Choosing the right business structure is a foundational decision for any entrepreneur or business owner. For professionals in accounting and finance, understanding the nuances between S Corporations (S Corps), C Corporations (C Corps), and Limited Liability Companies (LLCs) is especially critical. Not only does the structure impact your tax obligations and liability, but it also influences your ability to attract investors, scale your business, and comply with regulatory requirements. In this comprehensive guide, we’ll break down the definitions, advantages, disadvantages, and practical examples of each structure, LLC vs Corporation to help you make an informed decision.

Table of Contents

- What Are S Corps, C Corps, and LLCs?

- Key Differences: S Corp vs C Corp vs LLC

- In-Depth Analysis

- Practical Examples

- Which Structure Is Right for Your Business?

- Steps to Start an S Corporation (S Corp)

- Steps to Start a C Corporation (C Corp)

- Steps to Start a Limited Liability Company (LLC)

- Industry Breakdown (IRS, 2009)

- Frequently Asked Questions (FAQs)

What Are S Corps, C Corps, and LLCs?

S Corporation (S Corp)

An S Corporation is a special type of corporation that elects to pass corporate income, losses, deductions, and credits through to shareholders for federal tax purposes. This means the business itself does not pay federal income taxes; instead, shareholders report the income or loss on their personal tax returns. S Corps are limited to 100 shareholders, who must be individuals, certain trusts, or estates, and can only have one class of stock.

C Corporation (C Corp)

A C Corporation is the standard corporation under U.S. law. It is a separate legal entity from its owners (shareholders), providing strong liability protection. C Corps are subject to double taxation: profits are taxed at the corporate level and again when distributed as dividends to shareholders. Between S Corps vs C Corps, latter can have an unlimited number of shareholders and multiple classes of stock, making them ideal for larger businesses and those seeking venture capital.

Limited Liability Company (LLC)

A Limited Liability Company is a flexible business structure that combines elements of partnerships and corporations. Between Corporation vs LLCs, latter provide liability protection to their owners (called members) and offer significant flexibility in management and taxation. Profits and losses pass through to members’ personal tax returns, but members can choose to be taxed as a sole proprietorship, partnership, S Corp, or even C Corp.

Key Differences: S Corp vs C Corp vs LLC

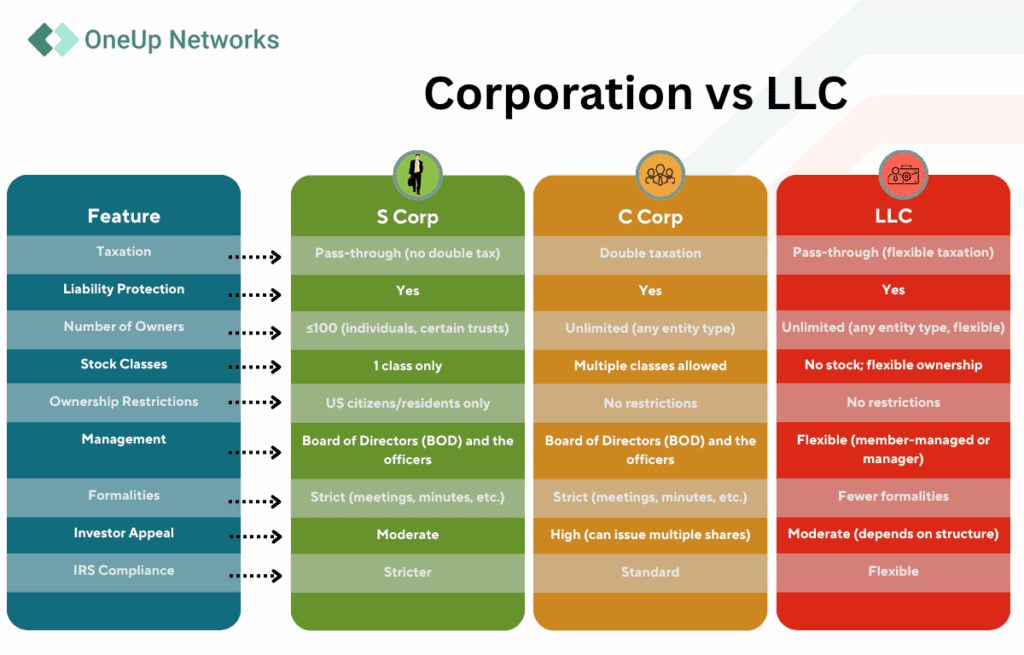

To help you visualize the distinctions, here’s a comparison table:

In-Depth Analysis

Taxation and Financial Impact

- S Corp: Income, deductions, and credits flow through to shareholders’ personal tax returns, avoiding double taxation. Shareholders who work for the company must receive a “reasonable salary,” which is subject to payroll taxes, while additional profits can be distributed as dividends, potentially reducing self-employment tax.

- C Corp: Profits are taxed at the corporate level (currently 21% federal rate), and dividends paid to shareholders are taxed again at the individual level. This double taxation can be a drawback for small businesses but may be offset by deductions and credits available only to C Corps.

- LLC: By default, LLCs are pass-through entities. Members can choose to be taxed as a sole proprietorship, partnership, S Corp, or C Corp, providing significant flexibility. Self-employment taxes apply to all profits unless the LLC elects S Corp status.

Liability Protection

All three structures offer limited liability protection, meaning owners are generally not personally responsible for business debts or lawsuits. However, C Corps vs S Corps may offer slightly stronger protection in certain legal contexts due to their formal corporate structure.

Ownership and Flexibility

- S Corp: Limited to 100 shareholders, who must be U.S. citizens or residents. Only one class of stock is allowed, which can limit fundraising options.

- C Corp: Unlimited shareholders and multiple classes of stock, making it easier to attract investors and raise capital.

- LLC: Highly flexible ownership structure, with no restrictions on the number or type of members. Members can be individuals, corporations, or even foreign entities.

Formalities and Compliance

- S Corp and C Corp: Both require adherence to corporate formalities, such as holding annual meetings, maintaining minutes, and appointing a board of directors.

- LLC: Fewer formalities, making it easier and less costly to maintain.

Practical Examples

Example 1: Small Accounting Firm

A solo accountant decides to form an LLC for its simplicity and flexibility. As the business grows and hires employees, the accountant elects S Corp status to reduce self-employment tax on profits distributed as dividends.

Example 2: Tech Startup

A group of entrepreneurs plans to seek venture capital and go public. They form a C Corp to take advantage of unlimited shareholders, multiple classes of stock, and investor appeal.

Example 3: Family-Owned Business

A family with 50 members wants to pass ownership to the next generation. They choose an S Corp to benefit from pass-through taxation and limited liability, while staying within the 100-shareholder limit.

Which Structure Is Right for Your Business?

There is no one-size-fits-all answer. The best structure depends on your business goals, size, industry, and growth plans.

- S Corp: Ideal for small businesses with fewer than 100 shareholders, especially those looking for tax savings and investor involvement.

- C Corp: Best for larger businesses, startups seeking venture capital, or those planning to go public.

- LLC: Perfect for small to mid-sized businesses seeking flexibility, simplicity, and minimal formalities.

Steps to Start an S Corporation (S Corp)

Forming an S Corp involves a series of legal and administrative steps to ensure compliance with both state and federal regulations. Here’s a streamlined process:

- Choose a Business Name

Select a unique and compliant business name that is distinguishable from existing entities in your state. Check availability on your state’s Secretary of State website and conduct a trademark search to avoid conflicts. - File Articles of Incorporation

Submit your Articles of Incorporation (sometimes called Certificate of Incorporation) to your state’s Secretary of State office. This document includes your business name, purpose, registered agent, and stock details. Filing fees vary by state. - Designate a Registered Agent

Appoint a registered agent with a physical address in the state of incorporation to receive legal documents on behalf of your S Corp. - Obtain an Employer Identification Number (EIN)

Apply for an EIN from the IRS online or by mail. This nine-digit number is essential for tax filing, opening bank accounts, and hiring employees. - File IRS Form 2553 to Elect S Corp Status

File Form 2553, Election by a Small Business Corporation, with the IRS to officially elect S Corp status. All shareholders must sign the form. The deadline is generally within 2 months and 15 days after the beginning of the tax year for which the election is effective. - Create Corporate Bylaws

Draft bylaws that outline the governance structure, including rules for appointing directors and officers, issuing stock, and holding meetings. - Hold Initial Board of Directors Meeting

Elect directors, appoint officers, and adopt bylaws. Keep detailed minutes of this and subsequent annual meetings. - Obtain Necessary Business Licenses and Permits

Depending on your industry and location, obtain all required state and local licenses to operate legally.

Steps to Start a C Corporation (C Corp)

Starting a C Corp follows a similar incorporation process but with some distinctions:

- Choose a Business Name

Verify the name’s availability and compliance with state naming rules. Conduct trademark checks to avoid infringement. - File Articles of Incorporation

File Articles of Incorporation with your state’s Secretary of State, including corporate name, purpose, registered agent, and authorized shares. Pay the required filing fees. - Designate a Board of Directors

Appoint a board responsible for corporate oversight and policy. The board will also authorize stock issuance. - Draft Corporate Bylaws

Prepare bylaws that govern how the corporation operates, including meeting protocols, voting rights, and officer duties. - Obtain an Employer Identification Number (EIN)

Apply for an EIN from the IRS to identify your corporation for tax purposes and banking. - Issue Stock Certificates

The board authorizes and issues stock to shareholders, specifying the number of shares and classes. This is critical for ownership and investor relations. - Hold Initial Board Meeting

Conduct the first board meeting to approve bylaws, appoint officers, and take other organizational actions. Record minutes for legal compliance. - Obtain Business Licenses and Permits

Secure all required local, state, and federal licenses to operate legally.

Steps to Start a Limited Liability Company (LLC)

Between LLCs vs Corporation, LLC offer more flexibility and fewer formalities. The steps include:

- Choose a Business Name

Select a unique name that complies with your state’s LLC naming rules. Confirm availability via your Secretary of State’s website and trademark databases. - File Articles of Organization

Submit Articles of Organization (sometimes called Certificate of Formation) to your state’s Secretary of State. This document establishes your LLC’s legal existence. Filing fees vary by state. - Designate a Registered Agent

Appoint a registered agent with a physical address in the state to receive legal and tax documents. - Create an Operating Agreement

Draft an operating agreement that outlines ownership percentages, management structure, profit distribution, and member responsibilities. While not always required by law, it is highly recommended. - Obtain an Employer Identification Number (EIN)

Apply for an EIN from the IRS for tax purposes, banking, and hiring employees. - Register for State and Local Taxes and Permits

Depending on your business activities and location, register for applicable state taxes and obtain necessary licenses or permits. - Comply with Ongoing Requirements

Some states require annual reports or fees for LLCs. Stay compliant with these to maintain good standing.

Real-World Facts and Figures

- Number of U.S. Businesses: There are approximately 33.2 million businesses in the U.S. as of 2024, with 99.9% (31.7 million) classified as small businesses.

- Revenue Contribution: Small businesses contribute about $11.75 trillion (44%) of total U.S. business revenue, while large corporations generate $14.95 trillion (55-56%).

- Startups: There are about 1 million startups in the U.S., employing 5 million people (4% of the private sector workforce).

These statistics underscore the importance of choosing the right business structure, as small businesses and startups drive innovation and employment across the country.

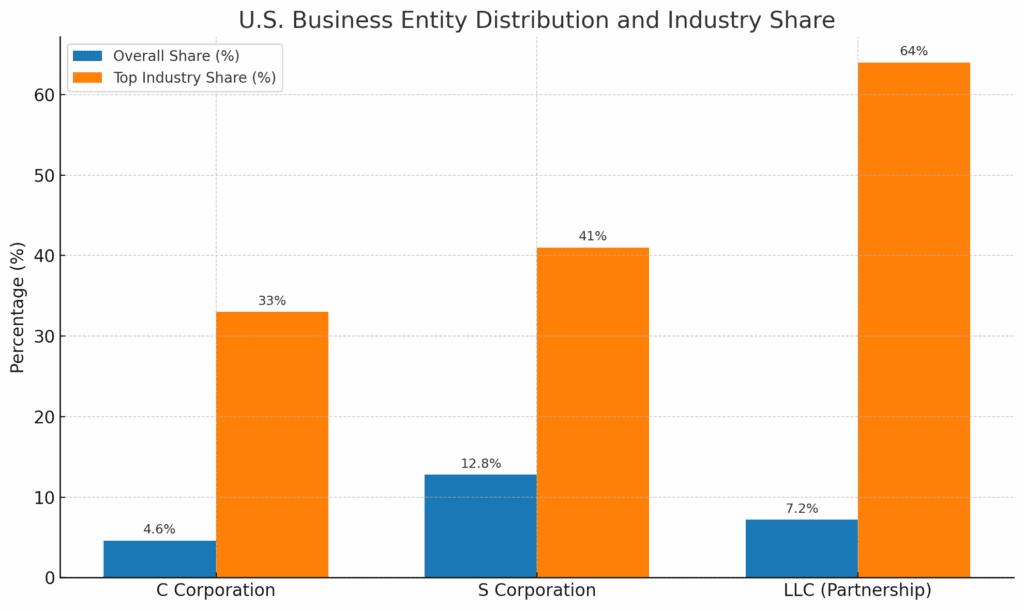

Industry Breakdown (IRS, 2009)

From the Joint Committee on Taxation (2015) detailing returns by industry (2009 data):

| Entity Type | Top Industries (by # of returns) |

|---|---|

| C Corporations | Services, Retail Trade, Construction (~33% total) |

| S Corporations | Services, Construction, Real Estate (~41%) |

| Partnerships/LLCs | Real Estate, Finance & Insurance, Services (~64%) |

Here is the professional bar chart showing:

- Overall Share (%) of U.S. business entities based on IRS data.

- Top Industry Share (%) for each entity type within sectors like services, construction, and real estate.

Frequently Asked Questions (FAQs)

The primary difference between c corp vs s corp is taxation. S Corps are pass-through entities, avoiding double taxation, while C Corps are subject to double taxation at both the corporate and shareholder levels.

Yes, between LLC vs corporation, LLC can elect to be taxed as an S Corp by filing IRS Form 2553, provided it meets the eligibility requirements.

An S Corp can have no more than 100 shareholders, who must be individuals, certain trusts, or estates.

C Corps offer unlimited shareholders, multiple classes of stock, and strong liability protection, making them attractive to investors and businesses planning to go public.

LLCs are generally the easiest to maintain due to fewer formalities and greater flexibility in management and taxation.

Conclusion

Choosing between an S Corp vs C Corp vs LLC is a strategic decision that impacts your taxes, liability, and growth potential. For accounting and finance professionals, understanding these structures is essential for advising clients and making informed choices for your own business. By considering your business goals, size, and industry, you can select the structure that best supports your success.

Remember, the right structure between llc vs corporation today may not be the best fit tomorrow—so review your options regularly as your business evolves.

For expert advice on business formation and cloud solutions tailored to the accounting and finance industry, connect with OneUp Networks. Our team is here to help you navigate the complexities of business structure and technology integration.

Read Also:

- How Does CCH ProSystem Fx Tax Software Handle Complex Tax Scenarios?

- Managed Service Provider (MSP)! FAQs to Make Complexity Simple!

- QuickBooks Online vs QuickBooks Desktop: Which is Best for Your Accounting Needs?

- How to Host a QuickBooks Desktop Company File?

- All About Tax Season: What to Expect in 2025 and How to Prepare?