Filing taxes as a self-employed person isn’t the same as being a W2 employee. There’s no employer to withhold taxes, handle deductions, or manage your paperwork. But with the right 1099 tax tips, you can take full control of your finances, reduce your tax burden, and avoid IRS penalties. Whether you’re a gig worker, consultant, or side hustler, this guide covers everything you need to stay compliant and save money, including:

- How 1099 taxes actually work

- What write-offs you can legally claim

- How to file without stress

- Smart planning strategies that can save you thousands

Let’s turn tax season from stressful to strategic.tegic.

Table of contents

Why 1099 Taxes Matter More Than You Think

As a self-employed person, you’re not just paying income tax—you also owe self-employment tax, which covers Social Security and Medicare.

If you don’t plan for this, you could face surprise bills or penalties. But if you do it right, you’ll gain something most employees never get: full control over your money.

What Is a 1099 Tax Return?

If you earned money as a freelancer, contractor, or gig worker, the IRS sees you as self-employed. You likely received a Form 1099-NEC (nonemployee compensation) or 1099-MISC. You’ll report this income on your personal return, typically using Schedule C (profit and loss) and Schedule SE (self-employment tax).

Don’t Miss This: Worker Classification and W-9 Forms

If you pay contractors yourself, make sure they fill out Form W-9 before work starts. It ensures you have their correct info to file 1099-NEC forms if you pay them $600 or more during the year. Misclassifying someone can lead to big IRS fines, so get this part right.

Understanding How You’re Taxed: Key 1099 Tax Tips

You’re responsible for paying:

- Self-employment tax: 15.3% (12.4% Social Security + 2.9% Medicare)

- Federal income tax

- State income tax (if your state charges it)

Example:

Earn $50,000 and write off $10,000 in expenses? You’re taxed on $40,000, not the full amount.

Pro Tip: Want help staying on top of taxes year-round?

Get access to smart tools, personalized tax planning, and 1099 resources tailored to freelancers and entrepreneurs.

Join OneUp Networks today and simplify your self-employed finances.

Do I Need to Pay Estimated Taxes?

Yes. If you expect to owe $1,000 or more in taxes for the year, you’re required to make quarterly estimated payments:

- Q1: April 15

- Q2: June 15

- Q3: September 15

- Q4: January 15 (of the following year)

Paying quarterly avoids interest and penalties. Set reminders—you’ll thank yourself later.

How Much Should I Set Aside for Taxes?

A good rule of thumb: save 25% to 30% of your net income (after deductions) for taxes.

Estimated savings at different income levels:

- $30,000 income = Save $7,500 to $9,000

- $50,000 income = Save $12,500 to $15,000

- $80,000 income = Save $20,000 to $24,000

1099 Tax Deductions: The Best Write-Offs for Contractors

These are the big ones—and they’re 100% legit:

- Home office (a portion of rent, mortgage, utilities)

- Vehicle expenses (either mileage or actual costs)

- Supplies and tools (laptops, software, office items)

- Professional services (accounting, legal, contractors)

- Marketing (ads, social media tools, website)

- Phone & internet (for business use)

- Health insurance premiums (if you’re self-employed)

- Retirement contributions (like SEP IRAs or Solo 401(k)s)

Pro tip: Use apps like QuickBooks or FreshBooks to track all of this automatically.

Understanding 1099 Forms

Here’s a quick breakdown:

- 1099-NEC: You earned money as a contractor or freelancer

- 1099-MISC: You received other income (rent, prizes, royalties)

- 1099-G: You got unemployment or a state tax refund

Before you pay others, always collect a W-9—and make sure you send out 1099s by January 31 if you paid anyone over $600.

How to File 1099s for Contractors

If you’re a business owner who hired contractors, you’re required to send Form 1099-NEC to any nonemployee you paid $600 or more. You also have to file those forms with the IRS.

You can use platforms like:

- QuickBooks

- Tax1099

- Gusto

- Or even file directly through the IRS FIRE system

Note: If you’re submitting more than 10 forms, you must e-file.

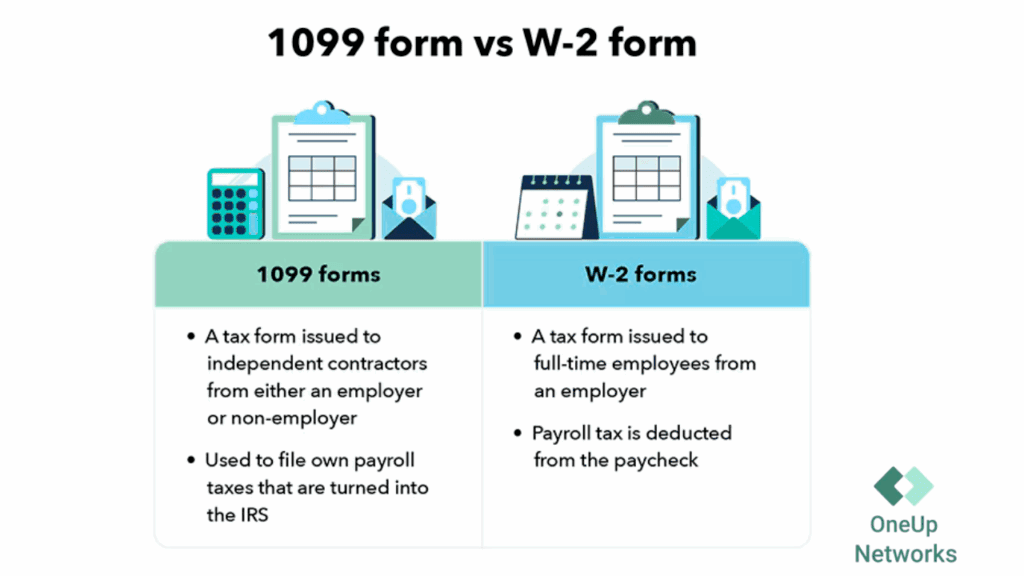

1099 vs W2: What’s the Real Difference?

| Feature | 1099 Worker | W2 Employee |

|---|---|---|

| Taxes withheld? | No | Yes |

| Benefits provided? | Usually no | Often yes |

| Business deductions? | Yes | Limited |

| Pay estimated taxes? | Yes | No |

Tax-Saving Strategies That Actually Work

- Track everything — Save every business-related receipt

- Use the home office deduction — Even a corner of your room counts

- Contribute to retirement — SEP IRAs and Solo 401(k)s reduce taxable income

- Pay quarterly estimates — Avoid late fees

- Work with a pro — Especially if your income is growing or complex

Example:

If you’re a designer earning $80,000 and contribute $15,000 to a SEP IRA while claiming legitimate business expenses, you could reduce your taxable income by over $25,000.

Real-Life Freelancer Success

Meet Jordan, a freelance developer:

Jordan made $60,000 last year. By keeping excellent records, claiming the home office deduction, and contributing to a retirement account, Jordan saved over $4,500 in taxes. “I used to dread tax time,” Jordan says. “Now it’s just part of running my business smartly.”

1099 Tax Myths You Should Ignore

Myth: “I don’t need to pay taxes until the end of the year.”

Truth: You must pay estimated taxes quarterly—or face penalties.

Myth: “Everything is deductible.”

Truth: Only business-related expenses that are ordinary and necessary qualify.

Myth: “I’ll never get a refund on 1099 income.”

Truth: You can get a refund if you overpay or qualify for tax credits.

Year-Round Tax Checklist for Freelancers

Keep this list handy as you go:

- Home office costs

- Mileage and vehicle expenses

- Business supplies and gear

- Software, tools, and platforms

- Internet and phone (business use only)

- Health insurance premiums

- Retirement contributions

- Accountant or tax software costs

Quick Tax Estimator (DIY Version)

Want a fast estimate?

- Add up your 1099 income

- Subtract all business expenses

- Multiply the result by 30%

- Divide by 4 for your quarterly payments

Example:

You earn $50,000 and spend $10,000 on business expenses. That’s $40,000 in net income.

Estimated taxes = $12,000

Quarterly payments = $3,000

Frequently Asked Questions (FAQs)

A 1099 tax return is the process of reporting income earned as an independent contractor or self-employed worker using forms like 1099-NEC or 1099-MISC.

1099 income is subject to self-employment tax (15.3%) plus federal and state income taxes. No taxes are withheld from your paychecks.

You can deduct business expenses such as home office, vehicle, supplies, professional services, and health insurance premiums.

Most experts recommend saving 25–30% of your net income for taxes.

Yes—especially if you expect to owe more than $1,000 in taxes annually.

Use tools like TurboTax Self-Employed or work with a CPA familiar with 1099s.

Yes, if you overpaid estimated taxes or qualify for refundable tax credits.

Form 1099-G reports certain government payments, such as unemployment compensation, and must be included on your tax return.

If you’re a business owner paying independent contractors, you’ll need to prepare 1099s for anyone you paid $600 or more during the year.

You have flexibility, can claim business deductions, and may work with multiple clients.

Bottom Line: Don’t Wait Until Tax Season

Self-employment taxes don’t have to be scary or confusing. With a little planning, you can save big, stay compliant, and feel in control of your finances. Treat taxes like a business tool—not a burden. Track your expenses. Make quarterly payments. Max out your deductions. These 1099 tax tips also apply to anyone navigating self-employed tax filing, understanding Schedule C, or planning for quarterly tax payments. The more you plan, the more you save.

The result? More money in your pocket—and a lot less stress come April.

Ready to take control of your self-employed finances?

Don’t go it alone—OneUp Networks is here to help with tools, tips, and expert support to make tax season a breeze.

Sign up now and start your path to stress-free tax filing.

Read Also:

- Navigating Tax Season 2025: How to Use QuickBooks for a Stress-Free, Efficient Tax Filing?

- Top 100 Motivational Finance Quotes for Accountants, Tax Pros & Business Leaders

- All About Tax Season: What to Expect in 2025 and How to Prepare?

- Which QuickBooks Enterprise Versions Fits Your Business Needs?

- QuickBooks Desktop FAQs: Guide to Resolving QuickBooks Queries