Are you struggling to issue and file 1099 forms for your independent contractors before tax deadlines? You’re not alone—an estimated 70% of small businesses find 1099 reporting challenging due to frequent IRS updates, complex vendor structures, and the risk of costly penalties. This comprehensive guide will walk you through everything you need to properly create, fill out, and file 1099s in 2024—whether you’re an accountant, CPA, tax professional, or finance industry leader. By the end, you’ll know exactly how to avoid compliance headaches, prepare bulletproof documentation, and leverage cloud hosting tools designed for stress-free 1099 management.

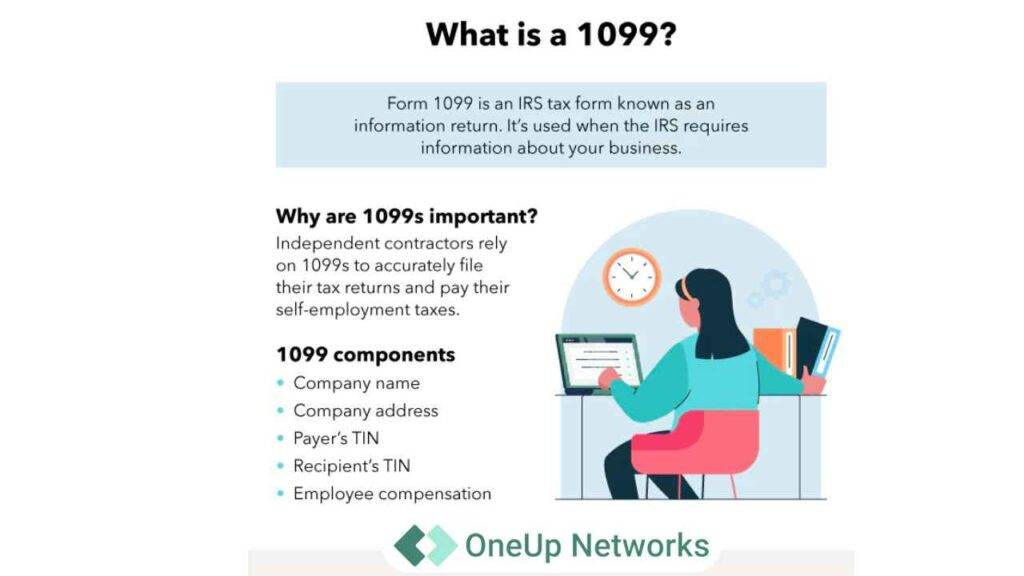

What Is a 1099 Form and Who Needs It?

A 1099 form is an information return required by the IRS that documents payments made to various non-employees, such as independent contractors, freelancers, and certain vendors. The most common type for contractors is the 1099-NEC (Nonemployee Compensation). If you paid any individual or entity $600 or more for services in a tax year, you must issue a 1099-NEC.

Who Needs a 1099?

- Independent contractors

- Freelancers

- Subcontractors

- Solo vendors and certain LLCs (unless taxed as C or S corps)

- Tax professionals and accountants who pay others for services

Exceptions:

Corporations are typically exempt, except in cases like legal and medical payments, which must be reported.

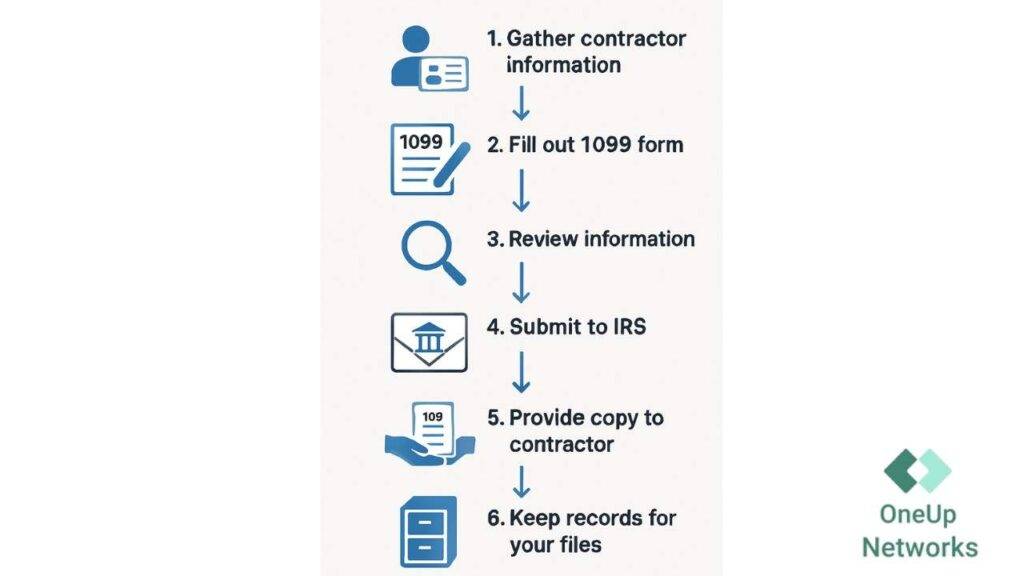

Step-by-Step: How to Create, Fill Out, and Issue 1099 Forms

1. Gather Required Information

What information is needed for a 1099?

- Contractor’s full legal name

- Address

- Taxpayer Identification Number (TIN) or Social Security Number (from Form W-9)

- Total amount paid during the year

- Your business name, address, EIN

Best Practice:

Collect signed W-9 forms from every contractor before payment to save time and avoid errors. Keep these in a secure cloud system for instant access.

2. Choose the Right 1099 Form

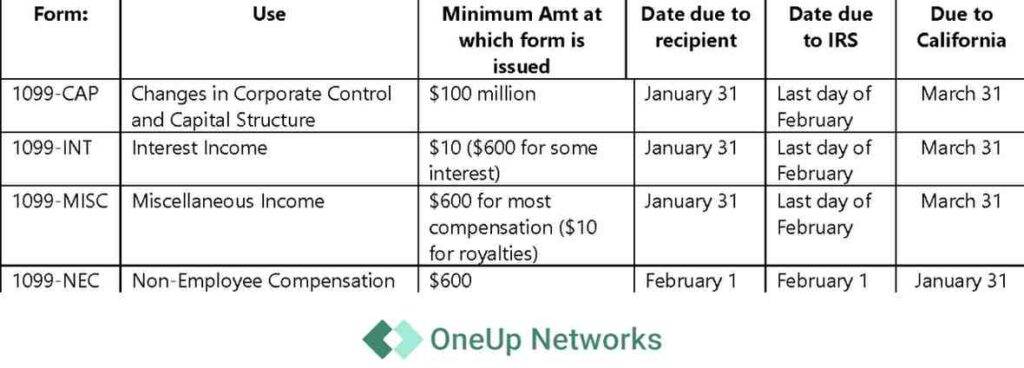

| Form Type | Use Case | Threshold | Deadline |

|---|---|---|---|

| 1099-NEC | Nonemployee compensation (contractors, freelancers) | $600 | Jan 31 |

| 1099-MISC | Rent, prizes, legal fees, other non-service payments | Varies | Jan 31/Feb 28 |

| 1099-K | Payment processors (Venmo, PayPal over $600) | $600 | Jan 31 |

| 1099-DIV/INT/OID | Dividends, interest, bond income | Any amount | Jan 31/Feb 28 |

Tip: For the vast majority of contractor relationships, the 1099-NEC is required.

3. Fill Out the 1099 Form: Section-by-Section

| Field | What to Enter | Example |

|---|---|---|

| Payer’s Info (top left) | Your business name, address, EIN | OneUp Networks, 123 Main St, EIN 12-3456789 |

| Recipient’s Info | Contractor’s full or business name, address, TIN/SSN | Jane Smith, 456 Oak Ave, SSN 987-65-4321 |

| Box 1: Nonemployee Comp | Total amount paid for services (aggregate over the year) | $8,500 |

| Box 4: Fed Tax Withheld | Any backup withholding (leave blank if none) | 0 |

| Box 5-7: State Info | State tax withheld, state/payer’s state number, state income (if applicable) | 0, N/A, 0 |

Detailed Section Instructions

- Box 1 (Nonemployee Compensation): Enter the total paid to the contractor in 2024.

- Payer/Recipient’s TIN: Get from each party’s W-9.

- Box 4 (Federal Tax Withheld): Fill ONLY if you withheld taxes (rare for most small businesses).

- Box 5-7 (State fields): Complete if you withheld state taxes or your state requires reporting.

- Account Number, Phone: Useful for large organizations tracking multiple contractors.

4. Review, Double-Check, and Prepare for Submission

- Confirm contractor classification: Avoid misclassifying employees as contractors—IRS penalties apply.

- Verify TIN and payment totals for accuracy.

- Check deadlines: Forms must be sent to both the IRS and recipient by Jan 31, 2025. Start early—cloud accounting software or e-filing platforms automate deadline reminders.

5. Ways to File Your 1099 Forms

| Method | Pros | Cons |

|---|---|---|

| Paper Filing | Familiar, no tech required | Slower, risk of error, postage costs |

| E-Filing | Fast, lower error rate, instant confirmation | Requires IRS TCC code, authentication |

| Payroll Providers | End-to-end automation, compliance | May have costs |

| Cloud Platforms | Secure, scalable for multi-users | Setup, may require training |

Trend: IRS now requires e-filing for organizations with 10+ forms in one tax year; most CPAs and accountants use secure cloud platforms for filing.

6. Distribute and Retain Copies

- Copy A: Submit to IRS (electronically or by mail)

- Copy B: Give to contractor by Jan 31

- Copy C: Keep for your records (minimum 3 years)

Some states require additional filing. Always check your local requirements.

Comparison Table: 1099 Forms vs. W-2 Forms

| Feature | 1099 Form | W-2 Form |

|---|---|---|

| Recipient | Contractor, vendor, freelancer | Employee |

| What’s Reported | Nonemployee compensation/payments | Wages, tax withholding, benefits |

| Tax Withholding | Generally no | Federal/state/local withholding required |

| Due Date | January 31 | January 31 |

| Filing Method | Paper, e-file, cloud system | Same |

| IRS Penalties | Yes, for late/missing or incorrect forms | Yes, for late/missing or incorrect forms |

Best Practices and Expert Insights for 1099 Preparation

- Collect W-9 forms at the start of the business relationship; don’t wait until year-end. This ensures all required info is on hand for quick form creation.

- Regularly reconcile contractor payments monthly using cloud hosting systems. This minimizes year-end surprises and allows automated flagging of eligible vendors.

- Use accounting platforms with built-in 1099 tools. 70% of top CPA firms have migrated to cloud software to automate filing and ensure accuracy.

- Stay current on rules—thresholds and e-filing requirements change. In 2024, e-filing is mandatory for 10+ forms; starting 2026, the IRS increases nonemployee reporting to $2,000 minimum, indexed for inflation.

- Secure documents in encrypted storage. Cloud hosting keeps forms safe and compliant with changing IRS cybersecurity guidelines.

Chart: Common 1099 Preparation Mistakes vs. Solutions

| Mistake | Consequence | Solution |

|---|---|---|

| Late W-9 Collection | Missing contractor data, delays | Collect at onboarding, cloud archive |

| Misclassified Payments | IRS fines, audits | Monthly payment review, cloud alerts |

| Manual Tracking | Lost forms, errors | Cloud system auto-track, backup |

| Paper Filing Past Deadline | Heavy IRS penalties | E-file with auto reminders |

| Forgetting State Requirements | Non-compliance, state fines | Consult local CPA, checklist template |

Case Study: Cloud-Enabled 1099 Preparation for CPA Firms

Case: Smith & Co Accounting, a mid-sized CPA firm, migrated to OneUp Networks for cloud hosting of their tax software in 2023. Result?

- Preparation time for 1099 forms was cut by 55%.

- Error rate dropped to under 1%.

- All contractor and payment data securely stored—no last-minute chases for W-9s or payment records.

Expert Insight:

“The key to mastering 1099 compliance is proactive data collection and cloud integration. Firms leveraging secure hosting platforms not only meet IRS deadlines but also protect client data—solidifying trust and long-term retention.” — Jane Morris, CPA, cloud accounting specialist

1099 Form Essentials for Contractors

| Section | Key Data | Source W-9? | IRS Required? |

|---|---|---|---|

| Contractor Legal Name | Yes | Yes | Yes |

| Contractor Address | Yes | Yes | Yes |

| Contractor TIN/SSN | Yes | Yes | Yes |

| Amount Paid in Tax Year | Calculated from books | No | Yes |

| Your Business EIN and Address | From setup or tax docs | No | Yes |

Filing Deadlines & Penalties

| Deadline | Penalty (per form) | Exception |

|---|---|---|

| Jan 31, 2025 | $60 (within 30 days of deadline) | If e-file mandatory |

| Feb 28, 2025 | $120 (after 30 days, before Aug 1) | None |

| After Aug 1 | $310 (late over 5 months) | None |

| Willful Neglect | $630 or 10% of reported income | None |

Frequently Asked Questions (FAQ) on 1099 Form:

Gather the contractor’s W-9 info, fill out the correct 1099 (usually 1099-NEC), send Copy B to the contractor, and file Copy A with the IRS by Jan 31.

Contractor’s full name, address, TIN/SSN, amount paid, your business EIN and address, and any tax withheld.

Yes, e-filing is preferred and often required (10+ forms). Use an IRS-certified platform, payroll provider, or cloud accounting software. Enter all details, verify, and submit electronically before the deadline.

Penalties from $60 up to $630 per form, potential IRS audits, and back taxes owed. Intentional disregard leads to higher fines.

See the table above and visual sample in this blog. Always fill out all required fields and double-check for accuracy.

Final Thoughts

Filling out 1099 forms for contractors doesn’t have to be a painful, error-ridden process. With OneUp Networks cloud-hosted accounting solutions, you can collect vendor data early, automate the entire preparation process, and e-file securely—all while swapping endless paper chases for streamlined digital workflows. As IRS rules evolve, choosing the right form, submitting before deadlines, and maintaining airtight compliance have never been more crucial.

Ready to elevate your accounting firm with unmatched performance, security, and flexibility?

OneUp Networks delivers blazing-fast QuickBooks Desktop hosting, enterprise-grade protection, and dedicated 24/7 support—no hidden fees, built just for CPAs and finance professionals. Experience seamless remote access, smooth migrations, and hassle-free setup.

Also Read These Helpfull Blogs: