making it a powerhouse for tax professionals.

Cloud hosting means running UltraTax CS on secure, remote servers rather than on local computers or office networks. This shift enables your team to access all features and client data from anywhere, at any time, using any device with an internet connection.

Key Reasons to Migrate UltraTax CS to the Cloud

- Enhanced Accessibility: Work from home, client sites, or while traveling—without losing access to critical data or software.

- Multi-User Collaboration: Multiple team members can work on the same files simultaneously, reducing bottlenecks and improving productivity.

- Scalability: Easily adjust your computing resources to match peak tax season demands, paying only for what you use.

- Robust Security: Advanced encryption, regular backups, and compliance with industry standards like HIPAA and PCI DSS protect sensitive client data.

- Business Continuity: Automated backups and disaster recovery ensure your firm can keep running, even in the event of hardware failure or natural disaster.

- Cost Efficiency: Reduce upfront hardware investments and ongoing IT maintenance costs by leveraging a pay-as-you-go model.

Step-by-Step Guide: How to Move UltraTax CS to the Cloud

1. Assess Your Current Setup

- Inventory Your Data: List all client files, workpapers, and custom settings currently stored on your local or network drives.

- Identify User Needs: Determine which team members need access and what permissions they require.

2. Choose a Cloud Hosting Provider

Select a cloud hosting provider like OneUp Networks, known for expertise in hosting tax and accounting software. Look for:

- High uptime guarantees (99.99%)

- Advanced security measures

- 24/7 expert support

- Seamless migration services

3. Plan Your Migration

- Schedule Migration: Choose a time with minimal disruption—outside of peak tax season if possible.

- Backup All Data: Ensure all UltraTax CS data is securely backed up before migration.

- Communicate with Your Team: Inform everyone about the upcoming changes and provide training if needed.

4. Migrate Your Data

- Data Transfer: Your hosting provider will securely transfer your UltraTax CS data from your local or network drive to the cloud environment.

- Testing: Verify that all files, settings, and integrations (e.g., with other CS Professional Suite applications) work as expected in the cloud.

- User Setup: Configure user accounts, roles, and permissions to match your firm’s workflow34.

5. Train Your Team

- Onboarding: Provide training sessions to ensure your team is comfortable with the new cloud-based workflow.

- Support: Offer ongoing support to address any questions or issues as your team adapts.

6. Go Live and Optimize

- Switch Over: Once all data is migrated and tested, make the cloud environment your primary workspace.

- Monitor Performance: Regularly check system performance and user feedback to identify opportunities for improvement.

What Features of UltraTax CS Are Enhanced in the Cloud?

Migrating UltraTax CS to the cloud doesn’t just preserve its powerful features—it amplifies them. Here’s how:

| Feature | On-Premise/Desktop | Cloud-Hosted with OneUp Networks | Example/Explanation |

|---|---|---|---|

| Accessibility | Limited to office | Anywhere, anytime, any device | Work remotely or from client sites with ease |

| Collaboration | Manual file sharing | Real-time, multi-user collaboration | Multiple preparers work on the same return at once3 |

| Data Security | Varies | Bank-level encryption, regular backups | Sensitive client data is always protected |

| Scalability | Fixed | Dynamic resource allocation | Scale up for tax season, scale down afterward |

| Uptime | Depends on IT | 99.99% uptime guarantee | No downtime during critical periods |

| Maintenance | Manual | Automatic updates and proactive support | No need to manage software updates yourself |

| Disaster Recovery | Manual backup | Automated, redundant backups | Quick recovery from hardware failure or disaster |

Example: During tax season, your team can collaborate on client returns in real time, even if some members are working from home or traveling. Automatic updates ensure you always have the latest tax forms and compliance rules, while robust security safeguards sensitive financial data.

How OneUp Networks Makes Your Migration Effortless

OneUp Networks specializes in cloud hosting for UltraTax CS, offering a solution tailored to the unique needs of accounting and finance professionals. Here’s what sets us apart:

Free Migration:

- Our experts handle the entire migration process at no extra cost, ensuring minimal disruption and maximum data integrity.

24/7 Expert Support:

- Our team is always available to assist with technical issues or questions, so you never face downtime or frustration.

Advanced Infrastructure:

- We use high-performance SSD-based servers and SSAE-16-certified data centers for unmatched speed, reliability, and security.

Automatic Backups:

- Your data is backed up regularly and stored for extended periods, so you’re always protected.

No Downtime, No Pain:

- With a 99.99% uptime guarantee, you can trust that your UltraTax CS environment will be available whenever you need it.

Seamless Integration:

- Our cloud environment supports all UltraTax CS features and integrates smoothly with other CS Professional Suite applications.

Flexible Pricing:

- Choose monthly or annual billing to match your budget and business needs.

Contact OneUp Networks today for a free consultation and experience a seamless, secure, and stress-free migration. Your future in the cloud starts here.

Real-World Benefits: Facts and Figures

- Cloud Adoption: Worldwide end-user spending on public cloud services is forecast to total $679 billion in 2024 and exceed $1 trillion by 2027.

- Productivity Gains: Accounting firms using cloud solutions report significant time savings, with automation reducing manual data entry and IT maintenance.

- Security: Cloud hosting providers like OneUp Networks use advanced encryption and compliance protocols to protect sensitive financial data, reducing the risk of breaches.

- Cost Savings: Moving to the cloud eliminates the need for expensive on-premise hardware and reduces IT labor costs, offering a clear return on investment.

Case Study: A Mid-Sized Accounting Firm’s Cloud Journey

Consider a mid-sized accounting firm with 15 staff members. Before migrating to the cloud, they faced challenges with remote work, data security, and collaboration during tax season. After partnering with OneUp Networks for UltraTax CS hosting, they:

- Enabled remote work for all staff, improving work-life balance and client service.

- Collaborated in real time on complex tax returns, reducing errors and speeding up turnaround times.

- Automated backups and updates, eliminating the risk of data loss and ensuring compliance with the latest tax laws.

- Scaled resources during peak periods, avoiding costly hardware upgrades.

- Cost Savings of up to 60% with OneUp Networks by claiming for Switch & Save to Cloud Offer.

Frequently Asked Questions (FAQs) on UltraTax CS Migration:

Yes, cloud hosting providers like OneUp Networks use advanced encryption, regular backups, and compliance with industry standards to keep your data safe.

Absolutely. With cloud hosting, your team can access UltraTax CS from any device with an internet connection, enabling seamless remote work and collaboration. Also, you can host all other applications which comes under Thomson Reuters CS Professional Suite

Cloud hosting includes automated, redundant backups and disaster recovery plans, so your data is protected and your business can continue without interruption.

No. All UltraTax CS features remain intact, and many are enhanced by the cloud environment, such as real-time collaboration and automatic updates.

OneUp Networks offers free migration, 24/7 expert support, and a seamless transition process to ensure your move to the cloud is smooth and worry-free.

Conclusion

Migrating UltraTax CS to the cloud is a strategic move for any accounting or finance firm looking to enhance productivity, security, and flexibility. With OneUp Networks, you get a trusted partner that handles every aspect of your migration, cloud cost savings from free data transfer to ongoing support and robust infrastructure. Experience the future of tax preparation today — Contact OneUp Networks to start your cloud journey.

Read Also: