The 2026 tax season introduces several important IRS tax law changes, adjustments, and new rules that will impact your 2026 tax return. Whether you’re an accountant, CPA, tax professional, or individual taxpayer, staying informed about these updates is essential for effective tax planning, maximizing refunds, and avoiding unexpected tax liabilities. This comprehensive guide covers the key tax changes for 2026, critical filing dates, reasons your taxes might change, and tips to optimize your 2026 tax return.

What’s New in 2026 That Can Save You Money?

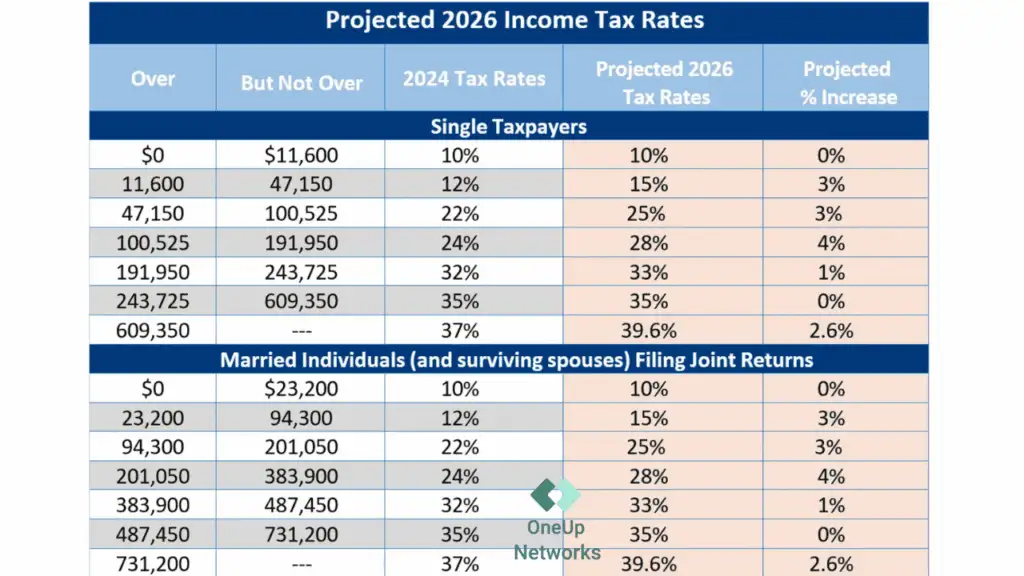

For 2026, the IRS continues the familiar seven-tax-bracket structure with inflation adjustments to income thresholds. The top federal income tax rate remains 37%, now applying to incomes above $647,850 for singles and $778,850 for married filing jointly.

The standard deduction increases again, allowing more income to be tax-free:

| Filing Status | 2025 Deduction | 2026 Deduction |

|---|---|---|

| Single | $15,750 | $16,500 |

| Married Filing Jointly | $31,500 | $33,000 |

| Head of Household | $23,625 | $24,750 |

The Child Tax Credit rises to $2,200 per qualifying child under 17, indexed for inflation, with new eligibility rules requiring children and at least one parent or guardian to have a Social Security number, impacting about 2.7 million children who qualified previously.

Retirement account contribution limits continue to rise, supporting greater savings:

- IRA contributions remain at $7,000 standard and $8,000 for those 50 and older

- Catch-up contribution limits for 401(k) and similar plans increase further in 2026

Energy tax credits are changing notably with key credits expiring or being phased out soon. For example, the Residential Clean Energy Credit (30% solar and wind installation tax credit) will no longer apply to systems installed after December 31, 2025. Alternative fuel vehicle refueling credits end after June 30, 2026.

Important 2026 Tax Filing Dates and Deadlines

| Date | Deadline/Description | Applies To | Notes/Actions Required |

|---|---|---|---|

| Late January 2026 | IRS begins accepting 2025 tax year returns | All taxpayers | Start preparing and filing returns |

| April 15, 2026 | Regular individual tax return filing deadline | Individual taxpayers | File Form 1040 and pay any taxes owed; last day to request extension (Form 4868) |

| June 15, 2026 | Automatic extension deadline for expats | U.S. taxpayers living abroad | File return or request extension if qualified; pay taxes due by April 15 to avoid interest |

| October 15, 2026 | Extended filing deadline (with Form 4868) | Taxpayers who filed extension | Final date to file returns after extension |

| January 15, 2027 | 4th quarter estimated tax payment due | Self-employed, contractors, investors | Avoid penalties by making timely estimated tax payments |

| Other Estimated Tax Deadlines: | |||

| April 15, 2026 | 1st quarter estimated tax payment due | Self-employed, contractors, investors | |

| June 15, 2026 | 2nd quarter estimated tax payment due | Self-employed, contractors, investors | |

| September 15, 2026 | 3rd quarter estimated tax payment due | Self-employed, contractors, investors |

Why Your Taxes Might Increase in 2026

Several factors may cause higher tax bills in 2026 despite stable tax rates:

- Bracket creep as wage growth outpaces inflation adjustments.

- Expiration or reduction of key tax credits and deductions, especially energy-related and charitable contributions.

- New Social Security number requirements limiting Child Tax Credit eligibility.

- Caps on itemized deductions and gambling loss limits.

- Changes in income reporting and withholding due to higher 1099 thresholds.

How to Maximize Your 2026 Tax Return

- Use the larger standard deduction amounts to reduce taxable income

- Maximize retirement contributions and plan catch-up contributions if eligible

- Claim the expanded Child Tax Credit, ensuring IRS requirements like Social Security numbers are met

- Utilize energy-related credits on eligible projects placed in service before their expiration dates

- Leverage charitable donation deductions available to both itemizers and non-itemizers under new limits

- Review 1099 reporting and withholding to optimize estimated tax payments and avoid surprises

- Consult tax professionals familiar with 2026 IRS rules and OBBBA provisions for personalized planning

Detailed Breakdown of Important 2026 Tax Law Changes

Tax Brackets and Inflation Adjustments

The seven federal tax brackets remain in place, with thresholds adjusted upwards:

- 10% rate now applies up to $12,000 for single filers, $24,000 for married filing jointly

- Other brackets rise accordingly, with the top 37% rate starting at $647,850 (single filers)

Standard Deduction Increases

| Filing Status | 2025 Deduction | 2026 Deduction |

|---|---|---|

| Single | $15,750 | $16,500 |

| Married Filing Jointly | $31,500 | $33,000 |

| Head of Household | $23,625 | $24,750 |

Child Tax Credit and EITC Updates

- Child Tax Credit increases to $2,200 per child with inflation indexing

- New requirement: children and at least one parent/guardian must have a valid Social Security number

- Earned Income Tax Credit eligibility rules remain with age limits 25 to 65 for taxpayers without qualifying children

Retirement Account Contribution Limits

For 2026, retirement account contribution limits continue to increase, allowing taxpayers to save more for the future:

- IRA Contributions:

- Standard limit: $7,000

- Age 50 or older: $8,000 (catch-up contribution included)

- 401(k) and Other Employer-Sponsored Plans:

- Catch-up contributions increase for older participants, including a new higher limit for ages 60–63

Additional Senior Deduction (Age 65+)

In addition to retirement contributions, taxpayers aged 65 or older may benefit from an extra deduction under the One Big Beautiful Bill (OBBBA):

- $6,000 additional deduction on top of the standard or itemized deduction

- This deduction is separate from retirement account contributions and applies specifically to seniors

Energy Tax Credits Changes

- Residential Clean Energy Credit (solar, wind, geothermal) expires for property placed in service after Dec 31, 2025

- Alternative fuel vehicle refueling credits end June 30, 2026

- Other clean electricity credits phase out or become more limited

One Big Beautiful Bill (OBBBA) – Legislative Updates You Should Know

The OBBBA introduces and continues several impactful provisions:

- Charitable deductions available to non-itemizers, capped at $1,000 (single) and $2,000 (married filing jointly).

- Limits on itemized deductions for very high-income taxpayers, capping the tax benefits received.

- Gambling loss deductions limited to 90% of winnings.

- Increased 1099 reporting threshold to $2,000 for certain non-W2 income.

- A new 1% excise tax on foreign money transfers.

Summary Table: 2026 Tax Changes at a Glance

The IRS has adjusted the income tax brackets for inflation in 2026, keeping the same seven-rate structure with updated income thresholds to mitigate the effect of inflation on taxable income.

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $12,000 | Up to $24,000 | Up to $18,750 |

| 12% | $12,001 – $47,650 | $24,001 – $95,300 | $18,751 – $72,150 |

| 22% | $47,651 – $119,100 | $95,301 – $238,200 | $72,151 – $177,650 |

| 24% | $119,101 – $204,500 | $238,201 – $409,000 | $177,651 – $291,650 |

| 32% | $204,501 – $367,900 | $409,001 – $735,800 | $291,651 – $523,950 |

| 35% | $367,901 – $609,750 | $735,801 – $1,219,500 | $523,951 – $877,750 |

| 37% | Over $609,750 | Over $1,219,500 | Over $877,750 |

These updated thresholds allow taxpayers to avoid being pushed into higher tax brackets solely due to inflation-driven income increases, consistent with IRS adjustments for 2026.

FAQs – Your 2026 Tax Season Questions Answered

The IRS is expected to start accepting 2026 tax returns (income for tax year 2025) in late January 2026.

January 1, 2026, through December 31, 2026, with returns filed in early 2027.

Yes, including a higher Child Tax Credit with new eligibility requirements and changes to energy and alternative fuel credits.

Federal tax rates remain the same with inflation adjustments to income thresholds.

Bracket creep, new deduction limits, phaseout of credits, and stricter eligibility rules may increase tax liabilities.

Final Word: Filing Smart and Saving More in 2026

The 2026 tax filing season brings substantial IRS changes wrapped in ongoing inflation adjustments and new legislative provisions under the One Big Beautiful Bill Act. By understanding these updates, you can optimize your tax filing, maximize refund potential, and stay compliant. Working with trusted tax professionals and leveraging updated cloud-hosted tax solutions remains crucial for successful tax season management in 2026 and beyond.

Don’t let outdated systems slow your firm down. With OneUp Networks, you get secure, high-performance cloud hosting for QuickBooks, tax applications, and virtual desktops—backed by 24/7 expert support. Work from anywhere, keep your data protected, and scale effortlessly as your business grows. Make the switch today and experience the difference—start your free trial now!

Read These Helpful Blogs Also: