For accounting and tax firms in 2025, choosing between VDI (Virtual Desktop Infrastructure) and RDS (Remote Desktop Services) is one of the most important IT decisions you’ll make. The right solution impacts cost, security, compliance, and client data protection — all critical for CPA firms that rely on QuickBooks, tax software, and secure remote access to serve clients efficiently.

Both VDI and RDS are remote desktop solutions for accountants, but they work in very different ways. VDI provides each user with an isolated virtual desktop, while RDS offers shared server sessions that are simpler and more affordable. Understanding these differences is essential if you want to balance scalability, performance, and compliance while keeping IT costs under control.

What Are VDI and RDS in Accounting?

Virtual Desktop Infrastructure (VDI):

VDI is a technology that delivers individual, fully isolated virtual desktops to users, making it ideal for CPA firms needing secure QuickBooks hosting and tax software hosting. Each user gets their own virtual machine (VM) with a dedicated operating system (like Windows 10/11), offering a personalized experience accessible from any device-PC, Mac, tablet, or smartphone.

Remote Desktop Services (RDS):

RDS, formerly Terminal Services, is a Microsoft Windows Server feature that allows multiple users to connect to a single server and share applications, a cost-effective remote desktop solution for accountants who need basic access. All users operate within a shared environment, accessing the same OS and applications, but with individual sessions.

Why VDI vs RDS Matters for Accounting and Tax Firms

- Data Security: Accounting firms handling sensitive client records or CPA tax software hosting need robust security and compliance

- User Experience: Accountants need uninterrupted, high-performance access to tax software and client files.

- Scalability: Firms must quickly add or remove users during tax season or as teams grow.

- Cost Control: IT budgets are tight; every dollar spent must deliver value.

VDI vs RDS Comparison for CPAs: Cost, Security, and Scalability

| Feature | VDI | RDS |

|---|---|---|

| User Environment | Each user gets a dedicated virtual desktop (VM) | Users share a single server environment (sessions) |

| OS Flexibility | Supports multiple OS (Windows, Linux, etc.) | Limited to Windows Server |

| Customization | High-users can personalize desktops and apps | Low-shared desktop, limited personalization |

| Security | Strong isolation; each desktop is separate | Shared environment; requires careful setup for security |

| Performance | Consistent, as resources are dedicated | May vary if users compete for resources |

| Scalability | Scales easily with more VMs | Quick to add users, but limited by server capacity |

| Administration | More complex, requires skilled IT | Easier to set up and manage |

| Cost | Higher (hardware, licensing, management) | Lower (shared resources, less hardware needed) |

| Best For | Firms needing security, compliance, customization | Firms prioritizing cost, simplicity, shared apps |

Example: How Accounting Firms Use VDI vs RDS

VDI Example:

Imagine every accountant in your firm has their own virtual computer in the cloud. When Jane logs in from home, she gets her own secure desktop, with her preferred settings, apps, and files-just like her office PC, but accessible from anywhere. If her desktop gets a virus, it doesn’t affect anyone else.

RDS Example:

Think of a shared office computer that everyone uses at different times. Each accountant logs in and sees the same desktop and apps. If John installs a new tax tool, everyone can use it. However, if one user runs a heavy report, it might slow down the experience for others.

Real-World Case Study: An Accounting Firm Switching from RDS to VDI

A leading CPA firm IT infrastructure was upgraded from RDS to VDI after struggling with QuickBooks hosting performance and data security issues. With VDI, each accountant received a dedicated virtual desktop, improving speed, compliance, and scalability. The firm reported smoother audits, faster onboarding for seasonal staff, and better protection of sensitive client data.

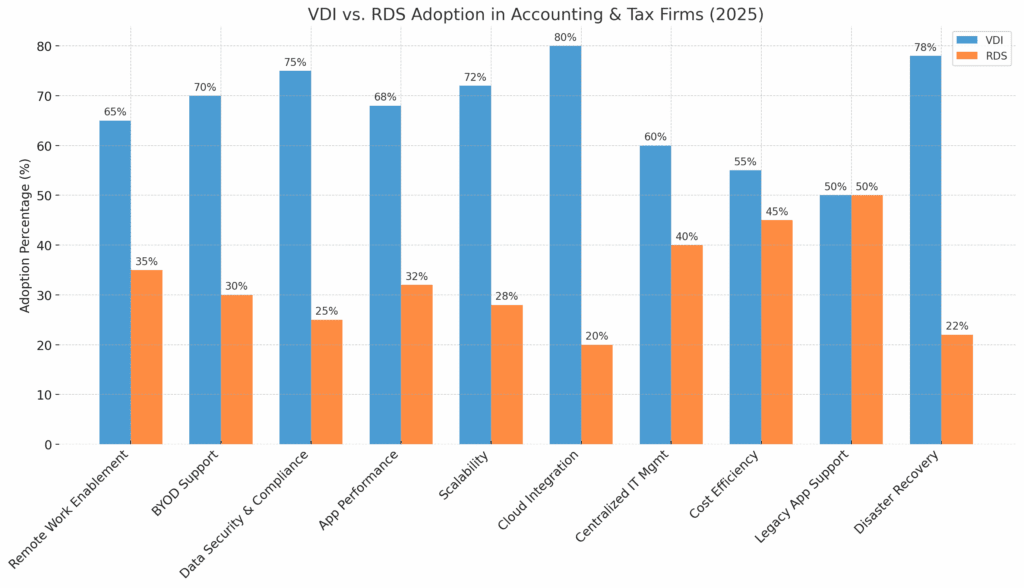

Market Trends: VDI vs RDS in the Accounting Industry

- The global VDI and DaaS (Desktop as a Service) market is booming, projected to grow from $14.4 billion in 2022 to $50.5 billion by 2030 — driving more demand for cloud hosting for accountants. (CAGR 20.3%).

- Desktop as a Service (DaaS), a cloud-based VDI model, is forecasted to reach $4.4 billion in spending by 2028, as more firms move away from on-premises solutions.

- Security and compliance are top drivers for VDI adoption in the accounting sector, according to Gartner and industry reports.

Pros and Cons of VDI and RDS for CPA Firms

| Criteria | VDI: Pros | VDI: Cons | RDS: Pros | RDS: Cons |

|---|---|---|---|---|

| Security | Strong isolation, ideal for compliance | Complex to manage | Easier setup, centralized control | Shared risk if server is compromised |

| Customization | Fully personalized desktops | Higher cost, more IT expertise needed | Simple, uniform environment | Limited personalization |

| Performance | Dedicated resources, better for heavy apps | Needs robust hardware | Lower cost, easy to scale for light use | Performance can degrade if overloaded |

| Cost | Higher upfront and maintenance costs | Lower licensing and hardware costs | Less flexibility for advanced needs | |

| Scalability | Scales with business growth | Quick to add users | Limited by server capacity | |

| User Experience | Consistent, familiar desktop | Simple for standard tasks | Can be less responsive for power users |

Which Remote Desktop Solution Is Best for Your Firm?

Choose VDI If:

- You handle highly sensitive or regulated data (e.g., client tax records, audits).

- Your firm needs to support a mix of operating systems or has power users running resource-intensive applications.

- Customization and isolated environments are critical for your workflow.

- You’re planning for long-term growth and need robust scalability.

Choose RDS If:

- Cost is your primary concern, and your team mostly uses the same applications.

- You have a small IT team and want a solution that’s easy to set up and maintain.

- Your users don’t need much desktop personalization.

- You need to quickly onboard seasonal or temporary staff with basic access.

Practical Scenarios for Accounting and Tax Firms

- Tax Season Surge: Onboard dozens of temporary staff quickly? RDS can get them up and running in minutes, but VDI ensures each gets a secure, isolated environment.

- Audit Readiness: VDI’s strong isolation and compliance features make it easier to pass security audits.

- BYOD (Bring Your Own Device): VDI allows accountants to securely access their desktop from any device, anywhere, without risking data leakage.

Frequently Asked Questions (FAQ)

Yes. VDI provides each user with an isolated virtual desktop, reducing the risk of data leaks between users. This makes VDI especially valuable for CPA firms that handle sensitive client tax data. RDS can be secure as well, but it requires strict configuration to prevent unauthorized access.

RDS is generally more affordable for small accounting firms because it uses shared server resources. However, for firms that need stronger compliance and security, VDI may provide better long-term value, especially during tax season when performance matters most.

Absolutely. Both QuickBooks hosting and tax software hosting work on VDI and RDS. The difference is that VDI offers better isolation and performance for heavy workloads, while RDS is often more cost-efficient for firms that only need standard applications.

Yes. Both solutions can be deployed in the cloud. Many firms now use cloud hosting for accountants to reduce IT maintenance costs while improving flexibility and scalability. Cloud-based VDI, also known as Desktop as a Service (DaaS), is growing quickly in the accounting sector.

VDI delivers a more personalized, consistent desktop experience — ideal for CPAs who need customization or run resource-heavy applications. RDS provides a shared environment that works well for standard accounting tasks but may feel slower during peak workloads.

Conclusion: Choosing Between VDI and RDS for Accounting Firms

Deciding between VDI vs RDS is more than just a technology choice — it’s a strategic decision that impacts your firm’s costs, security, compliance, and client experience.

- If your CPA firm handles highly sensitive tax data, needs compliance-ready systems, or wants a secure cloud hosting solution for accountants, VDI is the stronger long-term investment.

- If your priority is affordability and quick setup for seasonal staff, RDS may still be the right fit.

With the VDI and DaaS market growing rapidly and more accounting firms moving away from on-premise servers, now is the time to future-proof your IT strategy.

With the VDI market expected to triple by 2030 and cloud adoption accelerating, now is the time to evaluate your remote access strategy. For tailored advice and cloud hosting solutions designed for accounting professionals, contact OneUp Networks-your trusted partner in secure, scalable IT infrastructure.

At OneUp Networks, we specialize in QuickBooks hosting, tax software hosting, and secure IT for accountants. Our experts can help you choose the right solution — whether that’s VDI, RDS, or a hybrid approach — tailored to your firm’s needs.

Ready to modernize your accounting firm’s IT? Book a free consultation with OneUp Networks today.